What Is a Chargeback Definition How to Dispute and Example

Maddy Simpson, an experienced data journalist and fact-checker with a financial analytics background, defines a chargeback as the return of a payment to a debit or credit card after a customer successfully disputes a transaction on their account statement or transactions report. Chargebacks can occur on both debit and credit cards and can be granted for various reasons. The regulations governing chargebacks for debit cards and credit cards in the U.S. are Regulation E of the Electronic Fund Transfer Act and Regulation Z of the Truth in Lending Act, respectively.

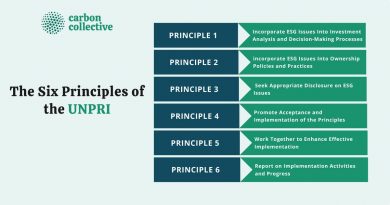

Key Takeaways:

– A chargeback is the return of a payment to a debit or credit card after a customer disputes the transaction.

– The chargeback process can be initiated by the merchant or the cardholder’s issuing bank.

– Merchants incur fees from the card issuer when a chargeback occurs.

– Federal law requires card issuers to offer chargebacks within 60 days of the billing date.

– Resolving the issue directly with the merchant may be an option other than requesting a chargeback from the bank.

Understanding Chargebacks:

A chargeback is a refund that returns funds taken from an account through a prior purchase. It differs from a voided charge, which is not fully authorized for settlement. Chargebacks involve fully processed and settled charges and require an electronic process involving multiple parties.

When to Ask for a Chargeback:

A chargeback is different from a refund, which is a repayment from a merchant for a returned product or a faulty product or service. A chargeback occurs when the card issuer returns funds to the account due to a disputed charge. Charges can be disputed for various reasons, including the cardholder being charged for undelivered items, a merchant duplicating a charge, technical issues causing mistaken charges, or fraudulent charges from compromised card information. The chargeback period refers to the timeframe in which credit cardholders can dispute charges.

Disputing a chargeback can be challenging and requires time, communication with a customer service representative, and possibly receipts or proof of transactions. Banks are usually supportive in cases of fraudulent charges, but resolving other chargebacks may be more complicated. Contacting the merchant directly may be an option in some cases.

Chargeback Processing:

The chargeback process can be initiated by the merchant or the cardholder’s issuing bank. If initiated by the merchant, the process is similar to a standard transaction, but the funds are transferred from the merchant’s account to the cardholder’s issuing bank through an acquiring bank and a processing network.

Who Pays for a Chargeback:

If the issuing bank initiates the chargeback, they facilitate the process through their processing network, and the merchant bank authorizes the funds transfer. In cases of fraudulent charges, the issuing bank may grant the cardholder a chargeback while researching and resolving the claim. Merchants typically incur fees for chargeback transactions, and additional penalties may apply.

How Do You Do a Chargeback on PayPal?

PayPal has its own dispute resolution process, but buyers can also file a chargeback with their debit or credit card issuer. The process is determined by the card issuer, but sellers can dispute the chargeback through PayPal.

How Long Do I Have to Ask for a Chargeback?

The chargeback period depends on the payment processor and can range from 60 to 120 days. The Fair Credit Billing Act allows chargebacks within 60 days of the billing date.

How Do You Fight a Chargeback?

When a customer initiates a chargeback, the merchant has a set period of time, usually around 30 days, to respond. The merchant can provide signed receipts, contracts, and other documentation to prove that the chargeback is in error.

The Bottom Line:

A chargeback is the return of a payment to a debit or credit card after a customer disputes a transaction. It can occur due to duplicate charges, undelivered merchandise, or fraudulent charges. The cardholder’s issuing bank usually initiates chargebacks, but merchants can also initiate them. Chargebacks come with fees that merchants typically pay. In cases other than fraud, contacting the merchant directly may help resolve the dispute.