What Is a Certificate of Deposit CD and What Can It Do for You

A certificate of deposit (CD) is a savings account that pays a fixed interest rate for a set period. Unlike traditional savings accounts, CDs require you to keep your money untouched for the entire term. This lack of flexibility is offset by higher interest rates. Here are the key points to remember:

– CDs provide higher interest rates compared to savings and money market accounts.

– They are a safer investment option than stocks and bonds, with a guaranteed rate of return.

– Most banks, credit unions, and brokerage firms offer CD options.

– Shopping around for the best rates can significantly increase your earnings.

– While CDs have fixed terms, there are early withdrawal options available.

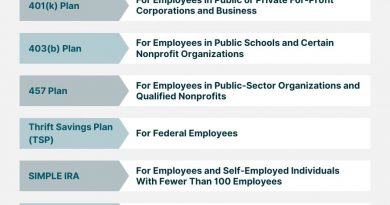

– Opening a CD is similar to opening a standard bank deposit account, with considerations for interest rates, term length, principal amount, and the institution.

– CDs are a great choice for conservative investors who want to earn more than traditional savings accounts without the risk or volatility of the market.

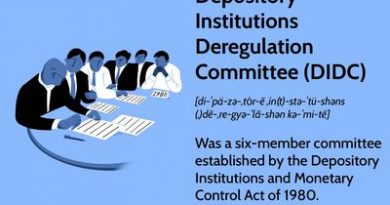

– CD rates are influenced by the Federal Reserve’s rate-setting actions.

– CDs are protected by federal insurance and considered one of the safest investment options.

– The decision to open a CD depends on your financial goals and the specific needs of your situation.

– CDs are widely available at banks, credit unions, and brokerage firms, both online and offline.

– Comparing CD rates across different institutions is essential to maximizing your earnings.

– Minimum deposit requirements vary by institution and sometimes affect the interest rate.

– The choice of CD term depends on your financial goals and expectations of interest rate changes.

– CD laddering is a strategy that provides access to higher rates while maintaining some liquidity.

– Unconventional term CDs can offer higher rates, so it’s important to consider all options.

– CD earnings are taxed as income in the year they are applied to your account, regardless of when you withdraw the funds.

– When a CD reaches maturity, you have options to roll it over, transfer the funds, or withdraw them.

– It’s generally not recommended to let your CD roll over without shopping around for better rates.

– Early withdrawal penalties apply if you need to access your funds before the CD term ends.

– Finding the best CD rates requires research and comparison across different institutions.

A certificate of deposit (CD) is a popular savings vehicle offered by banks and credit unions. When a depositor purchases a CD, they agree to leave a certain amount of money on deposit for a specified period, such as one year. In exchange, the bank pays a predetermined interest rate and guarantees repayment of the principal at the term’s end. For example, investing $1,000 in a 1-year, 5% certificate would yield $50 in interest over one year, in addition to the initial $1,000 investment.

Can You Lose Money on a CD?

In practice, it is unlikely to lose money on a CD for two reasons. First, they are guaranteed by the offering bank or credit union, legally obligating them to pay the agreed interest and principal amount. Second, they are typically insured by the federal government for up to $250,000. Even if the bank or credit union were to go bankrupt, the principal would likely still be repaid. Due to these safeguards, CDs are considered one of the safest investments available.

What Are the Advantages and Disadvantages of a CD?

Some savers appreciate CDs for their safety and predictability. However, CDs generally offer modest returns compared to riskier investments like stocks and bonds. When the offered interest rate falls below the current inflation rate, investors may experience a loss when considering inflation-adjusted returns. Yield-conscious investors may prefer riskier investments with higher potential returns.

The Bottom Line

Certificates of deposit provide stability for individuals seeking higher earnings without the risks associated with stocks and bonds. Before investing, carefully review the fine print. Although interest rates may surpass those of savings accounts and money markets, long-term commitments may result in missed opportunities if the federal funds rate rises. Early withdrawals may incur penalties that reduce the principal. Familiarize yourself with the limitations and benefits of your investment before finalizing.