Weighted What It Means and how It Works

Contents

Weighted: Meaning and Mechanism

Cierra Murry is a banking consultant, loan signing agent, and arbitrator with over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management. She specializes in banking, credit cards, investing, loans, mortgages, and real estate.

What is Weighted?

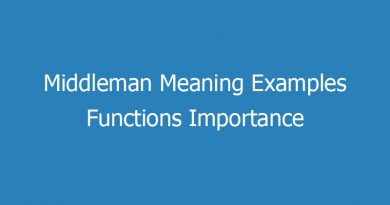

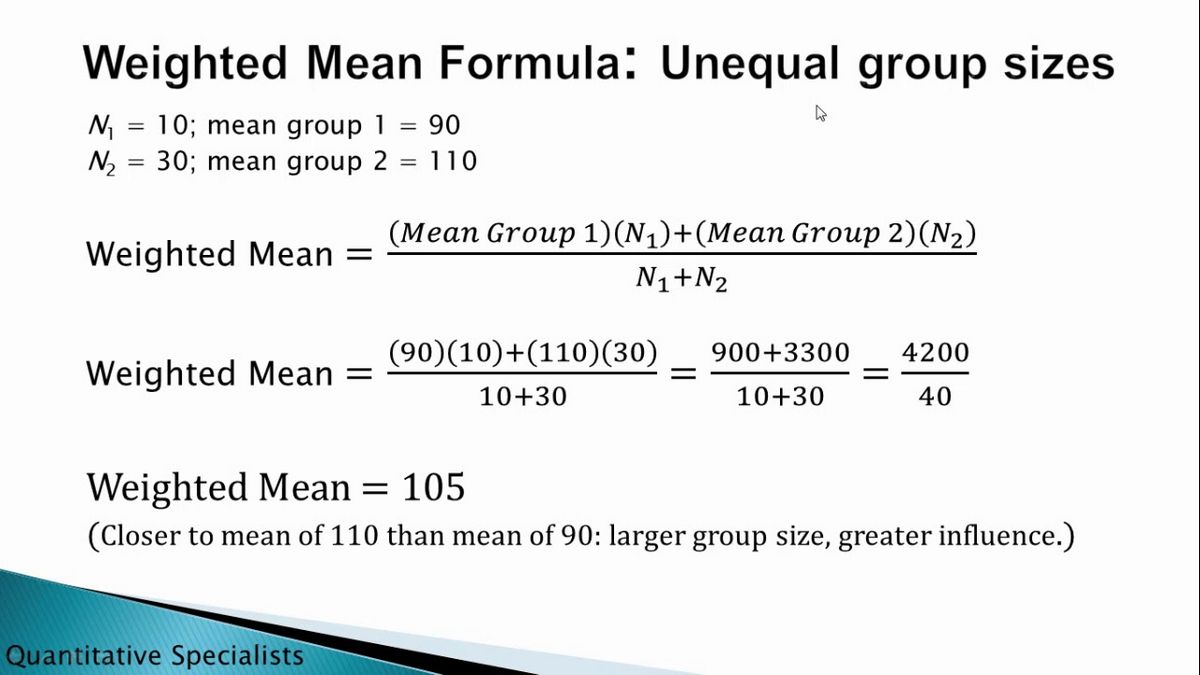

The term "weighted" refers to adjustments made to a figure in order to account for different proportions or "weights" of its components. For instance, in a weighted average, the significance of each component is considered proportionally, rather than equally weighing all individual components. The Dow Jones Industrial Average (DJIA), for instance, is a price-weighted average that compares each security based on its stock price in relation to the total sum of the prices of all stocks. Conversely, the S&P 500 Index and Nasdaq Composite Index base their evaluations on market capitalization, measuring each company relative to its market value.

While weighting is utilized in the DJIA and Nasdaq indexes to more accurately gauge the impact of changing stock prices on the overall market, it can also aid in assessing the historical and current prices of individual instruments through technical analysis.

Understanding Weighted

Weighting enables the prioritization of pertinent data, making it a common method in the investments and accounting industries. For instance, a weighted moving average places additional emphasis on recent data, providing a clearer view of current market activity. Similarly, a weighted alpha measures the extent to which a stock has risen or fallen within a specific period, giving more weight to recent activity. By focusing on the present period, this calculation offers a more relevant measure for short-term analysis. Other relevant weighted metrics include the weighted average cost of capital (WACC), weighted average coupon, and time-weighted average annual rate of return.

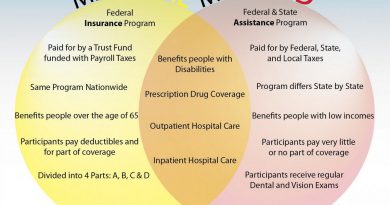

Considering Index Weights

Passive investing, or index investing, is often recommended as the optimal way to engage in the stock market. This approach is particularly suitable for investors who lack the time, aptitude, or interest in closely following the stock market. However, some investors value balance within an index and find periodic reviews of sector weightings essential. For instance, the S&P 500 Index, which serves as the basis for several passive investment vehicles, can become excessively weighted in specific sectors, such as information technology, if the market caps of these constituents grow disproportionately relative to other sectors. If an investor is uncomfortable with an excessively weighted sector, an index fund may not be the most suitable choice.