Warranty Deed Definition Types and How It s Used

Contents

- 1 Warranty Deed: Definition, Types, and Use

Warranty Deed: Definition, Types, and Use

What Is a Warranty Deed?

A warranty deed is a legal document that protects the buyer and ensures that the seller holds clear title to the property, free of liens, mortgages, and future claims.

The parties involved in a warranty deed are the seller (grantor) and the buyer (grantee), who can be individuals or businesses.

Most lenders require a warranty deed for financed properties.

Key Takeaways

- A warranty deed protects the buyer, ensuring the seller’s clear title and absence of liens or mortgages.

- A warranty deed is a legal document that safeguards against future title claims.

- Most lenders require a warranty deed for financed properties.

- The seller is the grantor, and the buyer is the grantee.

How Warranty Deeds Work

A deed transfers property from seller to buyer. During a transaction, a title company conducts a full title search to identify any past ownership issues.

A warranty deed holds the seller responsible for any breach discovered during the title search, even if the breach occurred before the seller’s ownership. It protects the buyer from past title defects or encumbrances.

The warranty deed, delivered at closing, includes an accurate legal property description, is signed and witnessed according to state law, confirms the seller’s grant of the property, and proves the amount paid for it.

Types of Warranty Deeds

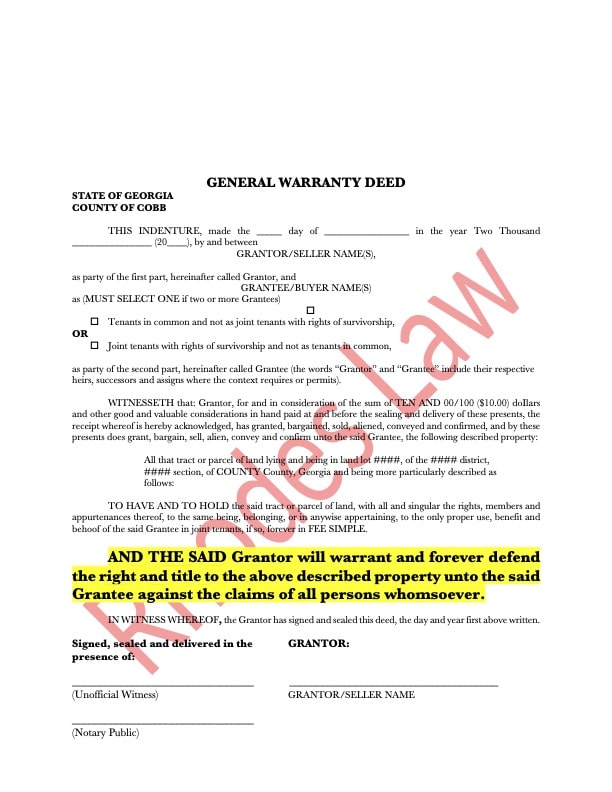

General Warranty Deed

• The grantor warrants rightful ownership and the right to transfer the title.

• The grantor warrants a lien-free property with no outstanding claims.

• The title can withstand third-party claims to ownership.

Special Warranty Deed

• Conveys title with no encumbrances during the grantor’s ownership.

• Does not guarantee against pre-existing title defects.

How to Get a Warranty Deed

A real estate agent or lawyer can assist in obtaining a warranty deed, providing protection and assurance during property transactions.

Having a warranty deed in place as a seller gives potential buyers assurance. It offers the highest level of protection and peace of mind to buyers. If there are no liens or claims on the property’s title, a warranty deed facilitates a successful transaction.

Other Types of Deeds

- A quitclaim deed transfers property between individuals without a sale, often among family members or during divorces. It relinquishes any future interests in the property.

- A deed in lieu transfers property to the lender instead of foreclosing, preventing negative impact on the borrower’s credit history.

- A special purpose deed enables property transfers without personal liability during court proceedings.

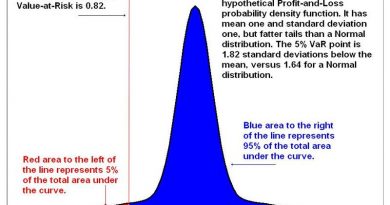

Difference Between Title Insurance and a Warranty Deed

A title search by a title company identifies issues, while a warranty deed holds the former owner responsible for title defects or claims. Title insurance covers a broader range of potential claims, including conflicting estate wills or tax liens.

Examples of Claims Protected by Warranty Deeds

A buyer is protected against fines resulting from code violations or unpaid HOA fees by the previous owner.

Risks of a Special Warranty Deed

Unlike a general warranty deed, a special warranty deed doesn’t hold the seller liable for pre-existing title issues. This poses risk to the buyer, as they lack legal protection if title issues arise after the transaction.

The Bottom Line

A warranty deed ensures clear title and absence of liens or mortgages. Combining a warranty deed, title search, and title insurance provides the highest buyer protection, eradicating title defects and future claims.