What Is a 401 k and How Does It Work

Contents

- 1 What Is a 401(k) and How Does It Work?

- 1.1 What Is a 401(k) Plan?

- 1.2 How 401(k) Plans Work

- 1.3 Contributing to a 401(k) Plan

- 1.4 How Does a 401(k) Earn Money?

- 1.5 Taking Withdrawals From a 401(k)

- 1.6 Required Minimum Distributions (RMDs)

- 1.7 Traditional 401(k) vs. Roth 401(k)

- 1.8 When You Leave Your Job

- 1.9 How Do You Start a 401(k)?

- 1.10 What Is the Maximum Contribution to a 401(k)?

- 1.11 Is It a Good Idea to Take Early Withdrawals From Your 401(k)?

- 1.12 What Is the Main Benefit of a 401(k)?

- 1.13 The Bottom Line

What Is a 401(k) and How Does It Work?

Our partners store and/or access information on a device, such as unique IDs in cookies to process personal data. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. These choices will be signaled to our partners and will not affect browsing data.

We and our partners process data to provide:

Store and/or access information on a device. Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners (vendors)

Accept All Reject All Show Purposes

Please fill out this field.

Table of Contents

Beginner’s guide to 401(k)s and what you need to know to get started

What Is a 401(k) Plan?

A 401(k) plan is a retirement savings plan offered by many American employers with tax advantages. It is named after a section of the U.S. Internal Revenue Code (IRC).

The employee who signs up for a 401(k) agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

Key Takeaways

- A 401(k) plan is a company-sponsored retirement account to which employees can contribute income, while employers may match contributions.

- There are two types of 401(k)s—traditional and Roth—which differ primarily in how they’re taxed.

- With a traditional 401(k), employee contributions are pre-tax, but withdrawals are taxed.

- Employee contributions to Roth 401(k)s are made with after-tax income and withdrawals are tax-free.

- Employer contributions can be made to both traditional and Roth 401(k) plans.

How 401(k) Plans Work

The 401(k) plan was designed to encourage Americans to save for retirement and offers tax savings. There are two main options, traditional and Roth, each with distinct tax advantages.

Traditional 401(k)

With a traditional 401(k), employee contributions are deducted from gross income. This means the money comes from your paycheck before income taxes have been deducted.

Your taxable income is reduced by the total amount of contributions for the year and can be reported as a tax deduction for that tax year. No taxes are due on either the money contributed or the investment earnings until you withdraw the money, usually in retirement.

Roth 401(k)

With a Roth 401(k), contributions are deducted from your after-tax income. This means contributions come from your pay after income taxes have been deducted. As a result, there is no tax deduction in the year of the contribution. When you withdraw the money during retirement, though, you don’t have to pay any additional taxes on your contribution or on the investment earnings.

Not all employers offer the option of a Roth account. If the Roth is offered, you can choose between a traditional and Roth 401(k), or contribute to both up to the annual contribution limit.

Tip

Contributing to a 401(k) Plan

Traditional and Roth 401(k) plans are defined contribution plans. Both the employee and employer can contribute to the account up to the dollar limits set by the IRS. Employees’ contributions to a traditional 401(k) plan are made with before-tax dollars and will reduce their taxable income and their adjusted gross income (AGI). Contributions to a Roth 401(k) are made with after-tax dollars and do not impact taxable income further.

A defined contribution plan is an alternative to the traditional pension, known as a defined-benefit plan. 401(k) plans have become more common, and traditional pensions have become rare as employers have shifted the responsibility and risk of saving for retirement to their employees.

Employees are responsible for choosing the specific investments held within their 401(k) accounts from a selection offered by their employer. Those offerings typically include a variety of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

Note

The employee’s account holdings may also include guaranteed investment contracts (GICs) issued by insurance companies and sometimes the employer’s own stock.

Contribution Limits

The maximum amount that an employee or employer can contribute to a 401(k) plan is adjusted periodically to account for inflation.

For 2024, the annual limit on employee contributions to a 401(k) is $23,000 per year for workers under age 50. Those aged 50 and over can make a $7,500 catch-up contribution.

If your employer also contributes or if you elect to make additional, non-deductible after-tax contributions to your traditional 401(k) account, there is a total employee-and-employer contribution amount for the year:

2024

- For workers under 50 years old, the total employee-employer contributions cannot exceed $69,000 per year.

- If the catch-up contribution for those 50 and over was included, the limit was $76,500.

2023

- For workers under 50 years old, the total employee-employer contributions cannot exceed $66,000 per year.

- If the catch-up contribution for those 50 and over is included, the limit is $73,500.

Employer Matching

Employers who match employee contributions use various formulas to calculate that match.

For instance, an employer might match $0.50 for every $1 that the employee contributes, up to a certain percentage of salary.

Financial advisors often recommend that employees contribute at least enough money to their 401(k) plans to get the full employer match.

Contributing to Both a Traditional and a Roth 401(k)

If their employer offers both types of 401(k) plans, an employee can split their contributions between a traditional and Roth 401(k).

The total contribution to the two types of accounts can’t exceed the limit for one account (such as $23,000 for those under age 50 in 2024 or $22,500 in 2023).

Employer contributions can be made to both a traditional 401(k) account and a Roth 401(k). Withdrawals from the former will be subject to tax, whereas qualifying withdrawals from the latter are tax-free.

How Does a 401(k) Earn Money?

Your contributions to your 401(k) account are invested according to the choices you make from the selection your employer offers. These options typically include a variety of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as you approach retirement.

How much you contribute each year, whether or not your company matches your contributions, your investments and their returns, plus the number of years you have until retirement all contribute to how quickly and how much your money will grow.

Provided you don’t remove funds from your account, you don’t have to pay taxes on investment gains, interest, or dividends until you withdraw money from the account after retirement (unless you have a Roth 401(k), in which case you don’t have to pay taxes on qualified withdrawals when you retire).

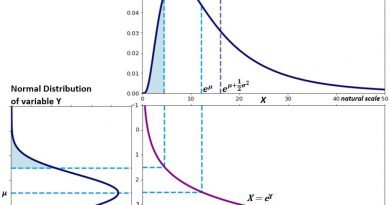

What’s more, if you open a 401(k) when you are young, it has the potential to earn more money for you, thanks to the power of compounding. The benefit of compounding is that returns generated by savings can be reinvested back into the account and begin generating returns of their own.

Over a period of many years, the compounded earnings on your 401(k) account can actually be larger than the contributions you have made to the account. In this way, as you keep contributing to your 401(k), it has the potential to grow into a sizable chunk of money over time.

Taking Withdrawals From a 401(k)

Once money goes into a 401(k), it is difficult to withdraw it without paying taxes on the withdrawal amounts.

"Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement," says Dan Stewart, CFA®, CEO and CIO of Revere Asset Management Inc., in Dallas. "Do not put all of your savings into your 401(k) where you cannot easily access it, if necessary."

The earnings in a 401(k) account are tax deferred in the case of traditional 401(k)s and tax free in the case of Roths. When the traditional 401(k) owner makes withdrawals, that money (which has never been taxed) will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401(k) owners must be at least age 59½—or meet other criteria spelled out by the IRS, such as being totally and permanently disabled—when they start to make withdrawals to avoid a penalty.

This penalty is usually an additional 10% early distribution tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401(k) plan. The employees are essentially borrowing from themselves. If you take out a 401(k) loan and leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Required Minimum Distributions (RMDs)

Traditional 401(k) account holders are subject to required minimum distributions (RMDs) after reaching a certain age.

Note that distributions from a traditional 401(k) are taxable. Qualified withdrawals from a Roth 401(k) are not.

Roth IRAs, unlike Roth 401(k)s, are not subject to RMDs during the owner’s lifetime.

Traditional 401(k) vs. Roth 401(k)

401(k) plans became available in 1978, offering the traditional 401(k). In 2006, Roth 401(k)s were introduced.

While Roth 401(k)s were slow to catch on, many employers now offer them. So the first decision employees often face is choosing between a Roth and a traditional 401(k).

As a general rule, employees who expect to be in a lower marginal tax bracket after they retire might want a traditional 401(k) for the immediate tax break.

Employees who expect to be in a higher bracket after retiring might prefer a Roth to avoid taxes on their savings later. Additionally, since there is no tax on withdrawals, all the money that the contributions earn over decades is tax free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401(k) plan, which matters if your budget is tight.

Since no one can predict future tax rates, many financial advisors suggest putting some money into each type of 401(k).

When You Leave Your Job

When you leave a company with a 401(k) plan, you generally have four options:

1. Withdraw the Money

Withdrawing the money is usually a bad idea unless you urgently need the cash. The money will be taxable in the year it’s withdrawn. You will be hit with the additional 10% early distribution tax unless you are over 59½, permanently disabled, or meet other IRS exceptions.

In the case of a Roth 401(k), you can withdraw your contributions tax-free and without penalty at any time as long as you have had the account for at least five years. However, keep in mind that you’re diminishing your retirement savings.

2. Roll Your 401(k) Into an IRA

By moving the money into an IRA, you can avoid immediate taxes and maintain the account’s tax-advantaged status. You will also have a wider range of investment choices than with your employer’s plan.

There are rules regarding rollovers that need to be followed to avoid costly mistakes. The receiving financial institution can assist with the process.

3. Leave Your 401(k) With the Old Employer

In many cases, employers allow departing employees to keep a 401(k) account in their old plan indefinitely, but no further contributions can be made. This generally applies to accounts worth at least $5,000. Smaller accounts may have to be moved.

Leaving 401(k) money where it is can make sense if the old employer’s plan is well managed and offers satisfactory investment choices. However, it can be easy to lose track of old 401(k) plans.

4. Move Your 401(k) to a New Employer

You can usually move your 401(k) balance to your new employer’s plan, maintaining its tax-deferred status and avoiding immediate taxes.

This could be a wise move if you prefer having the new plan’s administrator manage the investments rather than doing it yourself with a rollover IRA.

How Do You Start a 401(k)?

The simplest way to start a 401(k) plan is through your employer. Many companies offer 401(k) plans and some will match part of an employee’s contributions.

If you are self-employed or run a small business with your spouse, you may be eligible for a solo 401(k) plan. These retirement plans allow freelancers and independent contractors to fund their own retirement. A solo 401(k) can be created through most online brokers.

What Is the Maximum Contribution to a 401(k)?

For most people, the maximum contribution to a 401(k) plan is $23,000 in 2024 and $22,500 in 2023. If you are over 50 years old, you can make an additional catch-up contribution of $7,500 for both years. There are also limitations on the employer’s matching contribution.

Is It a Good Idea to Take Early Withdrawals From Your 401(k)?

There are few advantages to taking an early withdrawal from a 401(k) plan. If you take withdrawals before age 59½, you will face a 10% penalty in addition to any taxes owed. However, some employers allow hardship withdrawals for sudden financial needs, such as medical costs or buying a home. Taxes are still owed on the withdrawal.

What Is the Main Benefit of a 401(k)?

A 401(k) plan lets you reduce your tax burden while saving for retirement. Contributions are automatically subtracted from your paycheck. Many employers will match part of their employees’ 401(k) contributions, effectively boosting their retirement savings.

The Bottom Line

A 401(k) plan is a workplace retirement plan that allows you to make annual contributions up to a certain limit and invest that money for your later years once your working days are done.

401(k) plans come in two types: traditional and Roth. Traditional 401(k)s involve pre-tax contributions and tax-deferred earnings. Roth 401(k)s involve after-tax contributions and tax-free withdrawals in retirement. Both accounts allow employer contributions.