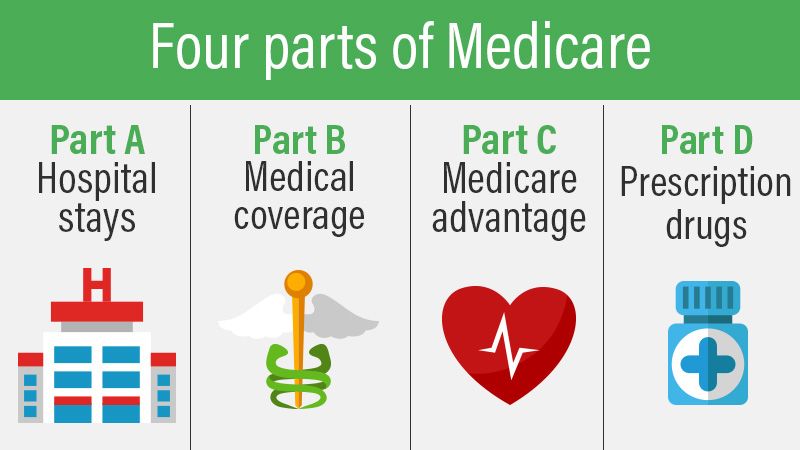

Medicare Part A What It Is How It Works

Medicare Part A is a component of the federal government’s health insurance program for older adults and eligible individuals. It pays for inpatient hospital stays, procedures, care in skilled nursing facilities, hospice care, and home health care. This coverage includes semi-private rooms, supplies, drugs, physical and occupational therapy at home for homebound individuals, and doctor’s services, medication, and grief-and-loss counseling for terminally ill patients.

Here are the key takeaways:

– Medicare Part A covers care at hospitals, skilled nursing facilities, nursing homes, and home health services.

– Most people receive Part A for free because of the Medicare payroll tax.

– If you haven’t started collecting Social Security at age 65, you need to enroll in Medicare online, by phone, or at a Social Security office.

– Medicare does not cover all services, such as custodial care in a nursing home.

– The CARES Act expanded Medicare’s ability to cover COVID-19-related treatment.

Medicare Part A, also known as Medicare hospital coverage, pays for care at hospitals, skilled nursing facilities, nursing homes, and home health services. If you paid Medicare taxes during your working years, you don’t pay premiums for Part A once you’re 65 years old. However, even if it’s premium-free, you may still have out-of-pocket expenses for copayments and coinsurance. Deductibles for inpatient hospital stays in 2024 are $1,632.

You’re eligible for Medicare Part A if you meet the citizenship and residency requirements and you are age 65 or older, receive disability benefits from Social Security or the Railroad Retirement Board for at least 25 months, have amyotrophic lateral sclerosis (ALS), or have end-stage renal disease (ESRD) and meet certain requirements.

Signing up for Medicare Part A depends on whether you’re receiving Social Security benefits. If you have ESRD, you can enroll in Parts A and B or in a Medicare Advantage Plan. If you’re not automatically enrolled and will be eligible when you turn 65, you should sign up through Social Security during your initial enrollment period.

Medicare Part A doesn’t cover everything, and providers must ask patients to sign a notice if a service may not be covered. It’s important to find out if Medicare will cover the cost before using a Part A service and inquire about alternatives or file an appeal.

The CARES Act of 2020 expanded Medicare’s ability to cover treatment and services for individuals affected by COVID-19, increasing flexibility for telehealth services and authorizing Medicare certification for home health services by certain healthcare professionals.

Medicare Part A’s cost depends on whether or not you paid Medicare taxes throughout your career. There may be a premium if you didn’t pay Medicare taxes, and regardless of premium costs, there are additional costs like co-pays, coinsurance, and deductibles.

Enrollment in Medicare Part A is automatic for many individuals who have received Social Security or Railroad Retirement Board benefits for a certain period or have been diagnosed with ALS. However, Medicare Part A does not include coverage for every medical need, so additional insurance may be necessary for dental, vision, doctor visits, prescription drugs, and more.