Variable Life Insurance Definition Tax Benefits Vs Term Life

Contents

- 1 Variable Life Insurance: Definition, Tax Benefits, Vs. Term Life

Variable Life Insurance: Definition, Tax Benefits, Vs. Term Life

What Is Variable Life Insurance?

Variable life insurance is a type of permanent life insurance with separate accounts consisting of various investment instruments, such as stocks, bonds, equity funds, money market funds, and bond funds.

Key Takeaways

- Variable life insurance is a type of permanent life insurance.

- This product contains separate accounts consisting of various investment instruments.

- Variable policies are considered securities contracts due to investment risks.

- Variable life insurance is often more expensive than other life insurance products, like term life.

How Variable Life Insurance Works

Variable life insurance can be considered a form of securities due to investment risks, making it a securities contract regulated by federal laws. Sales professionals must provide a prospectus of available investment products to potential buyers in accordance with these regulations.

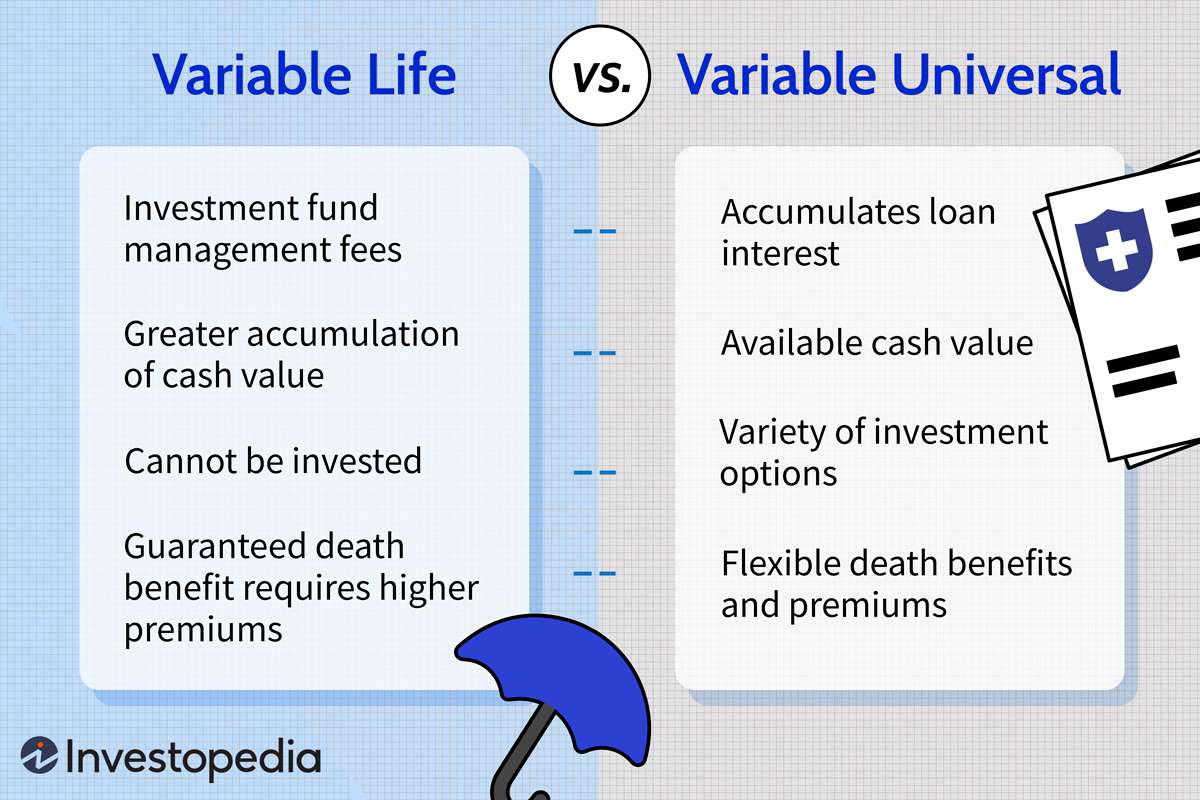

Variable life insurance has specific tax benefits, including tax-deferred accumulation of earnings. The cash value can be accessed through a tax-free loan as long as the policy remains in force. However, unpaid loans, including principal and interest, reduce the death benefit. Additionally, interest or earnings from partial and full surrenders are taxable upon distribution.

Variable Life Insurance Advantages

An attractive feature of variable life insurance is its flexibility regarding premium payments and cash value accumulation. Premiums are not fixed like traditional whole life insurance or term insurance policies. Policyholders can adjust their premium payments within certain limits based on their needs and investment goals.

Loan interest may become taxable upon surrender of the policy.

For example, if the policyholder pays a premium lower than necessary to sustain the policy, the accumulated cash value compensates for the difference. However, it’s important to understand that long-term reduced premium payments can compromise the cash value and overall status of the policy. Alternatively, policyholders can pay higher premiums to increase their cash value and investment holdings.

Unlike whole life insurance, the death benefit of variable life insurance is linked to the performance of the separate account funds. A positive aggregate performance can provide increased financial protection to the beneficiary upon the insured’s death.

In addition to its flexibility, variable life insurance offers the potential for significant investment earnings. Many policies provide a wide range of investment options, catering to investors with conservative or aggressive strategies.

Some of the best life insurance companies, such as Prudential and New York Life, offer variable life insurance plans.

Variable Life Insurance Disadvantages

Compared to other life insurance policies, variable life insurance is typically more expensive. Premiums cover administrative fees and the management of investment products. Policyholders may need to increase payments to keep the policy active or maintain a specific death benefit based on investment performance and premiums paid.

Some policyholders submit higher premiums than the cost of the insurance policy as a proactive measure to ensure policy guarantees. Additionally, policyholders bear all investment risks, as the insurer does not guarantee performance or protect against investment losses. Policyholders must remain educated about investments and monitor the performance of separate accounts.

Similar to most life insurance policies, individuals must undergo full medical underwriting to obtain variable life insurance. Those with compromised health or unfavorable underwriting factors may not qualify for coverage or may face higher premiums.

How is variable life insurance closer to a security than an insurance policy?

Variable life insurance includes separate accounts consisting of various investment instruments, such as stocks, bonds, equity funds, money market funds, and bond funds. Due to investment risks, variable policies are considered securities contracts regulated by federal laws. Sales professionals must provide potential buyers with a prospectus of available investment products to comply with these regulations.

What’s a main advantage of the variable life insurance policy?

The policy owner has the freedom to choose how to invest their cash value. Many policies offer a wide range of investment options to suit the needs of most investors, ranging from conservative to aggressive strategies. This can result in returns that surpass those of other insurance policies.