Understanding the Traditional Theory of Capital Structure

Contents

Understanding the Traditional Theory of Capital Structure

What Is the Traditional Theory of Capital Structure?

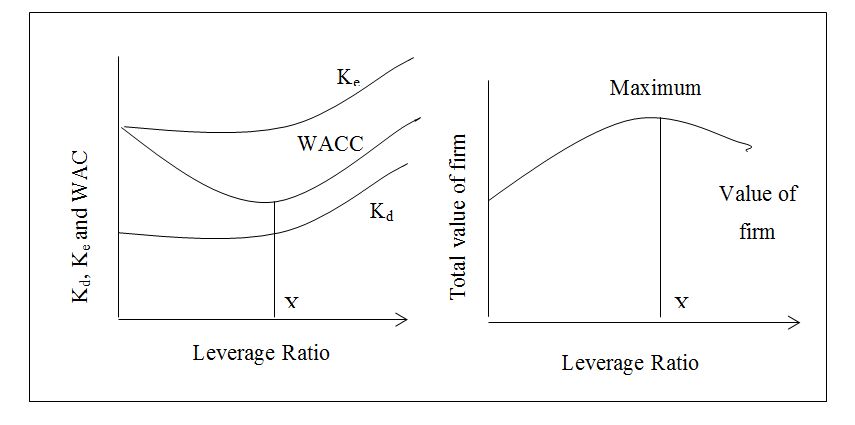

The traditional theory of capital structure states that minimizing the weighted average cost of capital (WACC) and maximizing the market value of assets leads to an optimal capital structure. This is achieved by using a mix of equity and debt capital. The optimal structure occurs when the marginal cost of debt and the marginal cost of equity are equal. Any other combination of debt and equity financing allows for the possibility of increasing firm value by adjusting leverage.

Key Takeaways

- The traditional theory of capital structure suggests an optimal mix of debt and equity financing that minimizes WACC and maximizes value.

- Optimal capital structure is achieved when the marginal cost of debt equals the marginal cost of equity.

- This theory assumes that the cost of debt or equity financing varies with leverage.

Understanding the Traditional Theory of Capital Structure

The traditional theory states that a firm’s value increases until it reaches a certain level of debt capital, after which it remains constant and then starts to decrease if there is excessive borrowing. This decline in value occurs due to overleveraging. On the other hand, a company with no leverage will have a WACC equal to the cost of equity financing and can lower its WACC by adding debt until the marginal cost of debt equals the marginal cost of equity financing. Essentially, the firm faces a trade-off between increased leverage and the rising costs of debt. Beyond this point, additional debt increases the cost of capital and decreases market value. An optimal capital structure is achieved by combining equity and debt financing.

The traditional theory emphasizes that wealth creation is not only dependent on investments in assets yielding positive returns, but also on using an optimal mix of equity and debt financing. Several assumptions underlie this theory, including the availability of only debt and equity financing, the firm paying all earnings as dividends, fixed total assets and revenues, fixed financing, rational investor behavior, and no taxes. Considering these assumptions, it is understandable why there are critics of this theory.

The traditional theory can be compared to the Modigliani and Miller (MM) theory, which suggests that debt and equity finance are interchangeable in efficient financial markets. According to the MM theory, other factors such as corporate tax rates and tax deductibility of interest payments determine the optimal capital structure of a firm.