What Are Deficits Definition Types Risks and Benefits

Contents

- 1 Deficits: Definition, Types, Risks, and Benefits

- 1.1 What Is a Deficit?

- 1.2 Understanding Deficits

- 1.3 Types of Government Deficits

- 1.4 Other Deficit Terms

- 1.5 Advantages and Disadvantages of Running a Deficit

- 1.6 Today’s Federal Budget Deficit in the U.S.

- 1.7 Why Is a Deficit a Problem?

- 1.8 Why Do Countries Run Deficits?

- 1.9 Which Country Has the Worst Deficit?

- 1.10 The Bottom Line

Deficits: Definition, Types, Risks, and Benefits

Carla Tardi is a technical editor and digital content producer with 25+ years of experience at top-tier investment banks and money-management firms.

What Is a Deficit?

In financial terms, a deficit occurs when expenses exceed revenues, imports exceed exports, or liabilities exceed assets. It is synonymous with a shortfall or loss and is the opposite of a surplus. A deficit can occur when a government, company, or person spends more than it receives in a given period, usually a year.

Key Takeaways

- A deficit occurs when expenses exceed revenues, imports exceed exports, or liabilities exceed assets.

- Governments and businesses sometimes run deficits deliberately, to stimulate an economy during a recession or to foster future growth.

- The two major types of deficits incurred by nations are budget deficits and trade deficits.

Understanding Deficits

Whether the situation is personal, corporate, or governmental, running a deficit reduces any current surplus or adds to existing debt. For that reason, many believe that deficits are unsustainable over the long term.

However, the economist John Maynard Keynes maintained that fiscal deficits allow governments to purchase goods and services that can help stimulate their economy—making deficits a useful tool for bringing nations out of recessions.

Proponents of trade deficits say they allow countries to obtain more goods than they produce and can also spur their domestic industries to become more competitive globally.

However, opponents of trade deficits argue that they provide jobs to foreign countries instead of creating them at home, hurting the domestic economy and its citizens. Also, many argue that governments should not incur fiscal deficits regularly because the cost of servicing the debt uses up resources that the government might deploy in more productive ways, such as providing education, housing, or public infrastructure.

Types of Government Deficits

The two primary types of deficits a nation can incur are budget deficits and trade deficits.

Budget Deficit

A budget deficit occurs when a government spends more in a given year than it collects in revenues, such as taxes. For example, if a government takes in $10 billion in revenue in a particular year, and its expenditures for the same year are $12 billion, it is running a deficit of $2 billion. That deficit, added to those from previous years, constitutes the country’s national debt.

Trade Deficit

A trade deficit exists when the value of a nation’s imports exceeds the value of its exports. For example, if a country imports $3 billion in goods but only exports $2 billion worth, then it has a trade deficit of $1 billion for that year. In effect, more money is leaving the country than is coming in, which can cause a drop in the value of its currency as well as a reduction in jobs.

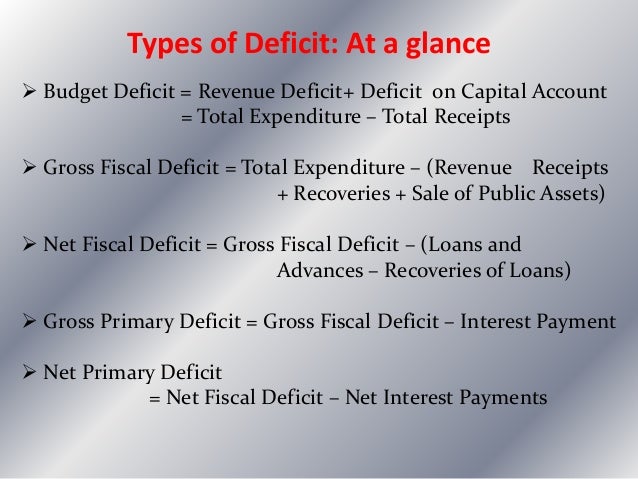

Other Deficit Terms

Along with trade and budget deficits, these are some other deficit-related terms you may encounter:

- Current account deficit is when a country is importing more goods and services than it exports.

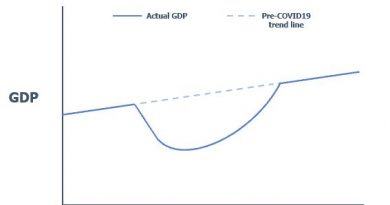

- Cyclical deficits occur when an economy is not performing well because of a down business cycle.

- Deficit financing refers to the methods governments use to finance their budget deficits—such as issuing bonds or printing more money.

- Deficit spending is when a government spends more than the revenue it collects during a certain period.

- Fiscal deficits occur when a government’s total expenditures exceed the revenue that it generates, excluding money from borrowing.

- Income deficit is a measurement used by the U.S. Census Bureau to reflect the dollar amount by which a family’s income falls short of the poverty line.

- Primary deficit is the fiscal deficit for the current year minus interest payments on previous borrowings.

- Revenue deficit describes the shortfall of total revenue receipts compared with total revenue expenditures for a government.

- Structural deficits are said to occur when a country posts a deficit even though its economy is operating at its full potential.

- Twin deficits occur when an economy has both a fiscal deficit and a current account deficit.

Advantages and Disadvantages of Running a Deficit

Deficits are not always unintentional or the sign of a government or business in financial trouble. Businesses may deliberately run budget deficits to maximize future earnings opportunities—for example, retaining employees during slow months to ensure an adequate workforce in busier times. Also, some governments run deficits to finance large public projects or maintain programs for their citizens.

During a recession, a government may intentionally run a deficit by decreasing its sources of revenue, such as taxes, while maintaining or even increasing expenditures—on infrastructure, for example—to provide jobs and income. The theory is that these measures will boost the public’s purchasing power and ultimately stimulate the economy.

But deficits also carry risks. For governments, the negative effects of running a deficit can include lower economic growth rates or the devaluation of the domestic currency. In the corporate world, running a deficit for too long can reduce the company’s share value or even put it out of business.

Today’s Federal Budget Deficit in the U.S.

In May 2023, the Congressional Budget Office (CBO) projected a federal budget deficit of $1.5 trillion for 2023. The CBO specified that this is subject to considerable uncertainty partly due to a shortfall in tax revenue. As of July 2023, the deficit has surpassed the estimate, sitting at $1.6 trillion.

In terms of the national debt, the CBO projected that as of the end of 2023, federal debt held by the public will reach 98% of GDP, compared with 79% at the end of 2019. Before the start of the Great Recession in 2007, it stood at 35% of GDP.

The CBO also projects that debt will continue to climb, reaching 102% of GDP in 2025 and 111% in 2030.

Why Is a Deficit a Problem?

Deficits are problems because they mean you are spending more than you’re earning. This applies to individuals, corporations, and governments. Deficits can result in more borrowing, more interest payments, and lower reinvestment, which can be difficult to remedy and lead to lower savings and revenue.

Why Do Countries Run Deficits?

Countries run deficits because they spend more than they earn, and sometimes that spending is necessary. Countries earn income/revenue through taxes. They need to spend this money in many ways, such as public infrastructure, Medicare and Social Security benefits, defense, salaries for government employees, and so on. Sometimes there just isn’t enough money in a year, so a country resorts to borrowing. Deficits also allow countries to spread taxes over time by allocating taxes over generations and can lead to economic growth if managed correctly.

Which Country Has the Worst Deficit?

The United States has the largest trade balance deficit in the world: $1.3 trillion as of 2022. For comparison, the second-largest is the U.K. with a trade balance deficit of $294 billion.

The Bottom Line

A deficit occurs any time expenses exceed income. For personal finance, it’s important to manage financial deficits, ideally spending within your means and saving your money. Similarly, large government deficits aren’t ideal but sometimes necessary to fund government programs or public infrastructure.

A deficit occurs any time expenses exceed income. For personal finance, it’s important to manage financial deficits, ideally spending within your means and saving your money. Similarly, large government deficits aren’t ideal but sometimes necessary to fund government programs or public infrastructure.