Long Squeeze What it is How it Works Example

Contents

Long Squeeze: What it is, How it Works, Example

What Is a Long Squeeze?

A long squeeze occurs when the price of a stock or other asset drops suddenly, leading to further selling. Long holders of a stock are pressured into selling their shares to prevent significant losses.

Key Takeaways

- A long squeeze happens when selling triggers additional selling, resulting in a significant price drop.

- Long squeezes are more common in assets that experience a drastic price rise followed by a price decrease, especially in low liquidity or low float stocks.

- Value investors and traders who seek oversold conditions typically buy stocks affected by a long squeeze.

Understanding Long Squeezes

A long squeeze usually occurs in illiquid stocks, where a small number of shareholders can create unwarranted price volatility in a short period. Unlike short squeezes, which involve short sellers causing a drop in price, a long squeeze requires panic among long holders leading them to sell their positions. The selling may last for some time or be brief. Value-buyers or short-term traders step in to buy shares at low prices, bidding them back up.

Long squeezes can happen in any market but are more dramatic in low liquidity markets. Both liquidity, technical factors, and supply and demand contribute to long squeezes. When a stock’s price has significantly increased, it becomes more susceptible to a long squeeze, particularly if the volume is high when the price falls. Those who bought near the peak will start selling if the price declines significantly, unable to bear the loss even if they anticipate a future price recovery.

Value-oriented investors and value investing styles are often the solution to oversold securities. Recognizing a long squeeze, value and deep-value investors quickly respond to stocks trading at discounts to their intrinsic value. If a stock doesn’t bounce back from the decline, then there may have been a fundamental reason for the sell-off or the stock was initially overpriced.

Long squeeze situations primarily affect stocks with limited float or market capitalization. These small or micro-cap securities lack sufficient liquidity to sustain price levels during irregular trading volumes. A quick trader or automated trading system can take advantage of a long squeeze before others bring the stock back from its oversold state.

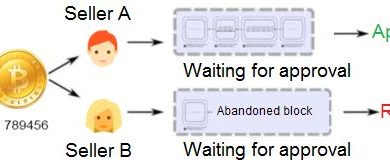

A stock’s float measures the number of shares available for trading, excluding those held in treasury or by insiders. Stocks with limited float are susceptible to squeezes, both long and short. In these stocks, share prices are influenced by fewer participants due to fewer available shares. A large sell order from a significant trader can trigger a cascade of selling. Conversely, highly liquid stocks with millions of shareholders and active buyer interest experience less severe long squeezes.

Long Squeeze Example

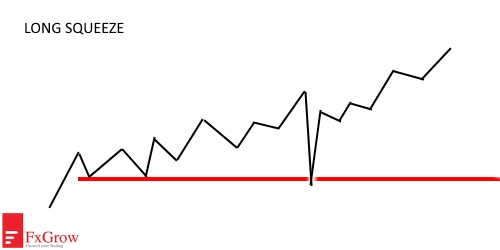

Intraday charts often display long squeezes. Since there is usually no new fundamental news about a company or the economy, the stock price fluctuates as people buy and sell.

Day traders aim to enter and exit a stock within the day. If the price starts to fall significantly, they will sell if they previously bought the stock. Their short timeframe prevents them from holding onto a falling stock.

Consider this 1-minute intraday chart of Apple (AAPL). The price constantly moves, and without fundamental data causing selloffs, the selloffs are the result of short-term longs forced to sell as the price declines.

The long squeezes were quickly met with buying, indicating that panicked long holders caused the declines as they took profits and cut losses, rather than a fundamental shift in the company’s value.