Microfinance Definition Benefits History and How It Works

Microfinance, also called microcredit, is a banking service provided to low-income individuals or groups without access to financial services. Institutions offer microloans ranging from $50 to under $50,000, along with checking and savings accounts, micro-insurance products, and financial and business education. The objective is to empower impoverished people to achieve self-sufficiency.

Key Takeaways:

– Microfinance is a banking service for low-income individuals without access to financial services.

– Microfinance enables safe small business loans in line with ethical lending practices.

– Microfinancing is prevalent in developing nations.

– Microfinanciers charge interest and establish repayment plans.

– The global microfinance market is valued at $187 billion and is projected to surpass $488 billion by 2030.

People trapped in poverty or with limited financial resources often turn to family, friends, or loan sharks for financial help. Microfinance fills the gap by providing safe small business loans. It is most common in developing nations like Bangladesh, Cambodia, India, Afghanistan, Democratic Republic of Congo, Indonesia, and Ecuador. Many microfinance institutions focus on helping women.

Microfinance institutions offer a range of services, from basic banking to startup capital for small business entrepreneurs and educational programs that teach investing principles. Unlike traditional lenders, microfinanciers prioritize entrepreneurial success. To ensure borrowers’ financial knowledge, they often require basic money-management classes covering topics like interest rates, cash flow, financing agreements, budgeting, and debt management.

Once educated, customers can apply for loans. Loan officers assist borrowers with the application process and oversee lending. While a small loan may not seem significant in developed countries, it can make a substantial impact for impoverished individuals, allowing them to start or sustain a business.

Microfinance loans have specific terms, including interest charges and repayment plans. Some lenders require borrowers to set aside a portion of their income in a savings account as insurance against default. Successful repayment builds credit history, enabling applicants to secure larger loans in the future. Despite being labeled "very poor," microloan borrowers often have higher repayment rates than those with traditional financing.

Microfinance is not a new concept; it has existed since the 18th century. The Grameen Bank in Bangladesh, founded in 1983 by Muhammad Yunus, brought global attention to microfinance. The bank promotes its "16 Decisions" to help people improve their lives. Other microfinance organizations operate worldwide and are supported by larger institutions or governments. Choices abound for lenders to support borrowers based on poverty level, geographic region, or type of small business.

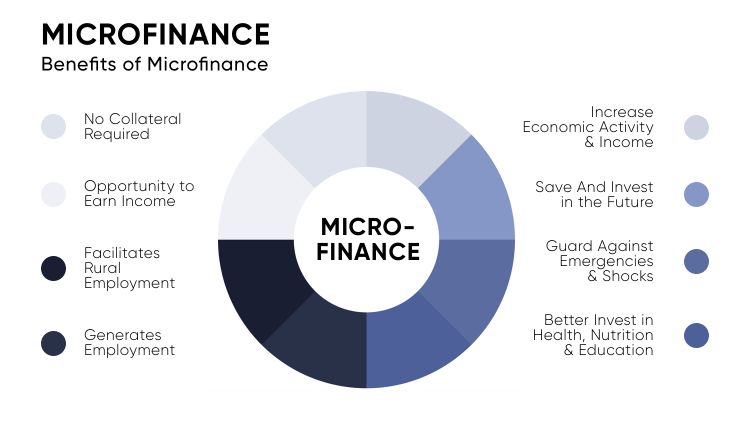

The benefits of microfinance extend beyond providing capital. Successful entrepreneurs create jobs, trade, and economic growth within communities. While microfinance has been praised, it has also faced criticism. Some argue that high interest rates exploit the poor, and for-profit microfinanciers prioritize profits over poverty alleviation. Others question the impact of small, individual loans and advocate for large-scale job creation and industry development.

In summary, microfinance offers banking services to low-income individuals by providing small loans, financial education, and other financial products. Despite criticism, microfinance has benefited millions of people globally. It remains a subject of debate as efforts continue to refine and improve its effectiveness for poverty alleviation.