What Does Income Tax Payable Mean in Financial Accounting

Contents

- 1 What Does Income Tax Payable Mean in Financial Accounting?

- 1.1 What Is Income Tax Payable?

- 1.2 Understanding Income Tax Payable

- 1.3 Deferring Tax Liability

- 1.4 Income Tax Payable vs. Income Tax Expense

- 1.5 What Does the Term Income Tax Payable Mean?

- 1.6 What Does Income Tax Expense Represent?

- 1.7 Why Do Taxes Owed to the IRS and Tax Amounts on Financial Statements Differ?

- 1.8 The Bottom Line

What Does Income Tax Payable Mean in Financial Accounting?

What Is Income Tax Payable?

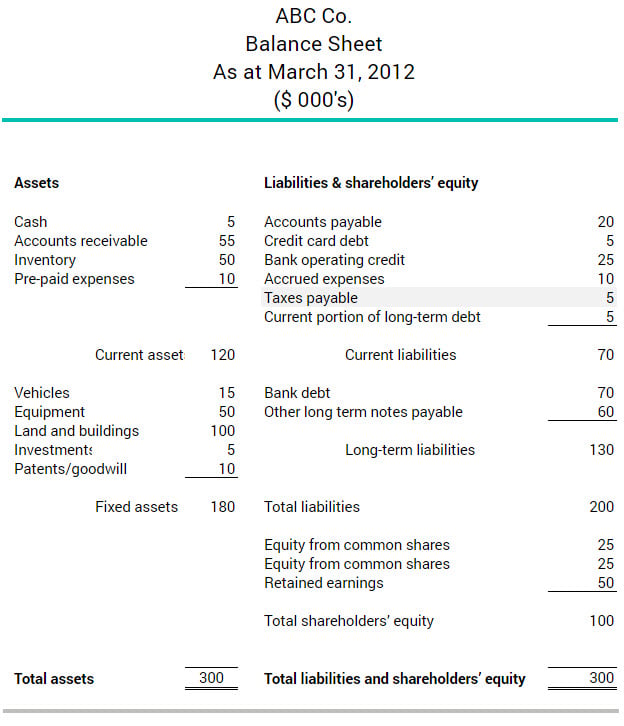

Income tax payable is a liability reported for financial accounting purposes. It represents the amount that an organization expects to pay in income taxes within 12 months, and it is reported in the current liabilities section on a company’s balance sheet.

Income tax payable is calculated using generally accepted accounting principles (GAAP) and the current tax rates in relevant jurisdictions. Businesses operating in the United States are subject to federal, state, and local tax laws, as well as the tax laws of other countries if they operate and generate income there.

Key Takeaways

- Income tax payable is the financial accounting term for a current tax liability on a company’s balance sheet.

- Calculating tax liabilities and reporting them on financial statements may involve different rules.

- Income tax payable on a balance sheet represents the total tax due to government tax agencies within 12 months.

- Taxes to be paid in a future year are reported as deferred income tax liabilities.

- Financial statements might include federal, state, local, and foreign taxes.

Understanding Income Tax Payable

Taxes owed by an organization are included in the line "income tax payable" on the balance sheet. Income tax payable is classified as a current liability and represents the amount that will be resolved (i.e., paid) within 12 months.

While generally accepted accounting principles (GAAP) dictate rules for reporting income or loss, these rules differ from those required for tax returns. Timing differences, such as depreciation and amortization, can cause disparities in reporting tax liabilities between the two systems. These differences are reflected in an organization’s financial statements, particularly concerning the timing of tax liabilities.

Tax liabilities accrued during a year but paid in a later year are reported on the balance sheet as deferred income tax liabilities.

For example, if a 2023 event resulted in $300 of income and was subject to a 21% corporate federal income tax rate, the income tax payable would be $63.

$300 x 0.21 = $63

Deferring Tax Liability

Tax liability may be calculated using GAAP but reported differently for tax purposes. Tax laws may require the recognition of income or a tax liability spread over multiple years. This timing difference is reflected in the financial statements.

Using the same example, if $300 of GAAP income for 2023 is spread over three years for tax purposes, the 2023 balance sheet would show a current income tax payable of $21, as taxes due to the IRS for 2023.

$300 x 0.21 = $63 / 3 = $21

The remaining $42, due to the IRS in the future, would be reported as a deferred tax liability.

A deferred tax liability arises when there is a difference between the current income tax liability reported on the balance sheet and the income tax expense reported on the income statement.

Income Tax Payable vs. Income Tax Expense

Balance sheets report the actual taxes owed to the IRS, categorized as either current tax liabilities (income tax payable) or deferred income tax liabilities (noncurrent, longer-term liabilities). However, income tax expense is reported on the income statement. This amount is usually the last expense item and is deducted from pre-tax profit to determine net income or profit.

For a US corporate taxpayer, GAAP determines the income tax expense for financial reporting purposes by applying the current corporate tax rate, which was 21% in 2023, to the profit before income taxes reported on the income statement.

Taxes other than income taxes, such as payroll taxes, property taxes, and sales taxes, may be identified as separate tax categories on financial statements. They may also be included in a comprehensive tally of tax expenses on an income statement and tax liabilities on a balance sheet.

Upon completing its federal income tax return, an organization knows the actual amount of taxes due to the US government for that tax year. The taxes payable within a year are reported on the balance sheet as current income tax liabilities. Taxes due in future years are listed as deferred income tax liabilities.

If the corporation also owes state, local, or foreign income taxes, those liabilities will be reflected on the balance sheet as well.

What Does the Term Income Tax Payable Mean?

"Income tax payable" is the financial accounting term for the current liability reported on an organization’s balance sheet. It indicates the taxes that the organization expects to pay within 12 months.

What Does Income Tax Expense Represent?

"Income tax expense" is the financial accounting term for the taxes that an organization owes on its pre-tax profit. The amount is determined under GAAP by applying the tax rate applicable under relevant laws to the organization’s pre-tax profit. It appears on an organization’s income statement.

Why Do Taxes Owed to the IRS and Tax Amounts on Financial Statements Differ?

Balance sheets report tax amounts as liabilities that affect the organization’s value. Taxes due within 12 months are current liabilities and are reported as income tax payable. Taxes to be paid in later periods are reported as deferred tax liabilities.

The Bottom Line

"Income tax payable" specifically refers to an amount reported on financial statements: a liability reported in the current liabilities section of a company’s balance sheet that indicates the expected amount to be paid in income taxes within 12 months.

Financial accounting rules for reporting tax liabilities and the tax code’s rules for determining tax amounts owed to the IRS can differ. GAAP accounting principles and the US tax code do not treat all items the same when calculating the tax amounts reported on financial statements and the tax liabilities reported on tax returns. Therefore, the amount of taxes owed on an organization’s tax return may not match the tax expense on its income statement.

The variation in accounting rules and reasons for determining tax expense and tax liabilities can create different amounts on income statements and balance sheets.