Variation Margin Definition Calculation Examples

Contents

Variation Margin: Definition, Calculation, Examples

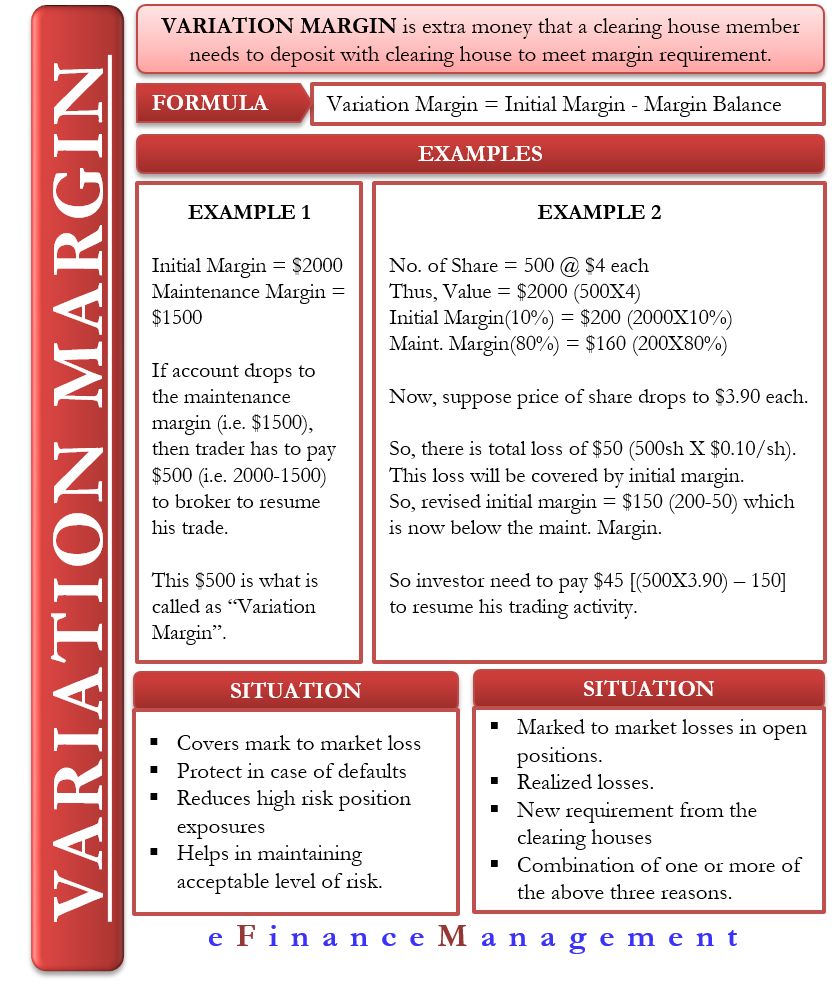

What is Variation Margin

Variation margin is a variable margin payment made by clearing members, such as futures brokers, to clearing houses based on adverse price movements of the futures contracts they hold. It is paid on a daily or intraday basis to reduce exposure from high-risk positions. Clearing houses use variation margin to maintain an appropriate level of risk and facilitate the payment and receipt of funds for all traders.

Key Takeaways

- Variation margin ensures margin levels for trading.

- It depends on factors like expected price movements, asset type, and market conditions.

Basics of Variation Margin

Variation margin brings the capital in an account up to the margin level. This margin, together with initial and maintenance margin, acts as collateral against potential trade losses.

For example, if a trader buys one futures contract, the initial margin may be $3,000. This is the required capital in the account. The maintenance margin could be $2,500. If the account balance drops below $2,500, the trader must top up to $3,000 to maintain an acceptable buffer level. The amount needed to bring the account to an acceptable level is the variation margin.

Now, imagine a broker with thousands of traders in different positions, making and losing money. The broker must consider all these positions and submit funds to clearing houses to cover the risk of all trades.

The amount of variation margin varies based on market conditions and price movements throughout the day. Additional funds may be required if the equity account balance falls below the maintenance or initial margin requirement. This request for funds is called a margin call.

Margin Call

A margin call occurs when a broker asks an investor for additional funds to meet the minimum margin requirement. This happens when the account loses money or when additional positions are taken, causing the equity balance to drop below the required minimum. If the investor cannot meet the margin call, the brokerage can sell the securities in the account to reduce risk or meet the required amount.

Maintenance Margin Requirement

Maintenance margin is important in calculating variation margin. It refers to the minimum amount of money an investor must keep in their margin account when trading stocks. This amount is typically lower than the initial margin required for trades and serves as collateral for borrowed funds from a brokerage.

The Financial Industry Regulatory Authority (FINRA) sets the maintenance margin at a minimum of 25% for stocks, but other brokerages may set higher minimums depending on risk levels and investors.

In futures trading, maintenance margin refers to the level at which an investor must top up their account to the initial margin amount.

Example of Variation Margin

Let’s say a trader buys 100 shares of stock ABC for $10 each. The broker sets an initial margin requirement of 50%, meaning the trader must have $500 in their account at all times to make trades. The maintenance margin is $300.

If the price of ABC falls to $7, the $300 loss is deducted from the initial margin account. This reduces the balance to $200, which is below the $300 maintenance margin. The new initial margin amount is $350 (50% of $700). The trader would need to add $150 to their account to continue trading.