Market-If-Touched MIT Order Meaning Overview Example

Market-If-Touched (MIT) Order: Meaning, Overview, Example

What Is a Market-If-Touched Order?

A MIT order is a conditional order that becomes a market order when a security reaches a specified price, even if only briefly. When using a buy MIT order, a broker will wait until the security reaches the specified level before purchasing the asset. A sell MIT order will trigger a market sell order when the security reaches a specified sell price.

While a price is specified for the market order, the fill price will vary based on liquidity. Market orders take any available price once triggered and may not fill at the specified price.

Key Takeaways

-A MIT order initiates a market order if a specified price level is reached.

– MIT orders are typically used to buy when a price is falling or to sell when a stock is rising.

– Market orders are prone to slippage, resulting in a worse fill price than expected, unlike limit orders.

Understanding Market-If-Touched Orders

A MIT order allows investors to purchase or sell a security at a desired value without actively monitoring the market. Similar to a stop order, MIT orders have an inverse buy or sell action compared to stop orders. For example, a buy MIT order looks for the price of an asset to fall, while a buy stop order activates when the market value of the security increases past a specified level.

Suppose a stock is trading at $10.00 per share. According to your analysis, the stock will be undervalued at $8.00 per share. You may place a MIT order at $8.00 per share. If the price moves to $8.00 or below—the trigger price—a market buy order will be sent out and filled at the best price at the time. That price may be $8, $8.02, $8.10, or $7.90, for example. This means you can invest near the "undervalued" price without constantly watching the market.

Market-If-Touched Order Strategies

MIT orders are designed to take advantage of sudden or unexpected changes in price. When combined with stop or limit orders, these order types cover any scenario where you may wish to buy or sell shares based on a trigger price.

Short-term traders may be waiting for the price to hit a key support level before entering into a long position. In this case, they can place a MIT buy order at the support level to automatically send a market purchase order once the price reaches the support level. If the price doesn’t reach the specified price, the order doesn’t trigger, and there is no trade.

Long-term investors may be waiting for the price to reach a certain price where it may be "undervalued." In this case, they may place a MIT order at that price to automatically trigger a market buy order once the price reaches the price level they view as undervalued.

Market-if-touched orders are often used in conjunction with various forms of fundamental and technical analysis that help set a key trigger price. Once that price is reached, the order type executes a market order, which is helpful for individuals managing many different opportunities or those who may not be readily available to manually execute trades.

Market-If-Touched Orders and Slippage

All market orders are subject to slippage. Slippage is getting a different price than expected on an order. For example, assume a trader places a MIT to sell a thinly traded stock at $50. If the stock doesn’t typically do a lot of volume, there may be a large spread between the bid price and ask price.

Assume the bid is $49.80 and the offer is $50. If someone else buys from the offer at $50 (touched), this will trigger the MIT sell order. Since it is a market order, it will seek out the closest bid to sell to. In this case, the order will fill at $49.80, assuming the bid quantity at $49.80 is of equal or greater size than the sell order.

If the sell order is larger than the quantity being bid at $49.80, then the market order will take all the shares at $49.80 and continue looking for shares to sell to at lower prices. The next bid may be $49.71. The sell order will sell to those bids as well, attempting to fill the rest of the sell order. The process will continue, seeking out additional shares to sell to at lower prices, until the sell order is filled.

The same process can happen when buying, where the trader ends up buying at a higher price than their trigger price.

It is also possible that the trader could see price improvement on their order, receiving a better average price than the trigger price. This could happen if the price gaps through the trigger price. When the stock re-opens the next trading day, the market order will be deployed, potentially receiving a much better fill price than the trigger price.

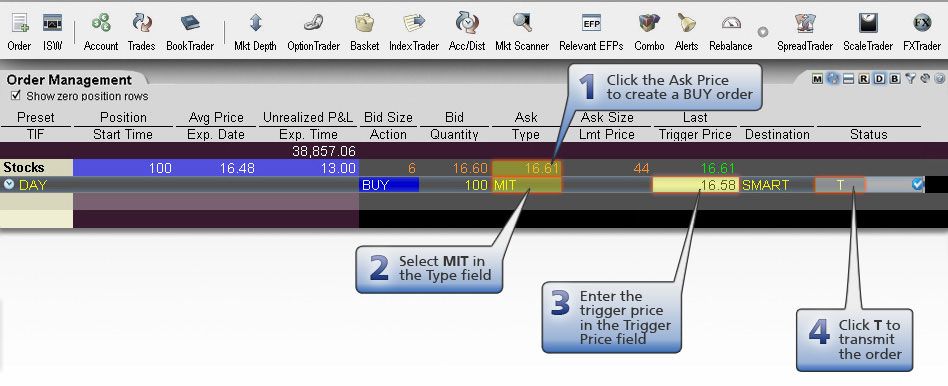

Example of a Market-If-Touched Order to Buy a Stock

Suppose a trader looks at a chart of Meta, formerly Facebook, (META) and decides they want to enter the stock if the price falls to $130. They could place a limit order, which will place a bid at $130 and will only fill at $130 or lower.

Our trader doesn’t want to risk the price touching $130 and then moving higher without their limit order at $130 being filled. So instead, they place an MIT with a trigger price of $130. If $130 is touched, a single order is processed at $130, the MIT will activate, sending out a market buy order, taking whatever price it can get. The offer when $130 is touched may be $130.10, in which case the market buy order will fill at $130.10.

The market order aspect of the MIT order indicates some urgency on the part of the trader to get in. They don’t want to miss out if their trigger price is touched. This means they may pay a slightly higher price than someone using a limit order at $130. The trade-off is that the MIT order is slightly more likely to be filled than the limit order.

The market order aspect of the MIT order indicates some urgency on the part of the trader to get in. They don’t want to miss out if their trigger price is touched. This means they may pay a slightly higher price than someone using a limit order at $130. The trade-off is that the MIT order is slightly more likely to be filled than the limit order.