MBA Refinance Index What It Is How It Works

Ali Hussain has a background in finance with large financial institutions and in journalism covering business.

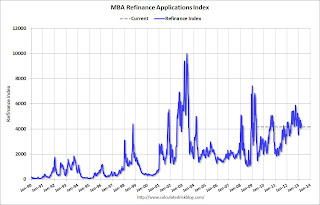

The MBA Refinance Index is a measurement put together by the Mortgage Bankers Association, a national real estate finance industry association. It helps predict mortgage activity and loan prepayments based on the number of mortgage refinance applications submitted.

Key Takeaways:

– The MBA Refinance Index predicts mortgage activity and loan prepayments based on refinance applications.

– Homebuilders pay attention to the index as it is a leading indicator of home sales.

– Investors use the index to gauge prepayment activity, which can impact holders of mortgage-backed securities (MBSs).

– Economists are interested in the index to understand how other areas of the economy are affected.

– The index is created through the MBA’s Weekly Application Survey.

Understanding the MBA Refinance Index:

The MBA Refinance Index measures the number of refinance applications submitted and is reported every Wednesday. It does not measure the number of closed refinance loans. The index reports the new weekly number, the percentage change from the previous week, and the index’s four-week moving average.

The index is a tool to predict mortgage activity. Homebuilders and mortgage investors pay attention to it as a leading indicator of home sales and mortgage prepayment activity, respectively.

Economists follow the index to understand the impact of refinancing on other areas of the economy. It is influenced by mortgage interest rates, 10-year bond rates, and home prices.

An increase in refinancing activity can be bad news for investors of mortgage-backed securities (MBS) because it replaces higher interest rate mortgages with lower interest payment mortgages.

The Mortgage Bankers Association also releases the MBA Purchase Index, which measures home loan applications for buying rather than refinancing. The MBA’s Weekly Application Survey is used to create various indexes that provide different focuses on the mortgage market.

The survey captures approximately 75% of all mortgage applications and covers a wide variety of mortgage types and lenders.

The Mortgage Bankers Association (MBA) publishes all of the indexes mentioned above. It represents mortgage bankers and works to promote fair and ethical lending practices.

A refinance index specifically refers to the MBA Refinance Index provided by the Mortgage Bankers Association (MBA). It provides weekly information on the U.S. mortgage market’s refinancing and prepayment activity.

There are various reasons not to refinance a home, including the cost and time. If the time to recoup the costs is longer than you plan on owning your home, it may not be worth it. The new interest rate and monthly savings should significantly improve to make refinancing worth the cost.

A mortgage index is the benchmark interest rate used to calculate the interest rate on an adjustable-rate mortgage (ARM). It comprises an index value and an ARM margin.