Variable Interest Entities VIE Definition and How They Work

Variable Interest Entities (VIE): Definition and How They Work

What Is a Variable Interest Entity (VIE)?

A variable interest entity (VIE) is a legal business structure in which an investor has a controlling interest despite not having a majority of voting rights. This controlling interest is achieved through a contractual relationship, rather than direct ownership. The structure is designed to protect the business from creditors or legal action. Characteristics of a VIE include equity investors who lack the resources to support the ongoing operating needs of the business.

Key Takeaways:

– A VIE is a legal business structure in which an investor has a controlling interest without a majority of voting rights.

– Investors in VIEs do not participate in residual gains or losses.

– VIEs are often set up as special purpose vehicles (SPVs) for holding financial assets or conducting research and development.

– Public companies must disclose their relationships to VIEs when filing their 10-K forms.

How a VIE Works

VIEs are frequently established as special purpose vehicles (SPVs) for holding financial assets or conducting research and development. They provide a way for companies to finance projects without risking the entire enterprise. However, VIEs have been misused to keep securitized assets off corporate balance sheets.

In a VIE, investors do not have a direct ownership stake. Instead, they have special contracts that dictate the terms and rules and pledge a percentage of profits. Investors do not participate in residual profits or losses, nor do they have voting rights.

Reforms following the global financial crisis aimed to counter misuse of VIEs. However, lobbying efforts resulted in relaxed rules, enabling banks to continue using off-balance-sheet entities to hide loans.

Regulating VIEs

Under Federal securities laws, public companies must disclose their relationships with VIEs in their 10-K forms. FASB Interpretation Number 46 outlines the accounting rules for VIEs. Revisions have been made to the original rule, particularly after the 2008 financial crisis, in order to improve transparency and financial reporting.

A beneficiary firm must meet certain criteria to be considered the actual beneficiary of a VIE. This includes having the power to direct activities that significantly affect the entity’s economic performance and having the obligation to absorb losses or the right to receive benefits that could be significant to the entity.

Special Considerations

If a company is the primary beneficiary of a VIE, it must disclose the entity’s holdings on its consolidated balance sheet. However, consolidation is not required if the company is not the primary beneficiary. Companies are still required to disclose information about VIEs in which they have a significant interest.

Examples of VIEs

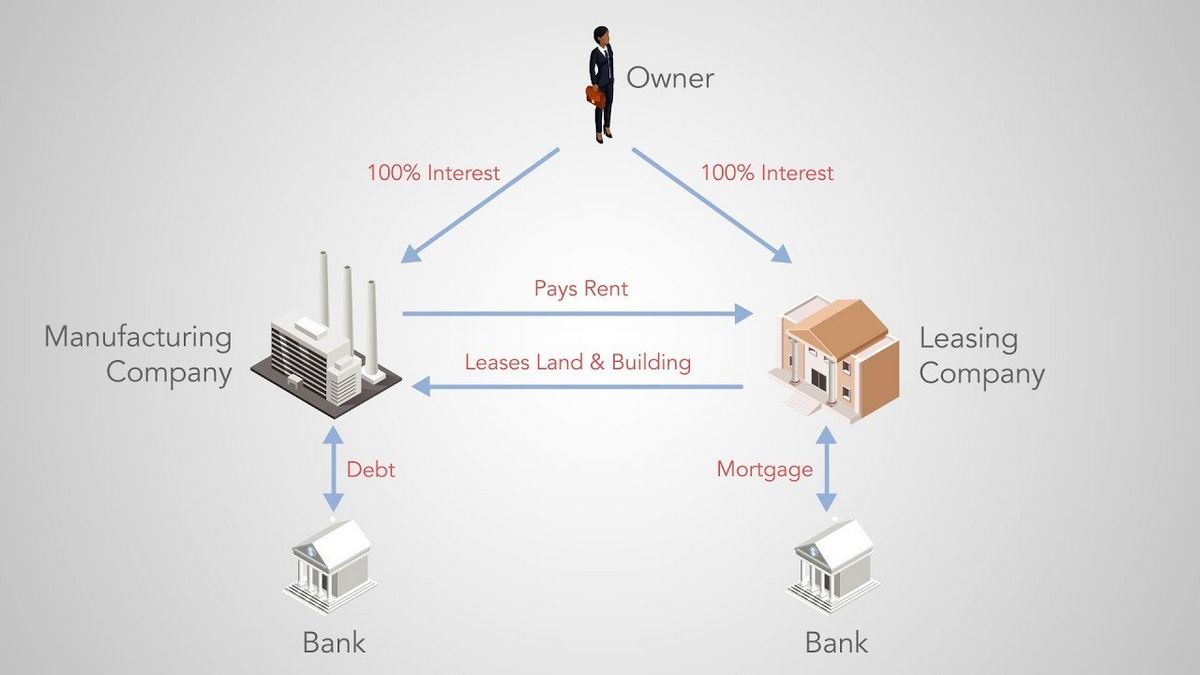

VIEs can take various forms depending on the needs of the beneficiary company. Examples include operating leases, subcontracting arrangements, and offshore companies.

How Does a VIE Work?

VIEs are contractual obligations between a beneficiary firm and a third party. The nature of the association is not considered ownership, allowing the VIE structure to circumvent reporting rules and regulations, as well as taxation.

Chinese VIEs in the U.S.

Over 100 Hong Kong- and Chinese-based corporations are structured as VIEs in the United States. This structure allows these firms, including well-known companies like Alibaba, Tencent, Baidu, JD, and NetEase, to bypass Chinese regulations that restrict foreign capital investments in certain types of Chinese companies, such as those in telecommunications or media.