Underground Economy Definition Statistics Trends and Examples

Contents

- 1 Underground Economy: Definition, Statistics, Trends, and Examples

- 1.1 What Is the Underground Economy?

- 1.2 Understanding the Underground Economy

- 1.3 Global Underground Economies

- 1.4 What Is Considered "Underground"?

- 1.5 Which Country Has the Largest Underground Economy?

- 1.6 What Are the Characteristics of an Underground Economy?

- 1.7 Why Do People Engage in the Underground Economy?

Underground Economy: Definition, Statistics, Trends, and Examples

What Is the Underground Economy?

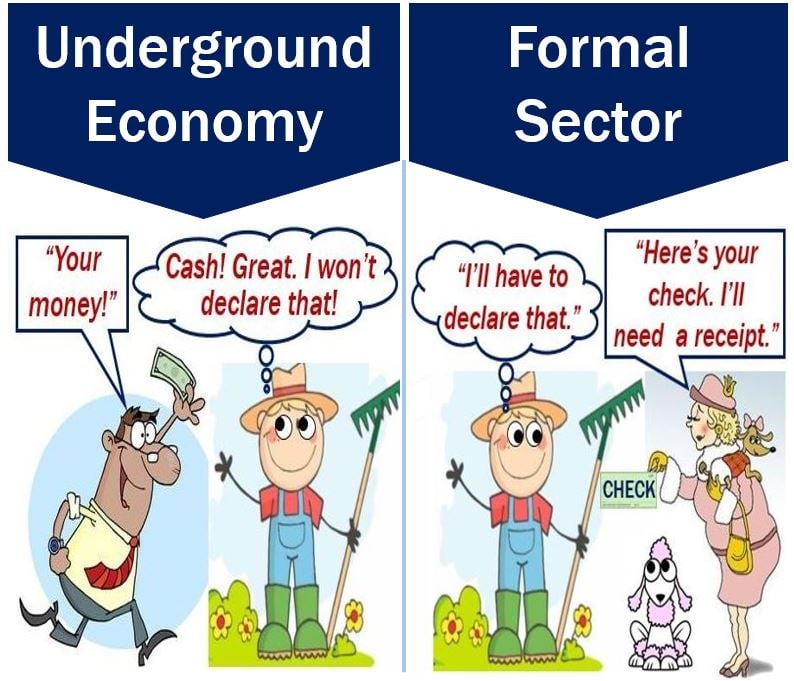

The underground economy refers to illegal economic transactions, involving unlawful goods, services, or non-compliance with reporting requirements. It is also known as the shadow economy, black market, or informal economy.

Key Takeaways

- The underground economy accounts for 11% to 12% of U.S. gross domestic product (GDP), approximately $2.25 trillion to $2.5 trillion.

- Activities in the underground economy vary across nations, states, and municipalities.

- Examples of underground economic activities include illegal drug trade, human trafficking, endangered species, and stolen goods.

Understanding the Underground Economy

Accurately estimating the size of underground economies is challenging as they evade governmental oversight and do not appear in official reports. However, monitoring outgoing expenditures can provide some statistics. The unaccounted money spent theoretically reflects the extent of black market activity.

In 2009, the American underground economy was estimated at $1 trillion, around 8% of U.S. GDP. Due to the 2008 financial crisis and subsequent economic contraction, underground expenditures reached approximately $2 trillion by 2013. The current estimate places the U.S. underground economy at 11% to 12% of GDP, around $2.5 trillion in 2021.

Global Underground Economies

According to a 2018 International Monetary Fund study, America’s underground economy has remained relatively stable compared to other nations. Findings from the study include:

- The average size of the shadow economy across all nations was 31.9%.

- Zimbabwe (60.6%), Bolivia (62.3%), and Georgia (64.9%) had the largest shadow economies.

- Austria (8.9%), the United States (8.3%), and Switzerland (7.2%) had the smallest shadow economies.

Underground economies can have varying effects, ranging from harmful to beneficial. In developing countries, uncollected tax revenue can impede economic growth and hinder public program development. However, participants in underground economies can boost overall economic activity and stimulate demand when they retain income that would have been lost through taxes. This is especially true in nations where corrupt officials divert tax revenues.

What Is Considered "Underground"?

Activities classified as underground economic transactions vary depending on jurisdictional laws. For example, alcohol may be banned in some countries but legally produced and distributed in others. Similarly, while drugs are illegal in most nations, some have legalized cannabis for medical or non-medical regulated use.

The illegality of marijuana in the United States in the early 1900s led to the rise of underground transactions. Subsequent studies have disproven the claims linking marijuana to crime, highlighting its therapeutic benefits in treating illnesses such as cancer and AIDS. Currently, 37 states and the District of Columbia allow medical use, while 18 states and D.C. permit non-medical regulated cannabis.

The underground economy also encompasses unreported income, such as self-employment earnings from babysitting. In New York State in 2018, an estimated 53.2% of cigarette sales occurred through underground transactions to avoid high sin taxes. Additionally, the underground economy includes untaxed sales of physical goods, smuggling, human trafficking, sales of copyrighted materials, trade of endangered animal species, antiquities, and illegally harvested human organs.

Which Country Has the Largest Underground Economy?

Zimbabwe has the largest underground economy, accounting for approximately 60.6% of its economic activity. Switzerland has the smallest underground economy, making up 7.2% of its economy.

What Are the Characteristics of an Underground Economy?

An underground economy encompasses more than just illegal activities like drug trade or weapon sales. It also includes unreported income, such as undeclared wages for restaurant employees or unreported earnings from babysitting. Additionally, bartering without involving cash and failing to report it is considered part of the underground economy.

Why Do People Engage in the Underground Economy?

People engage in the underground economy for various reasons, including obtaining items they cannot legally purchase, evading taxes, avoiding labor laws, and simplifying administrative paperwork.