Loss Carryforward Definition Example and Tax Rules

Contents

- 1 Loss Carryforward: Definition, Example, and Tax Rules

- 1.1 What Is a Loss Carryforward?

- 1.2 What Are the Rules for Loss Carryforwards?

- 1.3 How Can Businesses Use Loss Carryforwards?

- 1.4 Example of a Loss Carryforward

- 1.5 How Many Years Can a Loss Be Carried Forward?

- 1.6 How Much Loss Can You Write Off in a Loss Carryforward?

- 1.7 What Is the Difference Between a Loss Carryforward and Carryback?

- 1.8 The Bottom Line

Loss Carryforward: Definition, Example, and Tax Rules

What Is a Loss Carryforward?

A loss carryforward is an accounting technique that applies the current year’s net operating loss (NOL) to future years’ net income to reduce tax liability.

For example, if a company has negative net operating income (NOI) in year one but positive NOI in subsequent years, it can reduce future profits using the NOL carryforward to record the loss from the first year in the subsequent years.

This results in lower taxable income in positive NOI years, reducing the company’s tax owed. Loss carryforward can also refer to a capital loss carryforward.

Key Takeaways

- Loss carryforwards spread a current net operating loss (NOL) across subsequent years’ net operating income (NOI) to reduce future tax liability.

- The Tax Cuts and Jobs Act (TCJA) removed the two-year carryback provision, extended the 20-year carryforward provision indefinitely, and limited carryforwards to 80% of net income in any future year.

- Net operating losses originating before Jan. 1, 2018, are still subject to the former carryover rules.

What Are the Rules for Loss Carryforwards?

Prior to the implementation of the Tax Cuts and Jobs Act (TCJA) in 2018, the Internal Revenue Service (IRS) allowed businesses to carry net operating losses (NOL) forward 20 years to net against future profits or backward two years for an immediate refund of previous taxes paid. After 20 years, any remaining losses expire and can no longer reduce taxable income.

For tax years beginning Jan. 1, 2018, or later, the TCJA removed the two-year carryback provision, except for certain farming losses, but allows for an indefinite carryforward period. However, the carryforwards are now limited to 80% of each subsequent year’s net income. Losses originating before Jan. 1, 2018, are still subject to the former tax rules, and any remaining losses will expire after 20 years.

NOL carryforwards are recorded as assets on the company’s balance sheet. They offer a benefit to the company in the form of future tax liability savings. A deferred tax asset is created for the NOL carryforward and is offset against net income in future years. The deferred tax asset account is drawn down each year, not exceeding 80% of net income in any one of the subsequent years, until the balance is exhausted.

The NOL carryforward provision for federal income taxes was introduced as part of the Revenue Act of 1918. Some states have stricter limits for state income tax on carryforwards or carrybacks.

This federal income tax provision was initially intended to be a short-lived benefit to companies incurring losses from the sale of war-related items in the post-WWI era. Over the years, the provision’s duration has been extended, decreased, omitted, and reinstated. The purpose is to smooth the tax burden for companies with cyclical primary businesses that do not align with a standard tax year.

How Can Businesses Use Loss Carryforwards?

Businesses should claim NOL carryforwards as soon as possible to use them effectively. The losses are not indexed with inflation, so each year the claim becomes smaller.

For example, if a business loses $100,000 in the current tax year, although it can carry the loss forward for the next 20 years, it will have a larger impact the sooner it is claimed. Due to inflation, $100,000 will likely have less buying power and less real value in 20 years.

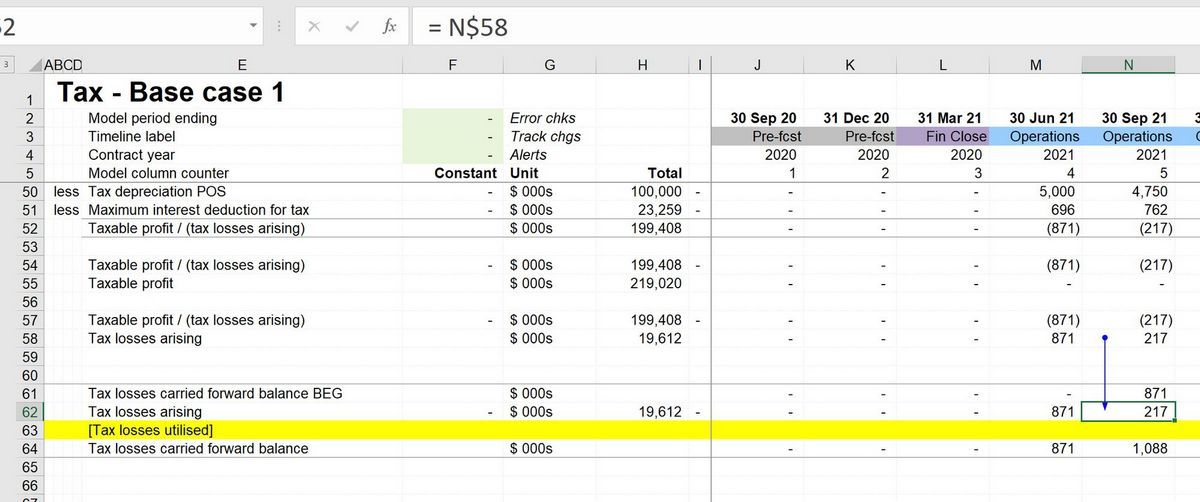

Example of a Loss Carryforward

Imagine a company loses $5 million one year and earns $6 million the next. The carryover limit of 80% of $6 million is $4.8 million. The full loss from the first year can be carried forward on the balance sheet to the second year as a deferred tax asset.

The loss, limited to 80% of income in the second year, can then be used as an expense on the income statement. It lowers net income and taxable income for that year to $1.2 million. A $200,000 deferred tax asset ($5 million – $4.8 million) remains on the balance sheet.

How Many Years Can a Loss Be Carried Forward?

A business can carry a loss forward for 20 years with a carryover limit of 80% of each subsequent year’s net income.

How Much Loss Can You Write Off in a Loss Carryforward?

A company can write off 80% of each subsequent year’s net income in a loss carryforward. This allows the company to carryover $9.6 million on the balance sheet in the second year if it lost $10 million in the first year and earned $12 million in the second year. The $9.6 million is then indicated as a deferred tax asset and represented as an expense on the income statement. This lowers taxable income in the second year to $2.4 million.

What Is the Difference Between a Loss Carryforward and Carryback?

A loss carryforward allows a business to carryover a loss to net operating income, reducing tax liability. This loss can be carried forward for the next 20 years. In contrast, a loss carryback allows a firm to apply a loss to a previous year’s tax return, resulting in an immediate refund of the taxes paid in that year.

The Bottom Line

When a business reports a loss in a given year, the carryforward tax provision allows the company to apply this loss to its future net operating income over a 20-year period. This has the potential to significantly reduce the company’s tax burden if it reports positive net income within this time frame.

Importantly, it is most effective to apply this loss sooner rather than later due to inflation impacting the purchasing power of money. Waiting to carryforward a loss may result in a decreased value over time.