What Is 3C1 and How Is the Exemption Applied

3C1 and the Exemption of Investment Companies

3C1 is a section of the Investment Company Act of 1940 that allows private investment companies to be exempt from certain regulations and reporting requirements set by the Securities and Exchange Commission (SEC). However, these firms must meet specific requirements to maintain their exception status.

Key Takeaways:

– 3C1 exempts certain private investment companies from regulations of the Investment Company Act of 1940.

– Investment companies must meet regulatory and reporting requirements stipulated by the SEC.

– 3C1 allows private funds with 100 or fewer investors and no plans for an initial public offering to bypass certain SEC requirements.

Understanding 3C1:

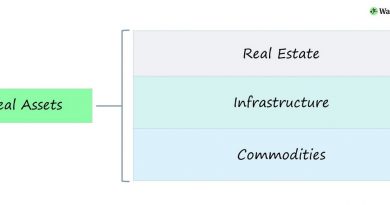

3C1 is the abbreviation for the 3(c)(1) exemption in section 3 of the Act. To understand section 3C1, we need to first review the Act’s definition of an investment company and its relationship to earlier sections of the Act, specifically 3(b)(1) and 3(c). An investment company, as defined by the Investment Company Act, primarily engages in investing, reinvesting, or trading securities. If companies fall under this definition, they must adhere to regulations and reporting requirements.

3(b)(1):

This section excludes certain companies from being considered investment companies and having to follow subsequent regulations. Companies are exempt if they are not primarily engaged in investing, reinvesting, holding, owning, or trading securities themselves, or through subsidiaries or controlled companies.

3(c):

This section further outlines exceptions to the investment company classification, including broker-dealers, pension plans, church plans, and charitable organizations.

3(c)(1):

This adds to the exceptions listed in 3(c) by stating specific parameters and requirements that, if met, allow private investment companies to not be classified as investment companies under the Act.

Specifically, 3(c)(1) exempts the following from the definition of an investment company:

“Any issuer whose outstanding securities (other than short-term paper) are beneficially owned by not more than one hundred persons (or in the case of a qualifying venture capital fund, 250 persons) and that is not making and does not presently propose to make a public offering of such securities.”

In other words, 3C1 allows private funds with 100 or fewer investors (or venture capital funds with fewer than 250 investors) and without plans for an initial public offering to avoid SEC registration and other requirements, including ongoing disclosure and restrictions on derivatives trading. These funds are also known as 3C1 companies or 3(c)(1) funds.

The result of 3C1 is that it enables hedge funds to avoid the SEC scrutiny faced by other investment funds, such as mutual funds, under the Act. However, investors in 3C1 funds must be accredited, meaning they have an annual income exceeding $200,000 or a net worth over $1 million.

3C1 Funds vs. 3C7 Funds:

Private equity funds are typically structured as 3C1 funds or 3C7 funds, with the latter referring to the 3(c)(7) exemption. Both types are exempt from SEC registration requirements under the Investment Company Act of 1940, but the nature of the exemption differs slightly. While the 3C1 exemption is determined by not exceeding 100 accredited investors, a 3C7 fund must have a total of 2,000 or fewer qualified purchasers. Qualified purchasers must meet a higher asset requirement of over $5 million, but a 3C7 fund can have more of these individuals or entities participating as investors.

Challenges of 3C1 Compliance:

Although monitoring the limit of 100 accredited investors may seem straightforward, it can present compliance challenges for funds. Private funds generally have protection for involuntary share transfers, such as when shares are split among family members after the death of an investor.

However, issues can arise with shares given as employment incentives. Knowledgeable employees, including executives, directors, and partners, are not counted against the fund’s tally. However, employees who leave the firm and take the shares with them will count toward the 100 investor limit. This limit is crucial for the investment company exemption and maintaining 3C1 status, so private funds make significant efforts to ensure compliance.