Market Psychology What Is It and Predictions

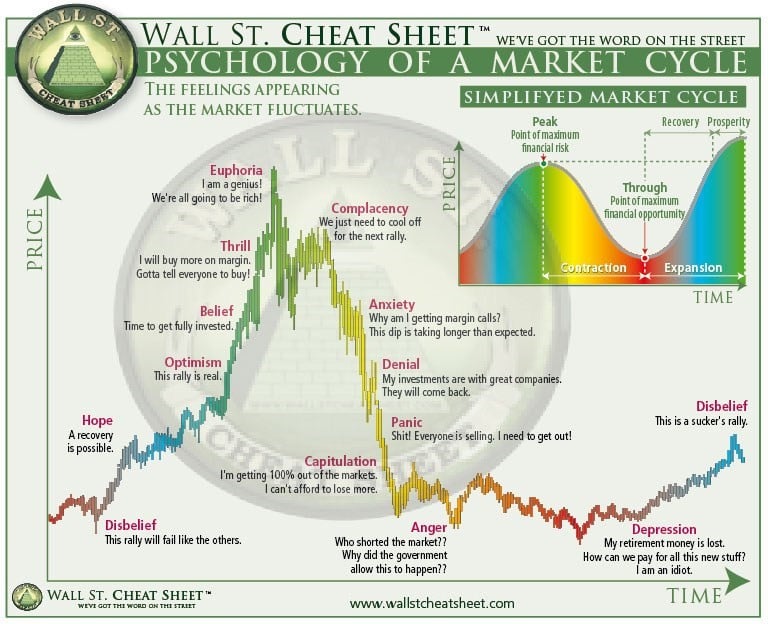

Market psychology refers to the behaviors and sentiment of market actors, explaining market movement that cannot be explained by other metrics. It describes the overall behavior of the market based on emotional and cognitive factors. Market psychology is not the same as trader psychology, which refers to the same factors but on an individual level.

Key Takeaways:

– Market psychology is the consensus sentiment of the market based on individual market participants.

– Greed, fear, anxiety, and excitement contribute to market psychology.

– Conventional financial theory fails to account for market psychology.

Market psychology is a powerful force that may or may not be justified by fundamentals or events. For example, if investors lose confidence in the economy and pull back on buying stocks, the overall market prices will fall along with individual stocks.

Greed, fear, expectations, and euphoria contribute to overall market psychology and can trigger boom and bust cycles in financial markets. These shifts in market behavior are often referred to as animal spirits.

Conventional financial theory, such as the efficient market hypothesis, does not adequately account for market psychology. While fundamentals drive stock performance, market psychology can override fundamentals and push stock prices in unexpected directions.

There are two prevailing methods of stock-picking: fundamental analysis and technical analysis. Fundamental analysis focuses on a company’s financials, while technical analysis considers trends, patterns, and market psychology.

Research in behavioral economics has identified systematic errors in human decision-making that stem from cognitive biases. These theories have been applied to investing, trading, and portfolio management strategies.

Market actors can display herding behavior and other irrational tendencies, such as panic selling and irrational exuberance, due to market psychology. Acknowledging market psychology allows us to understand that markets are not always efficient or rational.

By doing your own research and identifying oversold or overbought conditions caused by market psychology, you can make contrarian trades. Research can also help identify trends early without chasing them after their fundamentals have passed.

Market psychology applies to all asset classes, including stocks, bonds, forex, interest rates, and cryptocurrencies.

Indicators of market sentiment, such as the VIX, can measure fear or greed in the market. Technical analysis tools can also reveal sentiment based on historical price action and volume.

In conclusion, market psychology is the study of herd behavior and sentiment among economic actors, helping skilled traders forecast future price movements and fluctuations in supply and demand.