Marginal Revenue Product MRP Definition and How It s Predicted

Marginal Revenue Product (MRP): Definition and Prediction

What Is Marginal Revenue Product (MRP)?

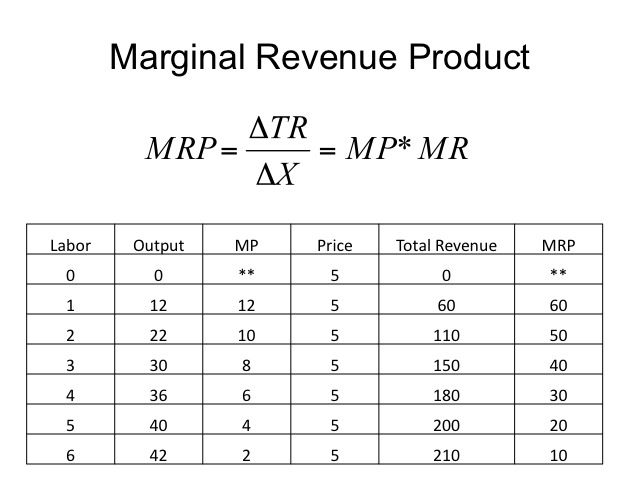

Marginal revenue product (MRP), also called marginal value product, is the additional revenue generated by adding one unit of a resource. MRP is calculated by multiplying the marginal physical product (MPP) of the resource with the marginal revenue (MR) generated. It helps determine the optimal level of a resource by assuming that expenditures on other factors remain unchanged.

Key Takeaways

- MRP is the additional revenue generated by using one more unit of a resource.

- It is used to make critical decisions regarding business production and resource optimization.

- MRP assumes that the spending on other factors remains unchanged.

Understanding Marginal Revenue Product (MRP)

Economists John Bates Clark and Knut Wicksell showed that revenue depends on the marginal productivity of additional production factors. Businesses frequently utilize MRP analysis for making crucial production decisions. For example, a farmer might consider purchasing another specialized tractor to increase wheat production. If the additional tractor can generate 3,000 bushels of wheat (MPP) and each bushel sells for $5 (marginal revenue), the MRP of the tractor would be $15,000.

The farmer would be willing to pay up to $15,000 for the tractor if other considerations remain constant. Accurately estimating costs and revenues is challenging, but businesses that can do so tend to survive and profit more than their competitors.

Special Considerations

MRP is based on marginal analysis, which examines decisions made at the margin. When a consumer purchases a bottle of water for $1.50, it does not imply that the consumer values all bottles of water at $1.50. Instead, it shows that the consumer subjectively values one additional bottle of water at more than $1.50 at that particular time. Marginal analysis assesses costs and benefits incrementally, not as a whole.

Marginalism is a crucial concept in economics, giving rise to insights such as marginal productivity, marginal costs, marginal utility, and the law of diminishing marginal returns.

MRP is critical for understanding wage rates in the market. It only makes sense to employ an additional worker at $15 per hour if the worker’s MRP exceeds $15 per hour. If the worker cannot generate at least an extra $15 per hour in revenue, the company experiences a loss.

Workers are typically not paid according to their MRP, even in equilibrium. Instead, wages tend to equal discounted marginal revenue product (DMRP), similar to the discounted cash flow (DCF) valuation for stocks. This discrepancy arises due to different time preferences between employers and workers. Employers must wait until the product is sold to recoup revenue, while workers are usually paid earlier. Thus, a discount is applied to wages, and employers receive a premium for waiting.

DMRP affects the bargaining power of workers and employers, except in the rare theoretical case of monopsony. If a proposed wage is below DMRP, a worker can negotiate better terms with different employers. When the wage exceeds DMRP, the employer may reduce wages or replace the employee. This process moves the labor supply and demand closer to equilibrium.