Micro-Investing Platform What it Means How it Works

Contents

Micro-Investing Platform: Meaning and Function

What Is a Micro-Investing Platform?

A micro-investing platform is an application that allows users to save small sums of money. These platforms aim to eliminate barriers to investing, such as brokerage account minimums, and encourage investment for individuals with limited incomes and assets.

Key Takeaways

- Micro-investing platforms make investing simple and painless, helping individuals build savings for future investments.

- These platforms invest tiny amounts of money, often rounding up transactions, into ETF-based accounts.

- Small savings can accumulate over time to generate better returns than traditional savings vehicles like certificates of deposit.

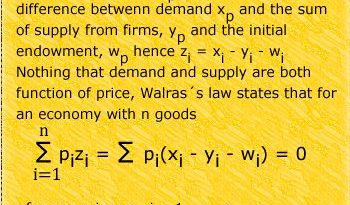

Understanding Micro-Investing Platforms

Micro-investing platforms are the digital-age equivalent of saving spare change in a jar. With these platforms, users can sign up and register their debit cards. Each purchase is rounded up to the nearest dollar, and the difference is deposited into an investment account. Robo-advisors like Acorns pioneered this concept.

You won’t notice the extra $0.50 missing from your account when you pay $3.50 for a cappuccino. However, over time, these small amounts add up in your brokerage account. If you buy that same coffee 20 times a month (every workday), you will have effortlessly invested $10 by the end of the month or $120 by the end of the year. While making your own cappuccinos at home is a better solution ($0.50 per cup), micro-investing offers an alternative for individuals who don’t want to change their behavior.

Micro-investing allows investments as low as a few pennies by eliminating per-transaction fees and investment minimums. Users don’t need to save up $100 for one share of a stock or mutual fund, nor do they need to pay brokerage fees to purchase that share. Instead, they pay a nominal fee (e.g., $1 per month) to the micro-investing platform, which invests their money in fractional shares.

These fractional shares are in exchange-traded funds (ETFs), ensuring diversification across different stocks and bonds and protecting investments against market swings, unlike investing in a single stock.

Even regular savers can benefit from micro-investing platforms. Saving $50 a month for 10 years in a savings account with 0% interest results in $6,000, which has less value due to inflation. However, investing $49 a month (after the $1 platform fee) for 10 years with an average annual return of 7% results in $8,580 before taxes and inflation.

Special Considerations

Features of Micro-Investing Platforms

Micro-investing platforms don’t require automatic investment but focus on facilitating small investments. Some platforms also aim to educate users about investing, helping them choose suitable ETFs based on their goals, risk tolerance, interests, and beliefs.

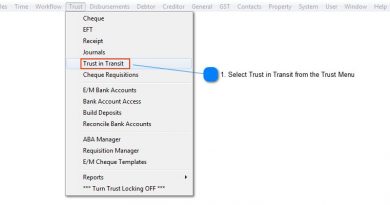

One notable micro-investing platform is Acorns Inc., which automatically invests spare change through a smartphone app. These platforms must register as a Registered Investment Advisor (RIA) and as a broker-dealer with the Securities and Exchange Commission (SEC).