Mezzanine Debt What It Is How It Works and Examples

Contents

Mezzanine Debt: What It Is, How It Works, and Examples

What Is Mezzanine Debt?

Mezzanine debt occurs when a hybrid debt issue is subordinated to another debt issue from the same issuer. It has embedded equity instruments attached, often known as warrants, which increase its value and flexibility when dealing with bondholders. Mezzanine debt is frequently associated with acquisitions and buyouts, and can be used to prioritize new owners in case of bankruptcy.

Key Takeaways

- Mezzanine debt is when a hybrid debt issue is subordinate to another debt issue from the same issuer.

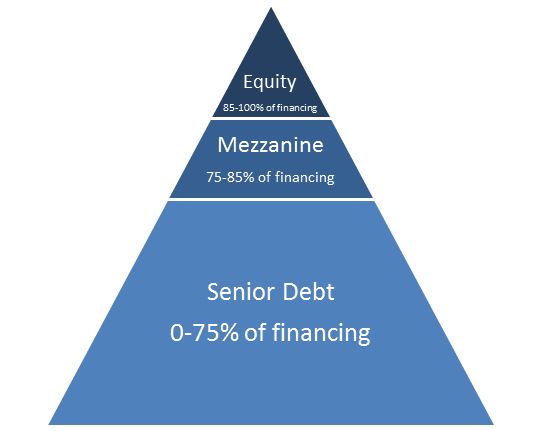

- Mezzanine debt bridges the gap between debt and equity financing and is one of the highest-risk forms of debt.

- Mezzanine debt behaves more like a stock than debt, as the embedded options make the conversion into stock attractive.

- Mezzanine debt offers high returns, often between 12% and 20% per year.

Understanding Mezzanine Debt

Mezzanine debt bridges the gap between debt and equity financing and is one of the highest-risk forms of debt. It offers high returns, often between 12% and 20% per year.

Types of Mezzanine Debt

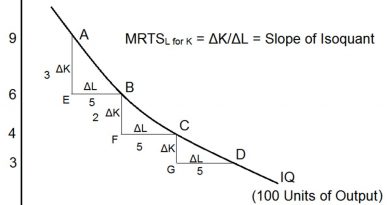

Mezzanine debt includes various types of equity, such as stock call options, rights, and warrants. It behaves more like a stock due to the embedded options.

Mezzanine debt structures are common in leveraged buyouts. For example, in a $100 million acquisition, a private equity firm may secure a loan of $80 million and seek a mezzanine investor to finance $15 million, minimizing the firm’s own capital investment to $5 million.

Under U.S. Generally Accepted Accounting Principles (GAAP), the classification of hybrid securities depends on the influence of the embedded option on the debt portion.

Example of Mezzanine Debt

Mezzanine debt is commonly used in mergers and acquisitions (M&A). In 2016, Olympus Partners received debt financing from Antares Capital to acquire AmSpec Holding Corp.

The total financing of $215 million included a revolving credit facility, a term loan, and a delayed draw term loan. Antares Capital provided the entire capital in the form of mezzanine debt, granting it equity options.