Vandalism and Malicious Mischief Insurance How It Works

Vandalism and Malicious Mischief Insurance: How It Works

What Is Vandalism and Malicious Mischief Insurance?

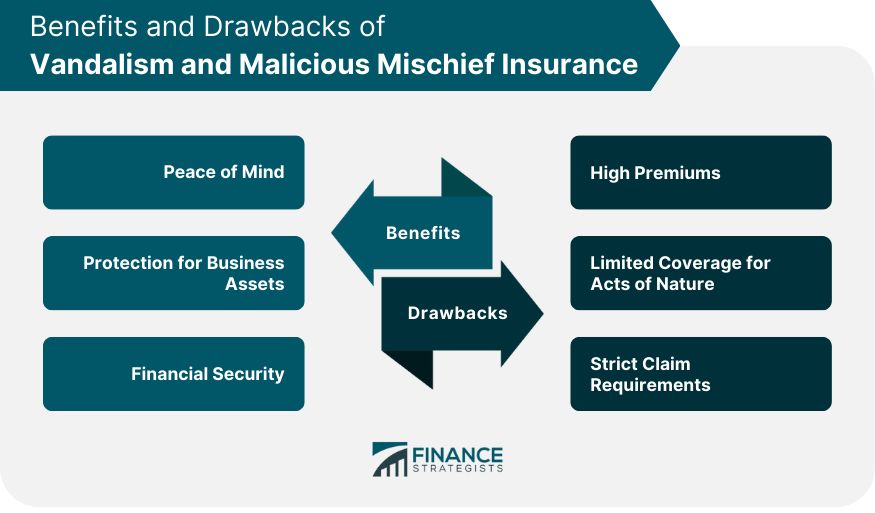

Vandalism and malicious mischief insurance protects against losses from vandals. This insurance is included in most commercial and homeowner policies.

It is important for unoccupied properties like churches and schools, which can become targets when vacant.

Key Takeaways:

– Vandalism and malicious mischief insurance is included in most commercial and homeowner policies.

– Churches and schools need this insurance because they can be targeted when unoccupied.

– Damage caused by ex-partners is the most common type of vandalism insurance claim.

– Vandalism losses are not covered on dwellings vacant over 60 days; losses by named insureds are also not covered.

How Vandalism and Malicious Mischief Insurance Works

Due to the risk and frequency of loss, this coverage often carries a higher deductible for unoccupied properties like churches and schools.

Vandalism and mischief involve intentional injury or destruction of property. It can be added as an endorsement to a standard policy, such as the standard fire policy.

Landlords can also benefit from this policy, especially for properties in high-crime areas.

What Is Covered?

Vandalism is the intentional damage of someone else’s property for the sake of causing damage. Malicious mischief is similar, but the damage may not have been intended.

The coverage includes damage to parts of the premises and personal property. For example, slashing tires or destroying a stereo would be covered if it meets the deductible.

The most common insurance claims for vandalism are damage caused by angry ex-partners seeking revenge.

Precautions should be taken against vandalism in unoccupied dwellings.

What’s Not Covered?

Vandalism or mischief losses are not covered if a dwelling has been vacant for over 60 days.

Vandalism by any insured person is also not covered. For example, if a partner named in the policy causes intentional damage, reimbursement would likely be denied.

What Does Vandalism Mean in Insurance?

Vandalism in insurance refers to intentional damage and destruction of property without theft. Breaking windows to destroy property is considered vandalism, while breaking in for burglary is not.

Is Tenant Damage Considered Vandalism?

Intentional damage by tenants is not covered as vandalism under a typical homeowner’s policy. Careful tenant screening can help prevent these damages.

Does Car Insurance Cover Vandalism?

Comprehensive car insurance covers deliberate acts of vandalism like slashed tires, broken windows, or damaged paint. Coverage depends on the provider and deductible.

The Bottom Line

Vandalism and malicious mischief insurance protects against deliberate property damage but does not cover theft or accidental damage. This insurance, along with other coverage for fire, weather, and more, offers important protection for property depending on where you live.