Modified Accelerated Cost Recovery System MACRS Explanation and Types

Contents

- 1 Modified Accelerated Cost Recovery System (MACRS): Explanation and Types

- 1.1 What Is the Modified Accelerated Cost Recovery System (MACRS)?

- 1.2 Understanding the Modified Accelerated Cost Recovery System (MACRS)

- 1.3 Types of MACRS

- 1.4 Property Classifications

- 1.5 What Is IRS Publication 946?

- 1.6 What Are the Tax Benefits of Depreciation?

- 1.7 What Does Useful Life Mean?

- 1.8 The Bottom Line

Modified Accelerated Cost Recovery System (MACRS): Explanation and Types

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

What Is the Modified Accelerated Cost Recovery System (MACRS)?

The modified accelerated cost recovery system (MACRS) is a depreciation system used for tax purposes in the U.S. MACRS depreciation allows the cost of an asset to be recovered over a specified period via deductions. The MACRS system puts assets into classes with set depreciation periods.

Key Takeaways

- MACRS allows a business to recover the cost basis of assets that deteriorate over time.

- The IRS provides guidelines on eligible assets for MACRS and useful life figures.

- MACRS allows for faster depreciation in the first years of an asset’s life.

- MACRS depreciation is more beneficial for taxes compared to other methods.

- There are two types of MACRS systems—the General Depreciation System (GDS) and the Alternative Depreciation System (ADS).

Understanding the Modified Accelerated Cost Recovery System (MACRS)

Depreciation is an income tax deduction allowing a business to recover the cost basis of certain property. Most tangible and certain intangible assets are depreciable. MACRS is the proper depreciation method for most assets. It allows for greater accelerated depreciation over longer periods. For property placed into service after 1986, the IRS requires businesses to use MACRS for depreciation.

Depreciation using MACRS can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and more.

MACRS cannot be used for intangible property, films, video tapes, recordings, and certain corporate or partnership property acquired in nontaxable transfers.

Types of MACRS

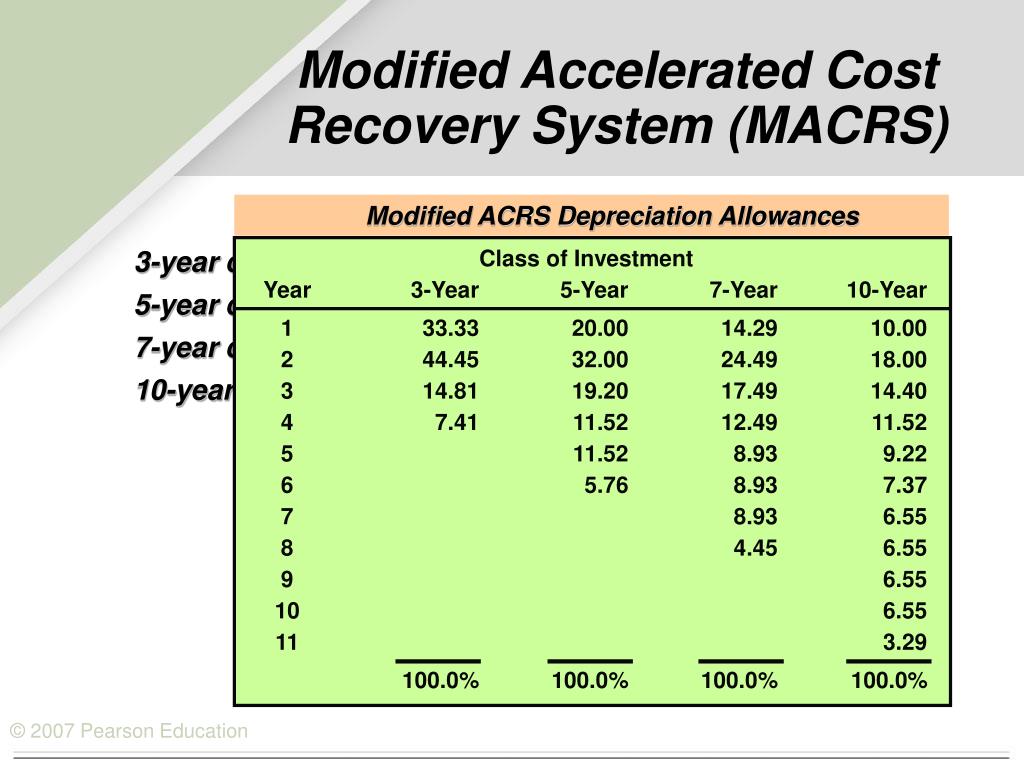

There are two MACRS systems—the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). GDS is generally used, while ADS is used in special cases.

GDS uses the declining balance method, allowing for larger depreciation expenses in the early years. ADS allows for depreciation over a longer period.

GDS is best for assets that depreciate quickly, while ADS is required for farming business property, property exempt from taxation, property used outside the U.S., and listed property used 50% or less in a business.

Businesses can elect to use ADS, but the election must cover all property in the same class and cannot be changed.

Property Classifications

The IRS publishes useful lives of various asset classes. This information is used to compute depreciation. Examples of asset classes and their useful lives are provided in the table below:

| Description of Assets | Useful Life (Years) |

| Tractors, racehorses, rent-to-own property, etc. | 3 |

| Automobiles, buses, trucks, computers, office machinery, breeding cattle, furniture, etc. | 5 |

| Office furniture, fixtures, agricultural machinery, railroad track, etc. | 7 |

| Vessels, tugs, agricultural structures, tree or vine bearing fruits or nuts, etc. | 10 |

| Municipal waste water treatment plant, restaurant property, natural gas distribution line, land improvements, such as shrubbery, fences, sidewalks, etc. | 15 |

| Farm buildings, certain municipal sewers, etc. | 20 |

| Water utility property, certain municipal sewers, etc. | 25 |

| Any building or structure where 80% or more of its gross rental income is from dwelling units | 27.5 |

| An office building, store, or warehouse that is not residential property or has a class life of less than 27.5 years | 39 |

IRS Publication 946 provides a full breakdown of asset classes and their useful lives. Tax depreciation for MACRS property is determined by multiplying the property’s cost basis by the percentage of business/investment use.

Derived tax depreciation is recognized in the company’s income tax return to determine taxable income. It is not recorded in financial statements, which use straight-line depreciation or other forms of accelerated cost depreciation.

MACRS is used for tax purposes and is not approved by U.S. Generally Accepted Accounting Principles (GAAP). Companies may use MACRS for tax depreciation and straight-line depreciation for financial statements.

What Is IRS Publication 946?

IRS Publication 946 details how to depreciate property and recover its cost via depreciation.

What Are the Tax Benefits of Depreciation?

Depreciation expenses lower taxable income, reducing the amount of taxes owed. Accelerated depreciation provides greater tax reduction in the earlier years of an asset’s useful life.

What Does Useful Life Mean?

Useful life is the estimated number of years an asset will remain in service for producing income. The IRS determines useful lives for assets, which dictate the depreciation period.

The Bottom Line

MACRS is a beneficial depreciation method used for taxes. Two types of MACRS, GDS and ADS, have different depreciation periods. GDS is usually used, while ADS is used in specific circumstances.