Member of Household What It Is and How It Works

Contents

- 1 Member of Household: What It Is and How It Works

- 1.1 What Is a Member of Household?

- 1.2 Understanding Members of Household

- 1.3 Importance of Member of Household Status

- 1.4 Who Is Counted as a Member of Household?

- 1.5 Other Considerations

- 1.6 How Does the IRS Define Household Composition?

- 1.7 Can Non-Family Members Be Considered Members of the Household for Tax Purposes?

- 1.8 How Does Divorce Impact Household Composition for Tax Filings?

- 1.9 Are Adult Children Living at Home Considered Dependents for Tax Purposes?

- 1.10 The Bottom Line

Member of Household: What It Is and How It Works

What Is a Member of Household?

A member of household is a person claimed as a dependent when filing tax forms. This allows a taxpayer to qualify for the dependency exemption or eligible tax credits. They can be a relative or a non-relative, but non-relatives must meet the relationship requirements outlined by the IRS.

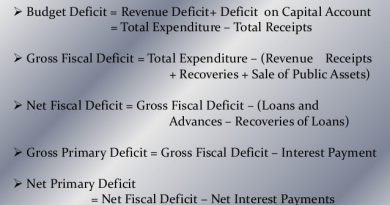

Key Takeaways

- A member of household is a dependent relative or non-relative that resides with a taxpayer.

- For tax purposes, dependent members of household can trigger eligibility for tax credits and deductions.

- To be an eligible member of household, certain qualifications must be met, such as family lineage or living with the household for longer than a year.

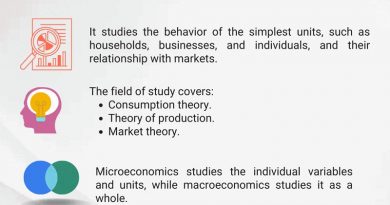

Understanding Members of Household

State and federal authorities define who is regarded as a member of household, with some variation by jurisdiction. Individuals must either live within the household for the tax year or be a relative who does not live with the taxpayer but meets certain criteria.

There are allowances for absences from the household during the tax year, such as illness, education, vacation, business needs, military service, or being in a juvenile detention facility. Being placed in a nursing home for medical care is also considered a temporary absence.

Importance of Member of Household Status

The concept of member of household is significant to the IRS because it influences tax-related matters. Your eligibility for tax credits and deductions, as well as your tax rate, may be affected. The head of household filing status often provides more favorable rates and deductions compared to the single status.

In addition, member of household status may increase the amount of credit you receive. Some credits depend on the number of qualifying dependents, and more members of your household can result in a higher tax refund.

One mistake taxpayers may make is not updating their household members from year to year due to life changes.

Who Is Counted as a Member of Household?

To be considered a member of household, a person must be at least one of the following:

- Lineal descendant (child, grandchild, great-grandchild; step-lineal descendants such as stepchildren are included)

- Brother or sister (includes stepbrothers/stepsisters and half-brothers/half-sisters)

- Lineal ancestor (parent, grandparent, great-grandparent; step-lineal ancestors are included)

- Niece, nephew, aunt, or uncle (not including relations by marriage)

- In-law (father-in-law, mother-in-law, son-in-law, daughter-in-law, brother-in-law, and sister-in-law)

- Anyone else who is neither related nor married to you, but who lives in your home for the entire year.

Other Considerations

Members of household can also be claimed if they resided at the domicile but died during the year. Newborns brought home from the hospital may also be claimed as members of household.

If the relationship between the tax filer and the person violates local law, they may not be considered a member of household. For instance, if the tax filer is in a personal relationship with someone who lives in their home but is married to someone else, the latter party cannot be claimed as a member of household.

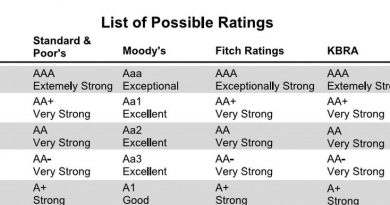

How Does the IRS Define Household Composition?

The IRS defines household composition as the individuals sharing a common residence, forming a family or domestic unit. This includes spouses, dependents, and others living together.

Can Non-Family Members Be Considered Members of the Household for Tax Purposes?

Yes, non-family members like roommates can be considered members of the household for tax purposes if they share the same residence. However, specific IRS criteria must be met.

How Does Divorce Impact Household Composition for Tax Filings?

Divorce alters household composition, impacting filing status and potential tax credits. It’s vital to update tax information promptly to reflect the new household structure.

Are Adult Children Living at Home Considered Dependents for Tax Purposes?

Adult children living at home may qualify as dependents if they meet IRS criteria, including age, relationship, and financial support. This determination can impact tax benefits for both parents and adult children.

The Bottom Line

Member of household status, for tax purposes, refers to individuals who share a common residence and form a family or domestic unit. It’s important because it can help determine your filing status, influencing tax rates, deductions, and eligibility for various tax credits and benefits.