Underlying Retention What It Is How It Works

Underlying Retention: What It Is, How It Works

What is Underlying Retention

Underlying retention is the net amount of risk or liability from an insurance policy retained by a ceding company after reinsuring the balance. The degree of underlying retention will vary depending on the ceding company’s assessment of the risks involved and the profitability of the insurance policy.

Understanding Underlying Retention

Underlying retention enables an insurer to avoid paying the reinsurance premium. The insurer will retain the most profitable or lowest-risk policies while reinsuring less profitable, higher-risk policies.

Reinsurance, also known as stop-loss insurance, is the practice of insurers transferring risk to other parties to reduce the likelihood of paying a large obligation resulting from an insurance claim.

Reinsurance allows insurers to remain solvent by recovering some or all of amounts paid to claimants. Reinsurance reduces net liability on individual risks and provides ceding companies the capacity to increase their underwriting capabilities.

Key Takeaways

– Underlying retention enables insurers to avoid paying reinsurance premiums by retaining their lower-risk components.

– The ceding company assesses risks to select policies that can be retained in its portfolio.

– Underlying retention is used in cases of non-proportional reinsurance.

By covering the insurer against individual commitments, reinsurance gives the insurer more security for its equity and solvency and more stable results during major events. Reinsurance allows insurers to underwrite policies covering a larger volume of risks without excessively raising administrative costs. Additionally, reinsurance provides liquid assets for insurers in case of exceptional losses.

Underlying Retention in Reinsurance

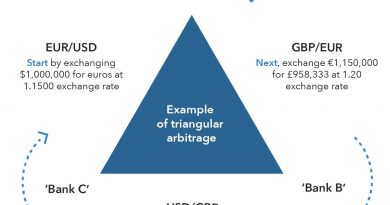

Under proportional reinsurance, the reinsurer receives a share of all policy premiums sold by the insurer. When claims are made, the reinsurer bears a portion of the losses based on a pre-negotiated percentage. The reinsurer also reimburses the insurer for processing, business acquisition, and writing costs.

With non-proportional reinsurance, the reinsurer is liable if the insurer’s losses exceed a specified retention limit. The reinsurer does not have a proportional share in the insurer’s premiums and losses. The retention limit may be based on one type of risk or an entire risk category.

Excess-of-loss reinsurance covers losses exceeding the insurer’s retained limit. This type of coverage is typically applied to catastrophic events.

Under risk-attaching reinsurance, all claims established during the effective period are covered, regardless of whether the losses occurred outside the coverage period. No coverage is provided for claims originating outside the coverage period.

Example of Underlying Retention

Suppose an insurance company has a reinsurance treaty limit of $500,000. It chooses to retain $200,000 worth of insurance risk. That portfolio consists mostly of policies worth much less and carrying significantly lower risk. For example, the company may choose to retain claims less than $100,000, which carry significantly less risk. On the other hand, policies for greater amounts, averaging say $100,000 in payouts, are reinsured. Thus, the reinsurer saves money on premium payments for low-risk policies.