Vertical Equity What it is How it Works Example

Contents

Vertical Equity: What it is, How it Works, Example

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

What Is Vertical Equity?

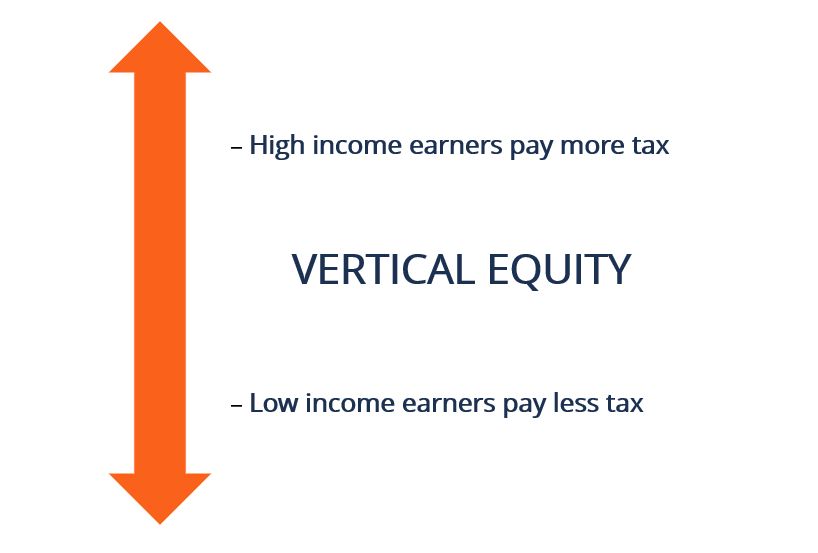

Vertical equity is a method of collecting income tax in which the taxes paid increase with earned income. The driving principle behind vertical equity is that those with the ability to pay more taxes should contribute more.

This can be contrasted with horizontal equity, where individuals with similar income and assets should pay the same amount in taxes.

Understanding Vertical Equity

The equity of a tax system speaks to whether the tax burden is distributed fairly among the population. The ability to pay principle states that the amount of tax an individual pays should be dependent on the level of burden the tax will create relative to the wealth of the individual. The ability to pay principle gives rise to two notions of fairness and equity—vertical and horizontal equity.

Vertical equity drives the principle that people with higher incomes should pay more tax, through proportional or progressive tax rates. In proportional taxation, the amount of taxes paid increases directly with income. Everyone pays the same proportion of their income in tax since the effective average tax rate does not change with income.

Key Takeaways

- Vertical equity is a method of income taxation where more taxes are paid as income increases.

- Vertical equity is based on the principle of ability to pay through progressive tax rates or proportional taxation.

- Vertical equity is often more achievable than horizontal equity, which can be undermined by loopholes and deductions.

Example of Vertical Equity

For example, consider a taxpayer that earns $100,000 per annum and another that earns $50,000 per annum. If the tax rate is flat and proportional at 15%, the higher income earner will pay $15,000 tax for the given tax year, while the taxpayer with the lower income will have a tax liability of $7,500. With the same rate applied across all income amounts, individuals with more resources or higher income levels will always pay more tax in dollars than lower earners.

Progressive Taxation

Progressive taxation includes tax brackets, where people pay taxes based on their income bracket. Each tax bracket will have a different tax rate, with higher income brackets paying the highest percentages. Under this taxation system, effective average tax rates increase with income, so the rich pay a higher share of their income in taxes than people in the lowest income bracket. For example, in the United States, a single taxpayer that earns $100,000 has a top marginal tax rate of 24%, as of 2019. Their tax liability would be $18,174.50 for an effective tax rate of 18.17%. The top marginal tax rate for a single taxpayer whose annual income is $50,000 is 22%. In this case, this taxpayer would pay $6,864 for an effective tax rate of 13.73%.

Another yardstick used to measure equity in a taxation system is horizontal equity, which states that people with similar abilities to pay should contribute the same amount in taxes to the economy. The basis behind this notion is that people in the same income group are equal in their contribution capacity to society and should be treated the same by imposing the same level of income tax. However, horizontal equity is hard to achieve in a tax system with loopholes, deductions, and incentives, because the provision of any tax break means that similar individuals effectively do not pay the same rate.