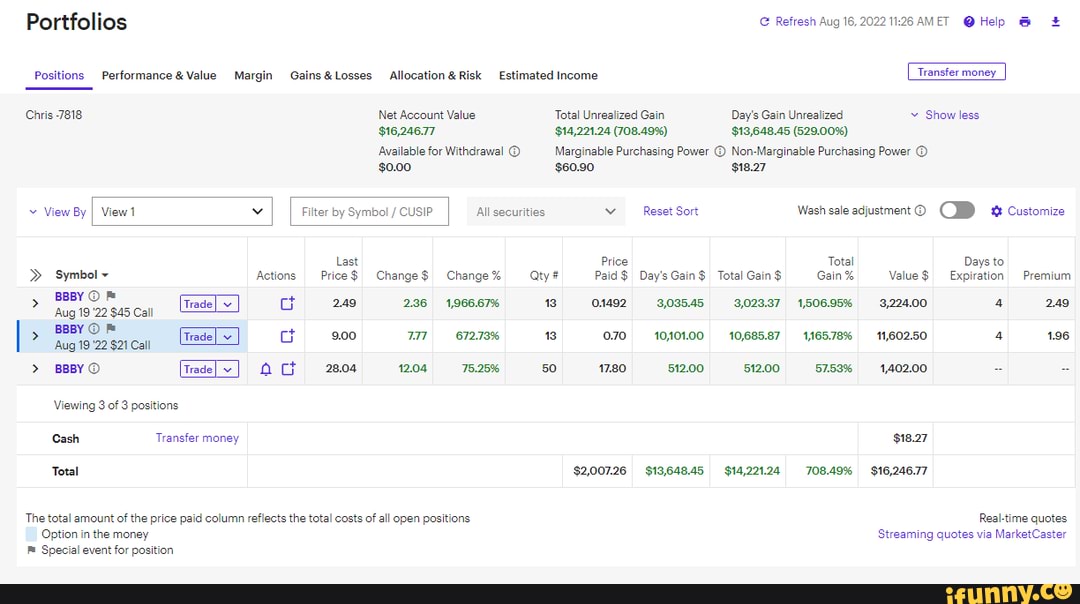

Marginable What it is How it Works Purchasing

Contents

Marginable: What it is, How it Works, Purchasing

What Is Marginable?

Marginable securities, such as stocks, bonds, futures, or other tradable securities, can be purchased on margin. This means they are bought using a loan provided by a brokerage or financial institution.

Key Takeaways

- Buying securities on margin involves taking a loan from a broker.

- Brokers only offer certain securities for margin purchases to limit the risk of loss.

- The Federal Reserve determines which securities are marginable, and brokers provide a list of marginable securities to their customers.

Understanding Marginable

The regulations governing marginable securities are established by Regulation T and Regulation U of the Federal Reserve. Self-regulatory organizations like the NYSE and FINRA also play a role in the regulatory process. Although brokers can enforce additional requirements, they must adhere to the minimum standards set by law.

The distinction between marginable and non-marginable securities serves two primary purposes. Firstly, it protects investors by reducing the risks associated with leverage. Secondly, it safeguards brokers and financial institutions by ensuring that the collateral provided by investors meets minimum quality standards.

Marginable securities generally have high liquidity. On the other hand, securities priced below $5 per share or those associated with initial public offerings (IPOs) are typically not marginable due to higher risks. Brokers often provide a comprehensive list of marginable securities on their websites.

Purchasing Marginable Securities

Investors must use a margin account to purchase marginable securities. These accounts require a minimum investment of $2,000, although some brokers may require more. Investors can borrow up to 50% of the purchase amount for marginable securities. For instance, with a $50,000 margin account, an investor can buy up to $100,000 worth of marginable securities. Investors also have the option to borrow less than 50% if desired, such as borrowing up to 25% of the purchase price.

Margin accounts also have a maintenance margin, which is a minimum cash balance or equivalent value required to control the securities in the account. This maintenance margin fluctuates daily based on the value of the securities held in the account.

If the value of the stocks in a margin account decreases, the maintenance margin increases. If the margin account falls below the maintenance margin, the customer is issued a margin call, which is a request from the broker for additional funds or securities to bring the account back to the required minimum.

Purchasing marginable securities, such as stocks, ETFs, and other securities, is more suitable for short-term holding periods due to the interest charged on margin loans. As interest accumulates over time, the marginable securities must generate greater returns to break even.