UN Principles for Responsible Investment PRI Definition

The UN Principles for Responsible Investment (PRI) is an international organization that promotes the incorporation of environmental, social, and corporate governance factors (ESG) into investment decision-making.

Key Takeaways:

– The UN Principles for Responsible Investment promotes environmental and social responsibility among investors.

– The organization relies on voluntary disclosures by signatories.

– UN Principles for Responsible Investment signatories are responsible for over $121 trillion in assets worldwide.

Understanding the UN Principles for Responsible Investment (PRI):

The core philosophy of the organization is that environmental and social considerations are relevant factors in investment decision-making. Supporters argue that it is financially and ethically irresponsible to not consider the environmental impact of a company when assessing its merits as an investment. Historically, investors have viewed environmental and social impacts as negative externalities to be ignored.

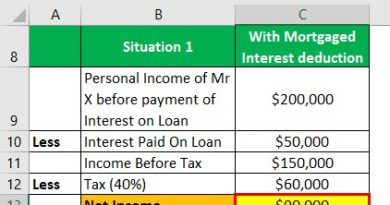

The PRI puts forward six core principles for signatory companies to commit to:

1. Incorporate ESG issues into investment analysis and decision-making processes.

2. Be active owners and incorporate ESG issues into ownership policies and practices.

3. Seek appropriate disclosure on ESG issues by invested entities.

4. Promote acceptance and implementation of the Principles within the investment industry.

5. Work together to enhance effectiveness in implementing the Principles.

6. Report on activities and progress towards implementing the Principles.

Signatories to these principles are responsible for over $121 trillion in assets under management (AUM), including prominent founding signatories like the Norwegian Government Pension Fund, the Government Pension Fund of Thailand, the Canada Pension Plan Investment Board, and the California Public Employees’ Retirement System (CalPERS).

Example of the UN Principles for Responsible Investment:

Standard Life, a financial services company acquired by Manulife in 2015, is a PRI signatory. They use ESG factors to assess emerging risks and opportunities in the automobile supply chain, specifically related to anti-pollution legislation by the European Union (EU).

After analyzing the potential impact of this legislation on automakers, parts suppliers, and the lithium-ion battery manufacturer, LG Chem, Standard Life adjusted their investments in the sector. They believe that increased emission standards will accelerate the transition to electric vehicles and create higher demand for batteries worldwide.