Market Letter What It is How It Works Example

Market Letter: What It is, How It Works, Example

What Is a Market Letter?

A market letter is a publication that informs investors and other stakeholders, often via paid subscription, about a particular category of investments. Market letters focus on specific areas of investing, such as growth stocks, value stocks, or real estate.

For example, a real estate market letter provides commentary on market trends and Real Estate Investment Trusts (REITs). A market letter on growth stocks informs individuals about stocks poised for significant future growth.

Key Takeaways

– Market letters provide information and advice about specific types of investments.

– There are thousands of market letters to choose from, covering a wide variety of investment types, guiding investors’ decisions.

– Most market letters underperform their benchmarks but offer insight into the financial sector.

– Readers should avoid unscrupulous or ineffective publications, especially given the abundance of online market letters.

How a Market Letter Works

Thousands of market letters are available online, covering asset classes from stocks and bonds to alternative investments. While some market letters recommend individual investments, others educate readers on investment strategies and industry sectors.

The quality of information can differ widely, and readers should consider authors’ track records and potential conflicting interests.

Newsletters emerge around hot or new sectors, such as cryptocurrencies and blockchain. However, credible market letters in these sectors are scarce due to limited long-term track records.

Cautiousness is necessary when dealing with specific investment recommendations, as unscrupulous publishers may engage in pump and dump scams.

Subscribing to a Market Letter

Most market letters require a subscription, with setup varying across providers. Some companies offer free advice and paid subscriptions for additional articles, including specific investment recommendations.

Other offers include a portion of the article for free but require a subscription or payment to access the complete content. Investment advice providers aim to profit from their knowledge.

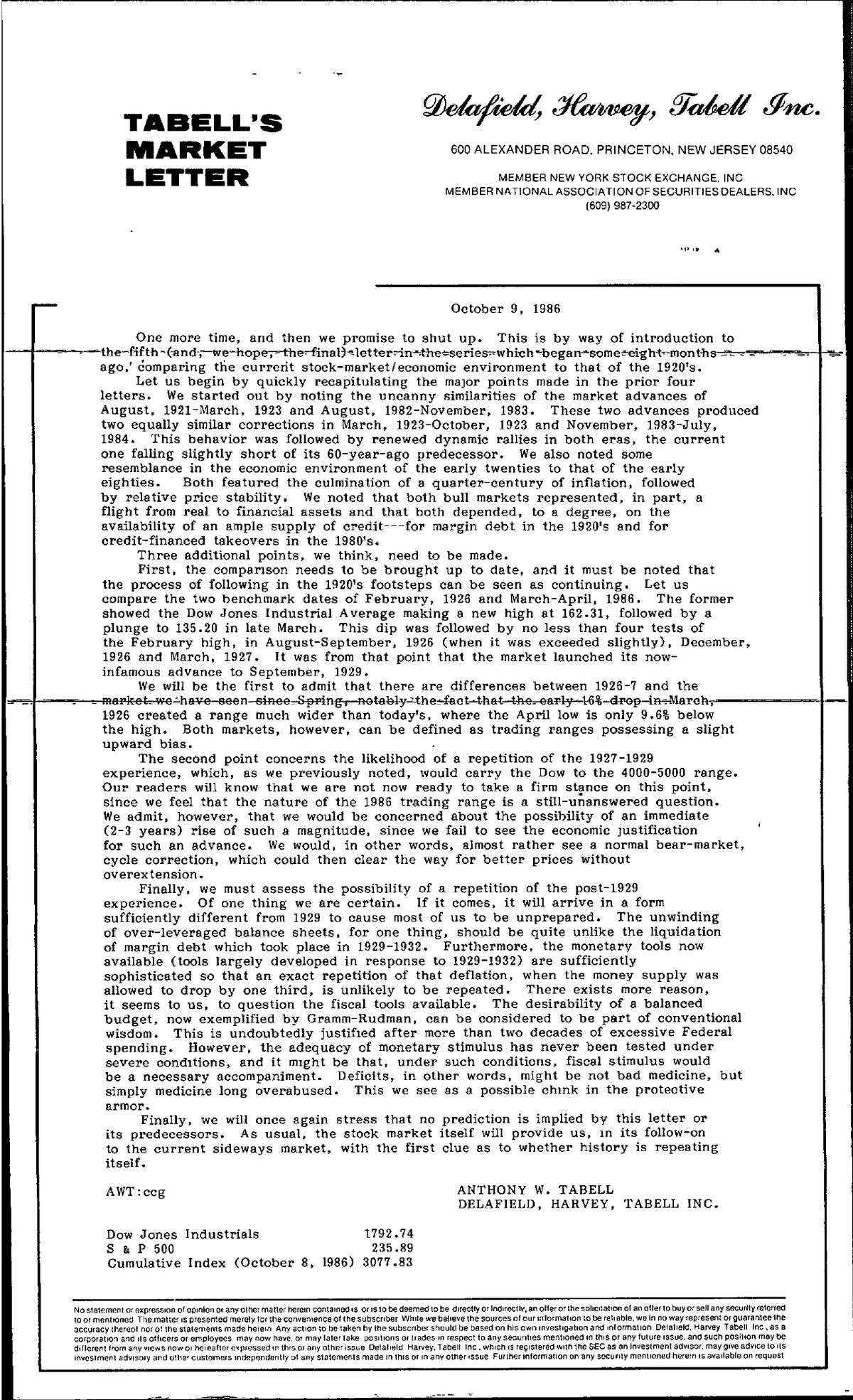

Real-World Example of a Market Letter

Financial service providers track market letter performance to guide readers. Hulbert Ratings, a popular source, evaluates how letters’ advice fares against their stated benchmarks. According to Hulbert Ratings, fewer than 10% of the market letters beat their benchmarks.

To assist readers, Hulbert Ratings publishes an "Honor Roll" featuring the year’s best letters. Examples from the 2020-2021 Honor Roll include Bob Brinker’s Marketimer, The Investment Reporter, Investor Advisory Service, and Wilshire 5000 Total Return Index. These letters focus heavily on U.S. equities.

It is advisable not to rely solely on one source, but rather to conduct thorough research using multiple sources. Additionally, studying the financials of companies and their respective industries is recommended. Certified financial advisors can also provide additional advice.

With the vast amount of information available today, cutting through noise and bad advice is crucial for making sound investment decisions.