What Are Defined Contribution Plans and How Do They Work

Defined Contribution Plans: A Concise Guide

A Defined Contribution (DC) plan is a retirement plan, like a 401(k) or 403(b), where employees contribute a fixed amount or percentage of their paychecks to an account intended for their retirements. The plan may also include employer matching contributions.

Key Takeaways:

– DC plans allow employees to invest pre-tax dollars in the capital markets, growing tax-deferred until retirement.

– Popular DC plans include 401(k) and 403(b).

– DC plans differ from defined benefit (DB) pensions, as they do not guarantee retirement income.

– Participation in DC plans is voluntary and self-directed.

Understanding DC Plans:

The ultimate value of a DC plan upon retirement is uncertain due to changing contribution levels and volatile investment returns. Withdrawals from DC plans without penalties are subject to restrictions.

Advantages of Participating in a DC Plan:

Contributions to a DC plan may be tax-deferred until withdrawals. Employers may provide matching contributions, and tax advantages allow for larger balance growth over time compared to taxed brokerage accounts.

Limitations of DC Plans:

DC plans require employees to manage their own investments, which can be challenging for those with little experience. Unlike DB pension plans, DC plans lack guarantees and may not provide sufficient retirement funds.

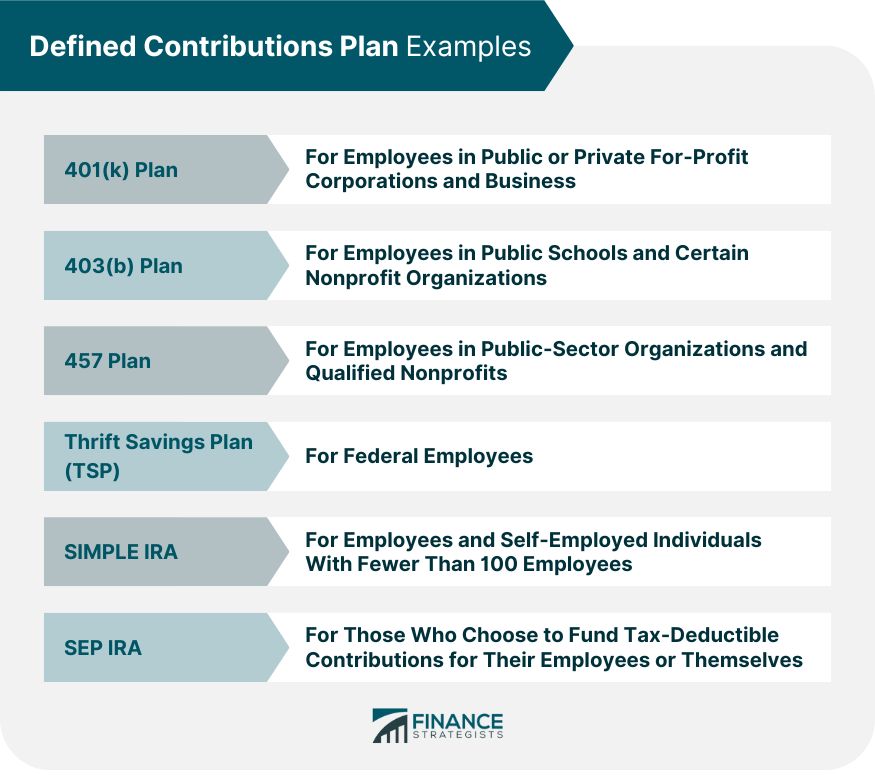

DC Plan Examples:

401(k), 403(b), 457, Thrift Savings Plan (TSP), and 529 plans serve various employee groups, including federal government employees and nonprofit organizations.

DC Plans vs. Defined Benefit Plans:

DB plans guarantee retirement income, while DC plans do not. DC plans are self-directed and funded by employees and employers.

Cashing Out a DC Plan:

Withdrawals before age 59½ may incur a 10% penalty, along with income tax.

Contributions to a DC Plan:

In 2023, individuals under 50 can contribute up to $22,500, with an additional $7,500 in catch-up contributions for those over 50.

In Conclusion:

Defined Contribution plans involve regular contributions from employers, employees, or both. Employees must select investment options aligned with their retirement goals.