Medicare Advantage Overview Types FAQs

Contents

- 1 Medicare Advantage: Overview, Types, FAQs

- 1.1 What Is Medicare Advantage?

- 1.2 How Medicare Advantage Works

- 1.3 Types of Medicare Advantage Plans

- 1.4 Special Considerations

- 1.5 Medicare Star Ratings

- 1.6 What is Medicare Advantage?

- 1.7 What Are the Disadvantages of Medicare Advantage?

- 1.8 Can I Sign Up for Medicare Advantage with a Preexisting Condition?

Medicare Advantage: Overview, Types, FAQs

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

What Is Medicare Advantage?

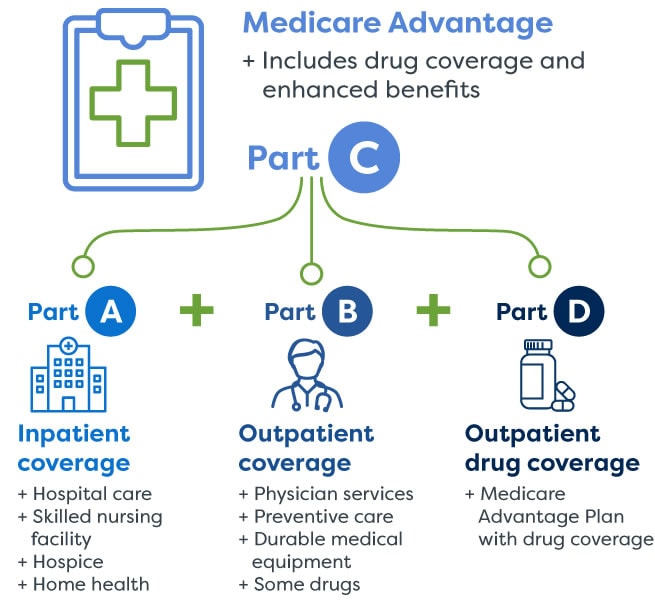

Medicare Advantage (MA) is a Medicare plan offered by private insurers who contract with the program. Medicare Advantage plans, also known as Medicare Part C, provide hospital, outpatient, and prescription drug coverage, replacing benefits under Medicare parts A, B, and D.

Anyone who joins an MA plan still has Medicare and must continue paying Medicare Part B premiums. Medicare Advantage plans typically have lower out-of-pocket costs than traditional Medicare while requiring members to receive care from network providers and obtain referrals to see specialists.

Key Takeaways

- Medicare Advantage, also known as Medicare Part C, are Medicare-approved plans offered by private insurers.

- Medicare Advantage plans replace hospital, outpatient, and prescription drug benefits under parts A, B, and D of traditional Medicare, with the exception of hospice care.

- MA plans often require patients to see network providers or charge higher out-of-pocket costs for outside providers and require referrals to see specialists.

- Medicare Advantage providers receive a fixed fee from the program for each participant and may charge policyholders out-of-pocket fees for some services.

How Medicare Advantage Works

Medicare is available for people age 65 or older, younger people with disabilities, and people with end-stage renal disease or amyotrophic lateral sclerosis (ALS).

Medicare Advantage plans are Medicare-approved policies offered by private companies as an alternative to traditional Medicare coverage. MA plans provide hospital and outpatient coverage that replaces parts A and B of Medicare, with the exception of hospice care. Most MA plans also include Part D prescription drug coverage.

Over 28 million people, about 48% of Medicare beneficiaries, were enrolled in a Medicare Advantage plan in 2022. Medicare Advantage plan providers receive a fixed fee from the program for each participant. The plan providers also collect out-of-pocket costs from policyholders and may limit coverage to network providers, requiring referrals to see specialists.

Some Medicare Advantage plans cover additional costs not covered by traditional Medicare, including vision, dental, and hearing-related expenses. Medicare Advantage plans don’t work with Medigap, also called Medicare Supplement Insurance.

The average Medicare Advantage monthly premium is $18.50 in 2024. Medicare Advantage participants pay any MA plan premium in addition to the monthly Medicare Part B premium, set at $174.70 in 2024.

Regional preferred provider organizations (PPOs) provide access to Medicare Advantage plans in rural areas and cover entire statewide or multi-state regions. Regional PPOs accounted for 5% of Medicare Advantage enrollees in 2020.

Types of Medicare Advantage Plans

The most common Medicare Advantage plan is a health maintenance organization (HMO). Other Medicare Advantage plans include PPOs, private fee-for-service (PFFS) plans, and special needs plans (SNPs). HMO point-of-service (HMOPOS) plans and medical savings account (MSA) plans are less common.

To join any Medicare Advantage plan, you must live within its service area and have Medicare parts A and B.

People with end-stage renal disease (ESRD) became eligible to sign up for Medicare Advantage plans in 2021. ESRD patients should compare the costs and benefits of Medical Advantage plans with those of traditional Medicare coverage and ensure their doctors and hospital are in the plan’s provider network.

Special Considerations

Medicare’s online plan-finder tool includes information about Medicare Advantage plans. To enroll, a consumer must provide the information on their Medicare card, including their Medicare number and coverage dates. Enrollment can be changed during a specified open enrollment period in the fall, typically from mid-October to early December.

Like other health insurance, each Medicare Advantage plan has different coverage rules and costs. Joining a Medicare Advantage plan may make someone ineligible for employer or union-based coverage, so if employer-based coverage fits a person’s needs, they may want to hold off on enrolling in Medicare.

All Medicare Advantage plans have an annual limit on out-of-pocket costs, which may make them more cost-effective. The out-of-pocket maximum for single coverage is $9,450 in 2024. For family coverage, the 2024 out-of-pocket maximum is $18,900.

Medicare Star Ratings

Medicare Star Ratings help seniors compare Medicare Advantage plans. The ratings range from one to five stars, based on up to 38 quality and performance measures, including customer service, screenings and preventive services, and chronic condition management. The ratings are released annually ahead of the fall Medicare open enrollment period, from Oct. 15 to Dec. 7.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a category of privately run health plans contracted by Medicare to provide an alternative to traditional Medicare coverage. Medicare Advantage plans replace coverage under Medicare parts A, B, and D. They often offer lower costs and cover more services than traditional Medicare, while limiting care to in-network providers and requiring referrals for specialists.

What Are the Disadvantages of Medicare Advantage?

Medicare Advantage can become expensive if you’re sick, due to co-pays. The enrollment period is limited, and you won’t be eligible for Medigap coverage if you have Medicare Advantage. Additionally, providers can leave and join your network at any time.

Can I Sign Up for Medicare Advantage with a Preexisting Condition?

Yes. Medicare Advantage offers coverage for individuals with preexisting conditions.