Upside Downside Gap Three Methods What They are How They Work

Upside/Downside Gap Three Methods: What They are, How They Work

What Is the Upside/Downside Gap Three Methods?

The Gap Three Methods is a three-bar Japanese candlestick pattern that indicates a continuation of the current trend. It is a variant of the Upside Tasuki Gap pattern, but the third candle completely closes the gap between the first two candles.

Key Takeaways

- The Upside/Downside Gap Three Methods is a three-bar candlestick pattern.

- The Upside Gap Three Methods pattern suggests a bullish continuation of the trend.

- The Downside Gap Three Methods pattern suggests a bearish continuation of the trend.

Breaking Down the Upside/Downside Gap Three Methods

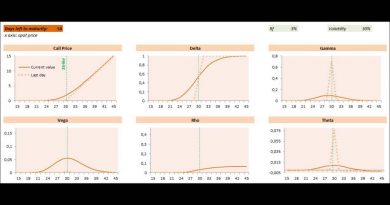

The Upside Gap Three methods is a bullish continuation pattern with the following characteristics:

- The market is in an uptrend.

- The first bar is a white candle with a long real body.

- The second bar is a white candle with a long real body where the shadows over both candles don’t overlap.

- The third bar is a black candle that has an open within the real body of the first candle and a close within the real body of the second candle.

The Downside Gap Three Methods is a bearish continuation pattern with the following characteristics:

- The market is in a downtrend.

- The first bar is a black candle with a long real body.

- The second bar is a black candle with a long real body where the shadows over both candles don’t overlap.

- The third bar is a white candle that has an open within the real body of the second candle and a close within the real body of the first candle.

The Upside/Downside Gap Three Methods is a rare but reasonably reliable pattern. Traders should apply other forms of technical analysis to seek confirmation, such as price action and technical indicators, when identifying this pattern.

Upside Gap Three Methods Trader Psychology

If the market is in a current uptrend, the rally continues on the first candle in a healthy session with the close well above the open, generating a wide range real body. This increases the bull’s confidence, while putting bears on the defensive. Their caution is justified because the second candle opens with a gap up and healthy buying pressure that lifts the security to a new high. Profit-taking causes the third candle to close the gap between the first and second candles. The bulls assume the uptrend will resume now that the gap has filled.

Downside Gap Three Methods Trader Psychology

If the market is in a current downtrend, the decline continues on the first candle in a weak session with the close well below the open, generating a wide range real body. This increases the bear’s confidence, while putting bulls on the defensive. Their caution is justified because the second candle opens with a down gap and active selling pressure that drops the security to a new low. Short covering causes the third candle to close the gap between the first and second candles. The bears assume the downtrend will resume now that the gap has filled.

Practical Example of Trading a Gap Three Methods Pattern

Paul has spotted an Upside Gap Three Methods pattern on the chart of Cellectis S.A. and wants to enter a long position in the direction of the trend and set his risk parameters. He could execute a trade at the closing price of the third candle at $16.39 and place a stop-loss order below the first candle’s low at $15.75. David may decide to take a more conservative approach and enter a buy stop order slightly above the second candle’s high at $16.95, waiting for confirmation that the uptrend has resumed. He could then use the low of the third candle at $16.27 as a stop-loss point.