Monetary Theory Overview and Examples of the Economic Theory

Monetary Theory: Overview and Examples of the Economic Theory

What Is Monetary Theory?

Monetary theory suggests that changes in money supply drive economic activity. It argues that central banks control economic growth rates by adjusting the amount of currency and liquid instruments circulating in an economy.

Key Takeaways:

– Monetary theory states that changes in money supply drive economic activity.

– The equation of exchange, MV = PQ, governs monetary theory.

– The Federal Reserve (Fed) controls the money supply through the reserve ratio, discount rate, and open market operations.

– Money creation is a topic of interest within Modern Monetary Theory (MMT).

Understanding Monetary Theory

Monetary theory posits that increasing a nation’s money supply will boost economic activity, while decreasing it will have the opposite effect. The equation of exchange, MV = PQ, guides monetary theory. M represents the money supply, V represents velocity, P represents the price of goods and services, and Q represents the quantity of goods and services. When M increases, P and/or Q rise assuming a constant V.

When the economy is near full employment, the price levels tend to rise more than the production of goods and services. However, when there is slack in the economy, the quantity of goods and services increases at a faster rate.

In many developing economies, monetary theory is controlled by the central government. In the U.S., the Federal Reserve Board (FRB) sets monetary policy independently.

The FRB focuses on maintaining stable prices, promoting full employment, and achieving steady GDP growth. Stable prices and access to capital are believed to optimize market functionality.

Types of Monetary Theories

In the U.S., the Federal Reserve (Fed) controls the money supply using three main levers:

– Reserve ratio: The percentage of reserves banks must hold against deposits. A decrease in the ratio allows banks to lend more, increasing the money supply.

– Discount rate: The interest rate charged to commercial banks needing additional reserves. A decrease in the rate encourages borrowing and increased lending.

– Open market operations (OMO): Buying and selling government securities. Buying securities increases the money supply, while selling securities contracts it.

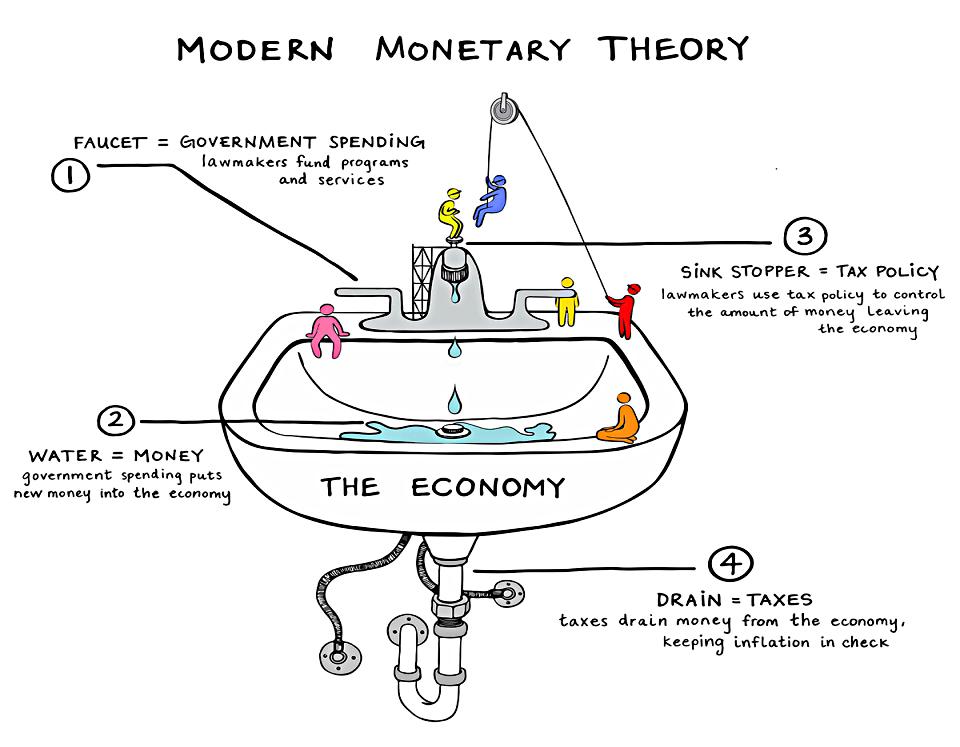

Monetary Theory vs. Modern Monetary Theory (MMT)

The core principles of monetary theory align with Modern Monetary Theory (MMT). Advocates, such as Alexandria Ocasio-Cortez and Bernie Sanders, support money creation as a useful economic tool. They dispute claims about currency devaluation, inflation, and economic chaos resulting from increased money supply.

MMT suggests that governments should spend freely, running deficits to fix economic issues. Countries with their own currencies, like the U.S., can increase the money supply or minimize the effects of expansionary monetary policy through taxation. The theory argues that countries cannot default on their debts because there is no limit to money creation.

Criticisms of Monetary Theory

Not everyone agrees that increasing the money supply is wise. Some economists argue that it lacks discipline and, if poorly managed, may lead to inflation, erode savings value, create uncertainty, and deter business investment.

Critics also challenge the idea that taxation can address these problems. Higher taxes during rising prices are unpopular and can trigger increased unemployment, further damaging the economy.

Japan is often used as an example, where continued fiscal deficits have produced mixed results. Critics claim that ongoing deficit spending has led to more unemployment without significant GDP growth.