Material News

Material news is information that may impact the value of a company’s securities or influence investor decisions. It directly relates to the company’s business and can cause the company’s share price to move up or down.

Key Takeaways:

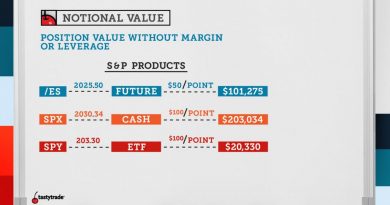

– Material news includes corporate events, earnings results, stock splits, and other price-sensitive developments in a company.

– Material news can affect a company’s stock price.

– The New York Stock Exchange (NYSE) has rules regarding the release of material news.

– Material news differs from material insider information, which is non-public information that can impact a company’s share price.

– Many investors and funds have trading strategies based on material news.

Understanding Material News:

Material news includes corporate events, earnings results, stock splits, and other price-sensitive developments in a company, such as proposed acquisitions, mergers, profit warnings, and director resignations.

The NYSE Listed Company Manual requires listed companies to notify the NYSE at least 10 minutes before announcing material news during trading hours. This allows the NYSE to temporarily halt trading in the company’s securities, if necessary.

Material news can cause a company’s share price to increase or decrease. Significant drops in share price may lead to a trading halt by the NYSE to prevent market panic.

NYSE Material News Rules:

On December 4, 2017, the NYSE changed its rules to prohibit listed companies from releasing material news after 4 p.m. Eastern Time, until the publication of the company’s official NYSE closing price or five minutes after the close of trading. This change amended the 2015 amendment of Section 202.06 of the NYSE Listed Company Manual, which requested companies to wait 15 minutes or until the publication of the company’s official closing price before releasing material news after the close of trading. The purpose of this delay is to prevent investor confusion when trading on other markets continues after the NYSE’s close of trading.

Material News vs. Material Insider Information:

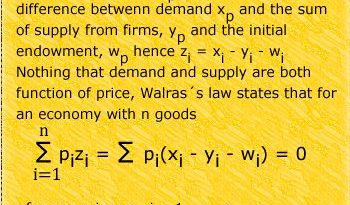

Material news is price-sensitive information publicly announced to shareholders, while material insider information is non-public information that will impact a company’s share price once disclosed. It is illegal to use material insider information to gain an advantage in trading or to provide it to others for the same purpose. Insider trading is severely punished by the Securities and Exchange Commission (SEC) with fines and imprisonment.

Trading Material News:

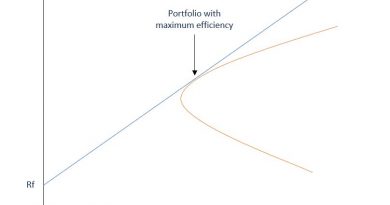

Algorithmic trading allows quantitative hedge funds to trade based on news headlines more efficiently than human traders. When material news is released, a stock may initially move significantly but recover as the market digests the information. Traders can use algorithmic trading to take advantage of the period before the news is fully absorbed and the market recovers.

Trading the news is a common strategy employed by many investors who make decisions before or after material news is announced. It is important to consider whether the news is already factored into the stock’s valuation and if it meets market expectations.