Look-Ahead Bias What it Means How it Works

Look-Ahead Bias: What it Means, How it Works

What Is the Look-Ahead Bias?

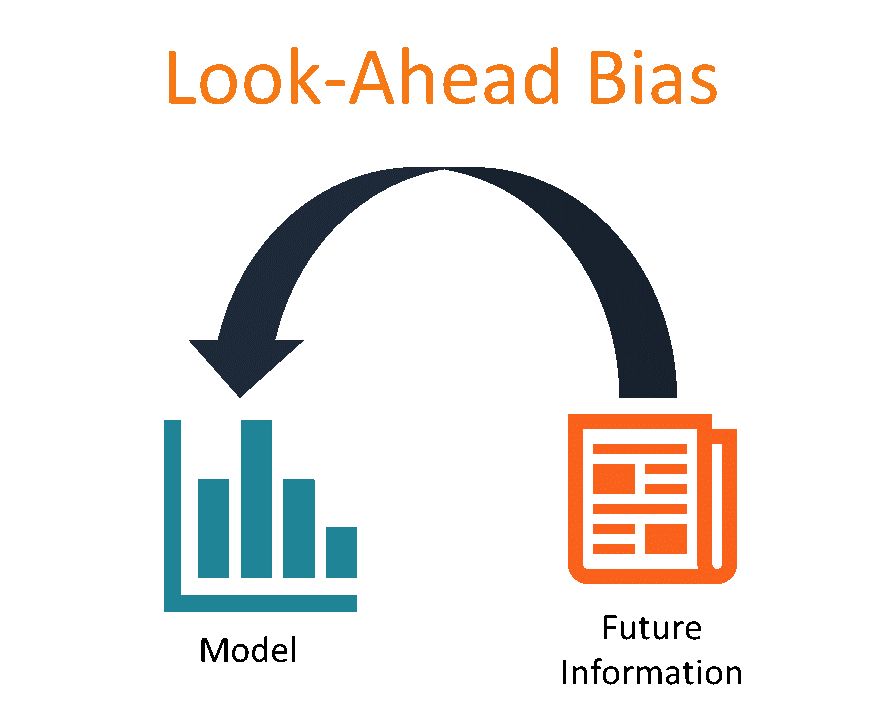

Look-ahead bias occurs when information or data that was not available during the analyzed period is used in a study or simulation. This can lead to inaccurate results and swayed outcomes. It’s important for economists, analysts, and investors to be aware of look-ahead bias when evaluating trading strategies.

Key Takeaways:

– Look-ahead bias uses data not available at the time, skewing results and leading to overconfidence in models.

– Careful research is necessary to determine what data was available at the time.

Understanding Look-Ahead Bias

Look-ahead bias often happens in hindsight scenarios, where individuals have more knowledge looking back than they did at the time of decision-making. Therefore, it may be unwise to judge past performance too harshly, especially when key information was missing.

To avoid look-ahead bias, investors must only use information available at the time of the trade when backtesting a trading strategy. Using information that was not available at the time will diminish the accuracy of the strategy’s performance and bias the results.

The Look-Ahead Bias and Other Biases in Investing

Look-ahead bias is one of several biases that must be considered when running simulations. Other biases include sample selection bias, time period bias, and survivorship bias. These biases can sway simulation results in favor of the desired outcome.

It is important for investors to carefully analyze the fundamentals of a company rather than solely relying on past performance. Overvaluation is always a risk.

To correct look-ahead bias, widening the sample to include all stocks that fit specific criteria at the start of the year and tracking their outcomes is necessary.

Overall, understanding and mitigating look-ahead bias is crucial for accurate data analysis and decision-making.