Unitized Fund What it is How it Works Considerations

Unitized Fund: What it is, How it Works, Considerations

Cierra Murry is an experienced writer specializing in banking, credit cards, investing, loans, mortgages, and real estate. With over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management, she serves as a banking consultant, loan signing agent, and arbitrator.

Contents

What is a Unitized Fund

A unitized fund is an investment fund structure that pools money from investors and provides individually reported unit values. The funds are managed towards a specific objective, often with a concentration in one stock. Investors receive a daily unitized value for their investment.

Unitized funds increase the efficiency of employee stock offerings, such as ESOPs, in benefit plans. Their unit price can be compared to the price of the company’s stock.

Key Takeaways

- A unitized fund pools assets from several investors, often with a focus on a single stock.

- Pensions and ESOPs that offer company stock to workers often use a unitized fund structure to increase efficiency in managing these shares.

- Unitized funds typically hold cash or other assets in addition to the focused investment, causing the unit value to differ slightly from the actual shares.

- Insurance companies in the U.K. may also use a unitized fund structure to manage investments for policyholders.

How Unitized Funds Work

Unitized funds are commonly used in employee benefit plans, such as pensions, where employers offer unitized stock funds that include the company’s publicly traded stock and some cash. These funds provide greater efficiency in managing company stock purchase plans. Their unit value varies from the market value of the company’s stock.

Pension funds may utilize a unitized structure to offer convertible investments between defined benefit and defined contribution plans. Participants have flexible sub-accounts within the unitized structure, allowing them to transfer and exchange assets.

Unitized Funds in Insurance

Insurance companies may also utilize unitized funds. These funds offer unit-linked investment options to investors, associated with an insurance plan. In a unit-linked fund, investors designate investment in a specified unit-linked fund as part of a broader collective investment. Unit-linked fund investments are managed collectively, with individual reporting on the investor’s unit value.

The total value of all the funds is reported as the total assets for the collective investment. These funds are commonly found in offshore financial centers in the UK and the British Isles.

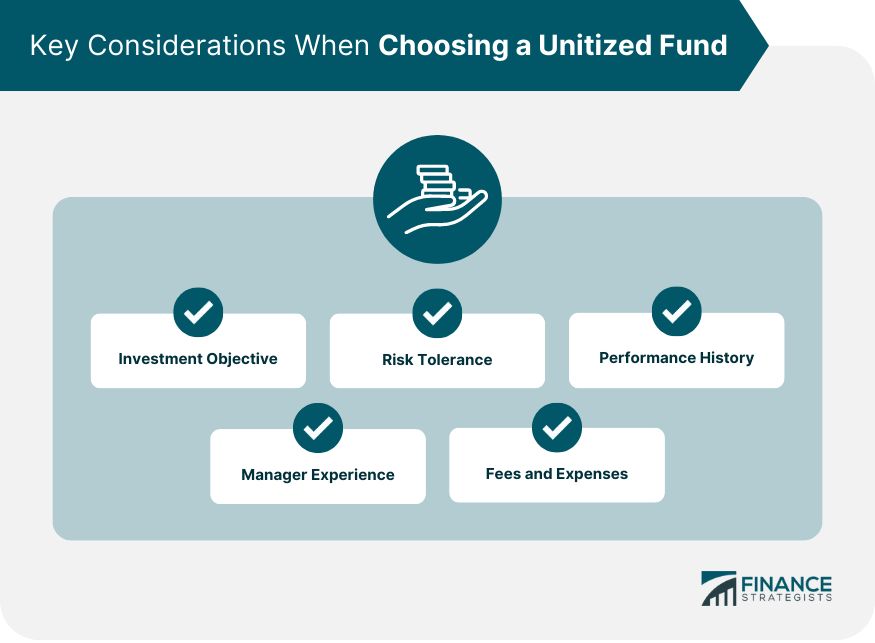

Unitized Fund Considerations

Investment companies may use a special unitized fund structure for fund management, complying with securities regulation. The structure provides efficiency in purchasing securities shares. Investors’ assets are pooled, and the fund calculates a unit value for each participant. The unit value acts as a comparable value or personal balance for the investor.

Unitized funds are typically offered as an alternative to mainstream investments. Investors should carefully review the prospectus to understand the fund’s structure. They can provide efficiencies when managing pooled assets in concentrated positions but may require complex record-keeping and include high administrative expenses.