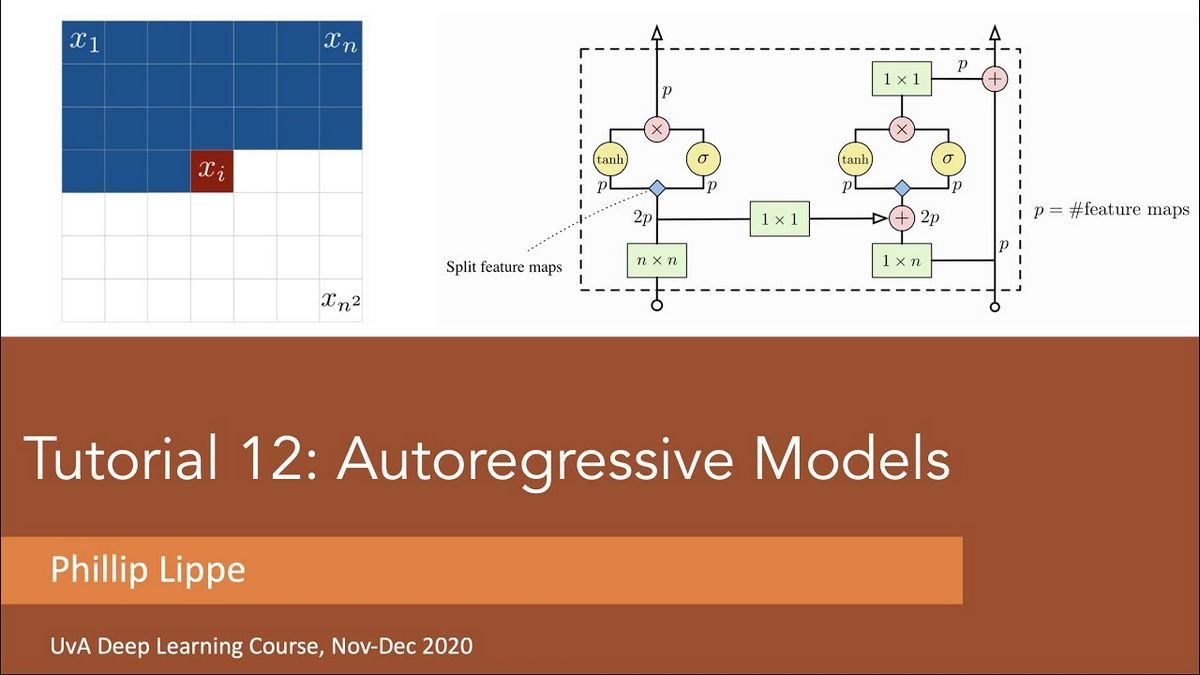

What Are Autoregressive Models How They Work and Example

Contents

Autoregressive Models: Definition, Function, and Example

What Is an Autoregressive Model?

An autoregressive model predicts future values based on past values. For instance, it can forecast a stock’s future prices based on its past performance.

Key Takeaways

- Autoregressive models predict future values based on the past.

- They are widely used in technical analysis to forecast security prices.

- Autoregressive models assume that the future will resemble the past.

- However, they may be inaccurate under certain market conditions, such as financial crises or technological change.

Understanding Autoregressive Models

Autoregressive models analyze processes that vary over time, assuming that past values impact current values. This statistical technique is commonly used in studying nature, economics, and other fields. Unlike multiple regression models, which use a linear combination of predictors, autoregressive models utilize past values of the variable.

An autoregressive process can be classified as AR(1), AR(2), or AR(0). An AR(1) process considers the immediate preceding value, while an AR(2) process incorporates the two previous values. The AR(0) process, on the other hand, accounts for white noise and exhibits no dependence between terms. Besides, coefficients used in these calculations can be derived using various methods, such as the least squares method.

Although autoregressive models are valuable for forecasting security prices, they rely solely on past information and assume that the fundamental forces that influenced past prices will remain constant. Consequently, they may produce surprising and inaccurate predictions if these underlying forces undergo significant change, such as due to a rapid technological transformation within an industry.

Nevertheless, traders continuously refine the use of autoregressive models for forecasting purposes. One notable example is the Autoregressive Integrated Moving Average (ARIMA), an advanced autoregressive model that considers trends, cycles, seasonality, errors, and other types of non-static data when making forecasts.

Analytical Approaches

In addition to technical analysis, autoregressive models can also be combined with other investment approaches. For instance, investors can employ fundamental analysis to identify promising opportunities and use technical analysis to pinpoint entry and exit points.

An Autoregressive Model Example

Autoregressive models assume that past values affect current values. For instance, when using an autoregressive model to forecast stock prices, it is assumed that recent market transactions influence the decisions of new buyers and sellers regarding the amount to offer or accept for the security.

While this assumption generally holds true, there are exceptions. For example, before the 2008 Financial Crisis, most investors were unaware of the risks posed by the significant portfolios of mortgage-backed securities held by many financial firms. During that time, an autoregressive model forecasting the performance of U.S. financial stocks would have predicted stable or rising prices in that sector.

However, once it became public knowledge that many financial institutions faced the imminent risk of collapse, investors shifted their focus from recent stock prices to underlying risk exposure. Consequently, the market rapidly devalued financial stocks, greatly confounding an autoregressive model’s predictions.

It is worth noting that in an autoregressive model, a one-time shock will indefinitely impact calculated variables’ values in the future. As a result, today’s autoregressive models still reflect the legacy of the financial crisis.