Market-Based Corporate Governance System Overview

Market-Based Corporate Governance System Overview

What Is a Market-Based Corporate Governance System?

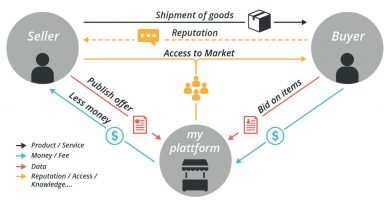

A market-based corporate governance system relies on investors to influence company management. It defines the responsibilities of participants, including shareholders, the board of directors, management, employees, suppliers, and customers.

Key Takeaways

- Market-based corporate governance systems place the responsibility of corporate management on investors.

- A market-based corporate governance system relies on capital markets to influence company management.

- Market-based corporate governance systems benefit from their ability to respond dynamically to changes.

- Issues with market-based governance systems include short-termism and the potential of index funds to undermine accountability.

Understanding Market-Based Corporate Governance Systems

A market-based corporate governance system is derived from common law. It is one of several corporate governance systems developed throughout the world. Since markets are the primary source of capital, investors have the most power in determining corporate policies.

Corporate governance covers how public companies are managed and interact with shareholders. A goal of corporate governance, according to the Organization for Economic Co-operation and Development (OECD), is to create an environment of market and business confidence in individual companies, maximizing their ability to put capital to use.

Corporate governance addresses issues ranging from ownership and compensation to diversity and the independence of a company’s board of directors. Transparency in public disclosure of information pertinent to shareholders and the investing public is a fundamental tenet.

Market-based corporate governance is one approach to ensuring protections for shareholders and company adherence to regulations. The U.S. and India are examples of market-based corporate governance systems that do not have national governance policies. Instead, they rely on securities laws and regulations. The global trend in governance is toward a “comply or explain” system where companies are required to adhere to governance codes.

Benefits of Market-Based Corporate Governance Systems

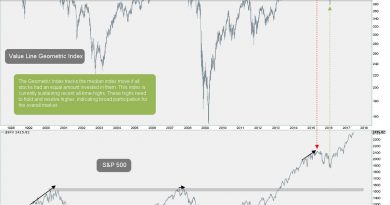

The most significant advantage of a market-based corporate governance system is its ability to respond dynamically to changes. In the short term, corporate leadership responds to changes in stock prices. If an issue arises with a company’s product, the stock price will fall, prompting management to address the issue. Rival firms will gain market share if the problem isn’t resolved.

In the long run, a market-based governance system allows for the establishment of new business practices. Different approaches, such as focusing on growing dividends or investor capital, can compete in this system.

Market-based governance allows for the rapid application of new theories.

Whenever a single standard is externally imposed, it limits competition and innovation. New technologies could be delayed for years. On the other hand, eliminating dividends would deprive conservative investors of income. The dynamism of market-based governance systems allows the best approaches to prevail.

Criticisms of Market-Based Corporate Governance Systems

One significant issue in a market-based corporate governance system is short-termism. Public companies manage to meet quarterly earnings targets set by sell-side analysts. They can use accounting maneuvers to achieve or beat these targets, boosting stock prices.

Governance experts suggest eliminating earnings guidance to promote a long-term view of company goals.

Another criticism is the impact of index funds. While index funds save fees for investors, their passive approach undermines accountability in a market-based governance system.