Long Market Value What It is How It Works

Contents

Long Market Value: What It is and How It Works

Cierra Murry is an experienced writer specializing in banking, credit cards, investing, loans, mortgages, and real estate. With over 15 years of expertise in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management, she serves as a banking consultant, loan signing agent, and arbitrator.

What Is Long Market Value?

The long market value is the total value, in dollars, of a group of securities held in a cash or margin account at a broker. It is calculated using the closing prices of the securities from the previous trading day. However, in a liquid market, real-time market values of individual securities are available.

Long market value is the opposite of short market value, which represents the total value of all net short positions held.

Key Takeaways

- Long market value shows the net value of an investor or trader’s long positions, as calculated by their brokerage.

- This includes most conventional asset classes in cash and margin accounts but may exclude certain non-traditional, exotic assets, or derivatives.

- Long market value can be calculated in real-time based on changes from the previous day’s closing prices.

Understanding Long Market Value

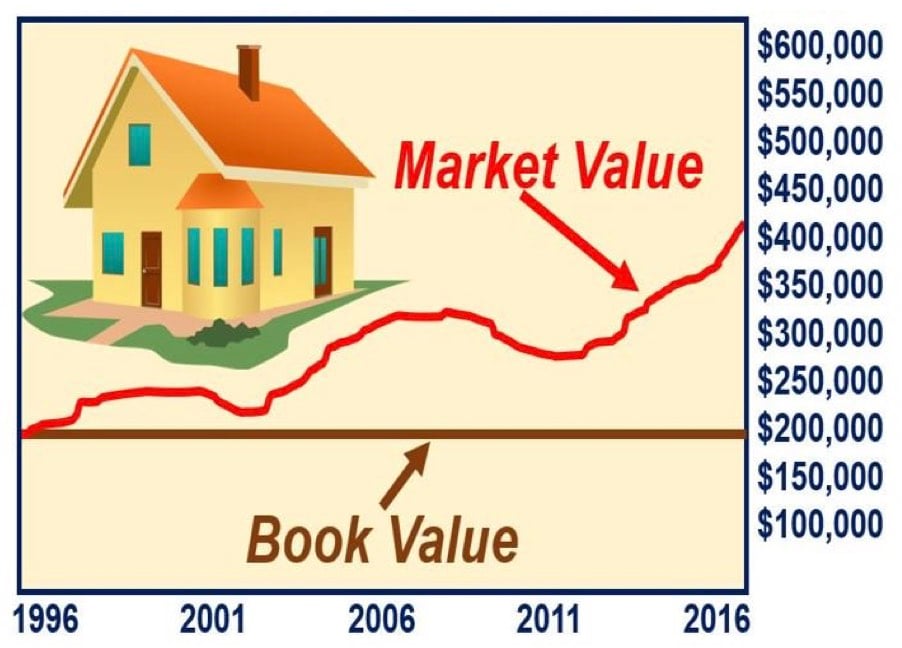

A long position indicates that an investor owns securities, such as stocks. The value of long positions increases when the market price of these holdings rises.

In contrast, a short position refers to when an investor borrows assets to sell them, betting on a decline in market price. A "long" position describes ownership of a security that will generate a profit if its price increases (i.e., buy low, sell high). On the other hand, a "short" position is the term used when a security is "sold" without actually owning it.

An investor can "short" a stock by borrowing it from another holder and buying it later to close the position (sell high, buy low).

Brokerages calculate long market values by including long positions in most common investment vehicles. However, holdings in commercial paper, options, annuities, and certain precious metals are often excluded. Margin accounts typically calculate long market value for conventional securities only, as options and similar instruments are not standard securities available for use with margin accounts, despite their regular use in portfolio management.

Today, real-time market value can be computed and viewed on a broker’s website or online trading platform. In situations where the previous closing price is unavailable, a third-party valuation or previous bid price can be used for the calculation.

Long Market Value and Margin

A margin account is a brokerage account that allows customers to use borrowed money (margin) to purchase securities. The loan is collateralized by the securities and cash in the account. With a margin account, customers leverage a broker’s money to amplify both gains and losses.

When securities are held in a margin account and an investor borrows money from the broker to buy more on margin, the long market value is used by the broker to monitor the account holder’s cash or equity position. If the equity balance of an account starts to decrease due to the decline in the value of long positions, the broker will issue a margin call to replenish equity. Failing to meet the margin call may result in the liquidation of the account’s holdings.