Trading Channel Meaning Types Indicators

Contents

Trading Channel: Meaning, Types, Indicators

What Is a Trading Channel?

A trading channel is drawn using parallel trendlines to connect a security’s support and resistance levels within which it currently trades. It may also be known as a price channel.

Key Takeaways

- A trading channel is drawn using parallel trendlines to connect a security’s support and resistance levels within which it currently trades.

- Trading channels provide one of the most important overlays that a technical analyst will use for long term analysis and trading decisions.

- Two broad types of trading channels that are popular with technical analysts are trend channels and envelope channels.

Understanding Trading Channels

Trading channels are useful in graphically depicting support and resistance levels. Technical traders rely on them to identify optimal levels to buy or sell a security. Technical analysts can also follow patterns that may occur within a channel to discern short term directional changes in market prices. Trading channels provide important overlays for long-term analysis and trading decisions.

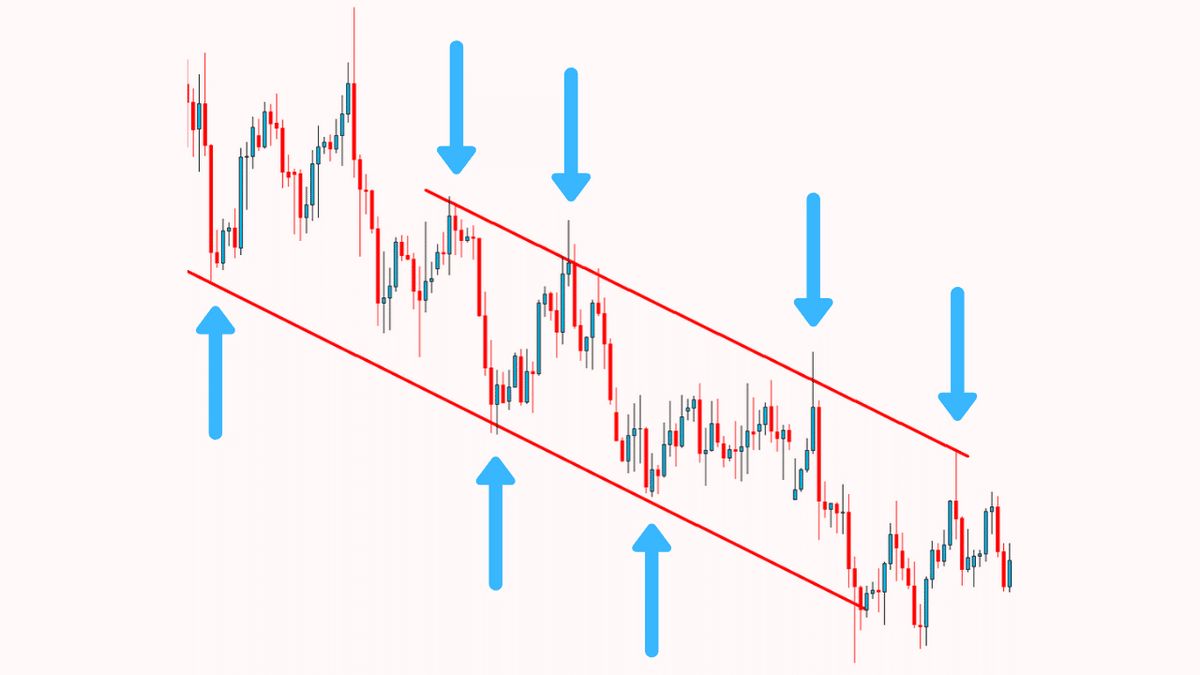

A trading channel is drawn on a security price series chart by graphing two parallel trendlines at resistance and support levels. Traders believe that security prices will remain within a trading channel and will look to buy at channel support and sell at channel resistance. However, the bigger trading opportunity presents itself when there is a channel breakout, where the probability of a quick, significant move in the security’s price increases dramatically.

Types of Trading Channels

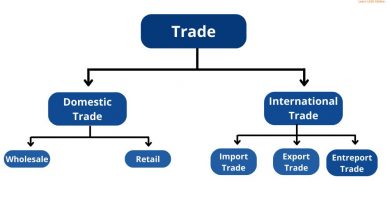

There are two broad types of trading channels that are popular with technical analysts—trend channels and envelope channels.

Trend Channels

Trend channels are drawn with defined slope trendlines at the resistance and support levels of a security’s price series. These channels are not used for long-term price analysis since they lack the ability to flow through reversals. Trend channel trading relies heavily on a security’s trend cycle, which spans through breakout gaps, runaway gaps, and exhaustion gaps. Trend channels can be flat, ascending, or descending.

- Flat channel: Sideways movement in the market with no upward or downward trend

- Ascending channel: Bullish trend

- Descending channel: Bearish trend

Envelope Channels

Traders can also use envelope channels to account for longer-term price movements. Envelope channels have trendlines drawn based on statistical levels. Two common envelope channels are Bollinger Bands and Donchian Channels.

- Bollinger Bands: Popular trading channels using moving average trendlines. The resistance trendline is two standard deviations above the moving average, and the support trendline is two standard deviations below.

- Donchian Channels: Envelope trading channels based on high and low prices. The resistance trendline is drawn based on the security’s high over a specified period (n), and the support trendline is based on the security’s low over the same period.

Trading Channel Indicators

Traders using trading channels to generate buy and sell orders typically trade based on the expectation that a security’s price will remain within the channel. This methodology requires careful diligence in trend channels, as reversals may occur. In both trend channels and envelope channels, traders typically choose to buy at the support trendline and sell at the resistance trendline.