Loss Ratio What It Is How It s Calculated Types

Contents

Loss Ratio: What It Is, How It’s Calculated, Types

Loss Ratio Definition

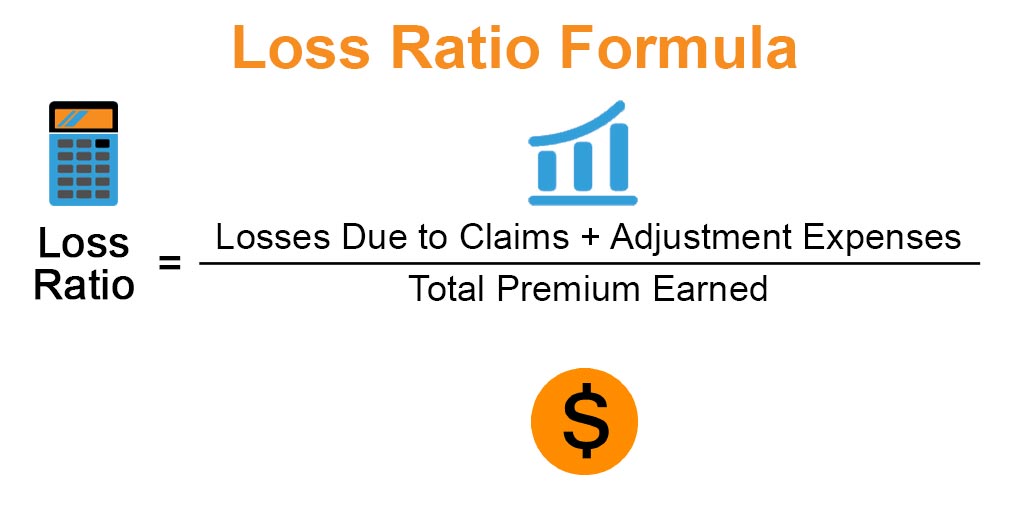

A loss ratio is a ratio used in the insurance industry to represent the losses incurred by an insurer in relation to the premiums earned. Losses include both paid insurance claims and adjustment expenses. The formula for calculating the loss ratio is (claims paid + adjustment expenses) / total earned premiums. For example, if a company pays $80 in claims for every $160 in collected premiums, the loss ratio would be 50%.

Key Takeaways

- A loss ratio measures the losses an insurer experiences due to paid claims as a percentage of premiums earned.

- A high loss ratio can indicate financial distress, especially for property and casualty insurance companies.

- Insurers calculate their combined ratios, which combine the loss ratio and expense ratio, to measure total cash outflows related to their operating activities.

- If the loss ratios associated with a policy become excessive, an insurance provider may raise premiums or choose not to renew the policy.

- Health insurers must allocate at least 80% of premiums to claims or healthcare improving activities, or they will need to issue a rebate to policyholders.

How a Loss Ratio Works

Loss ratios vary depending on the type of insurance. For example, the loss ratio for health insurance tends to be higher than the loss ratio for property and casualty insurance. Loss ratios help assess the financial health and profitability of an insurance company. Typically, a business collects premiums that exceed the amounts paid in claims. However, high loss ratios may indicate financial distress for a business.

Unlike auto and homeowners insurance, health insurance premiums under the Affordable Care Act (ACA) cannot be adjusted based on submitted claims or medical history.

Types of Loss Ratios

Medical Loss Ratio

A health insurance carrier with a medical cost ratio (MCR) of 80% pays $8 in claims for every $10 in premiums collected. The ACA requires health insurance carriers to allocate a significant portion of the premium to clinical services and healthcare quality improvement.

Health insurance providers must spend at least 80% of premiums on claims and activities that enhance the quality of care and provide more value to plan participants. Failure to meet this requirement results in the need to rebate excess funds to policyholders.

Commercial Insurance Loss Ratio

Businesses with commercial property and liability policies must maintain sufficient loss ratios to avoid premium increases and cancellations. For example, let’s consider a small used car dealer who pays $20,000 in annual premiums to insure their inventory. If a hailstorm causes $25,000 in damages and the business owner submits a claim, the one-year loss ratio for the insured becomes $25,000 / $20,000, or 125%.

To determine if a premium increase is necessary and for what amount, insurance carriers may review claims history and loss ratios from the past five years. If the insured has a short tenure with the insurer, the company may deem the auto dealer a future risk they do not want to cover, leading to the non-renewal of the policy.

Loss Ratio vs. Benefits-Expense Ratio

The benefit-expense ratio compares an insurer’s expenses for acquiring, underwriting, and servicing a policy to the net premium charged. Expenses may include employee wages, agent and broker commissions, dividends, advertising, legal fees, and other general and administrative expenses (G&A).

An insurer finds the combined ratio by combining the benefit-expense ratio with the loss ratio. While the benefit ratio examines company expenses, the loss-to-gain ratio analyzes paid claims, including adjustments, in relation to the net premium.

The healthcare industry tends to have higher losses compared to property or casualty insurance due to the higher number of probable claims. The combined ratio measures the outflow of funds from a company, including expenses and total losses, in relation to premium income.