What Are Federal Funds Definition and How Loans and Rates Work

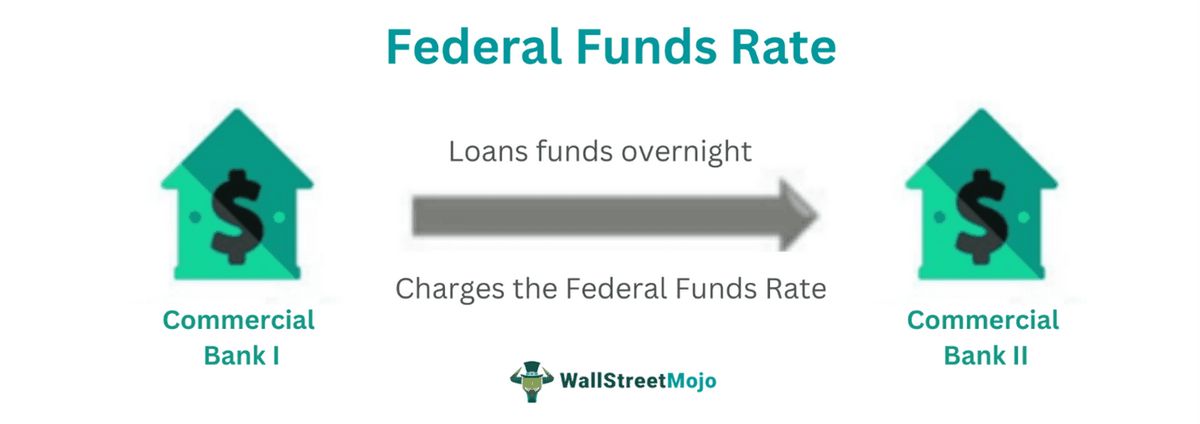

Federal funds, also known as fed funds, are excess reserves deposited by financial institutions at regional Federal Reserve banks. These funds can be lent to other market participants with insufficient cash on hand to meet lending and reserve needs. The loans are unsecured and made at a relatively low interest rate called the federal funds rate or overnight rate.

Key Takeaways:

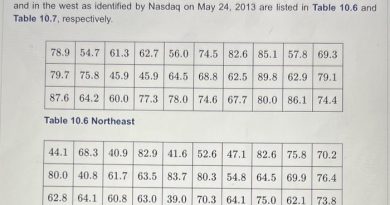

– Federal funds refer to excess reserves held by financial institutions, over and above the mandated reserve requirements of the central bank.

– Banks borrow or lend their excess funds to each other on an overnight basis.

– The federal funds rate is a target set by the central bank and is determined by the overnight inter-bank lending market.

Understanding Federal Funds:

Federal funds help commercial banks meet their daily reserve requirements. Excess reserves are cash amounts held in excess of what is required by regulators, creditors, or internal controls. These required reserve ratios set the minimum liquid deposits that must be in reserve at a bank.

The Federal Reserve Bank sets a target rate or range for the fed funds rate, which is adjusted periodically based on economic and monetary conditions.

Overnight Markets:

The fed funds market operates in the United States and runs parallel to the offshore eurodollar deposit market. Eurodollars are also traded overnight at a similar interest rate to the fed funds rate. Multinational banks often use branches in the Caribbean or Panama for these accounts.

The Fed Funds Rates:

The Federal Reserve uses open market operations to manage the supply of money in the economy and adjust short-term interest rates. The federal funds rate is one of the most important interest rates for the U.S. economy as it affects inflation, growth, and employment. It is set in U.S. dollars and typically charged on overnight loans.

Market Participants:

Participants in the fed funds market include U.S. commercial banks, U.S. branches of foreign banks, savings and loan organizations, government-sponsored enterprises like Fannie Mae and Freddie Mac, and securities firms and federal government agencies.