UCC-1 Statement Definition Types and Example

Contents

- 1 UCC-1 Statement: Definition, Types, and Example

- 1.1 What Is a UCC-1 Statement?

- 1.2 Understanding UCC-1 Statements

- 1.3 Types of UCC-1 Statements

- 1.4 How a UCC Filing Affects Credit Scores

- 1.5 Example of a UCC-1 Statement

- 1.6 Benefits of Filing a UCC-1 Statement

- 1.7 How to Remove a UCC Filing

- 1.8 Duration of a UCC Filing

- 1.9 Continuation Statements

- 1.10 The Bottom Line

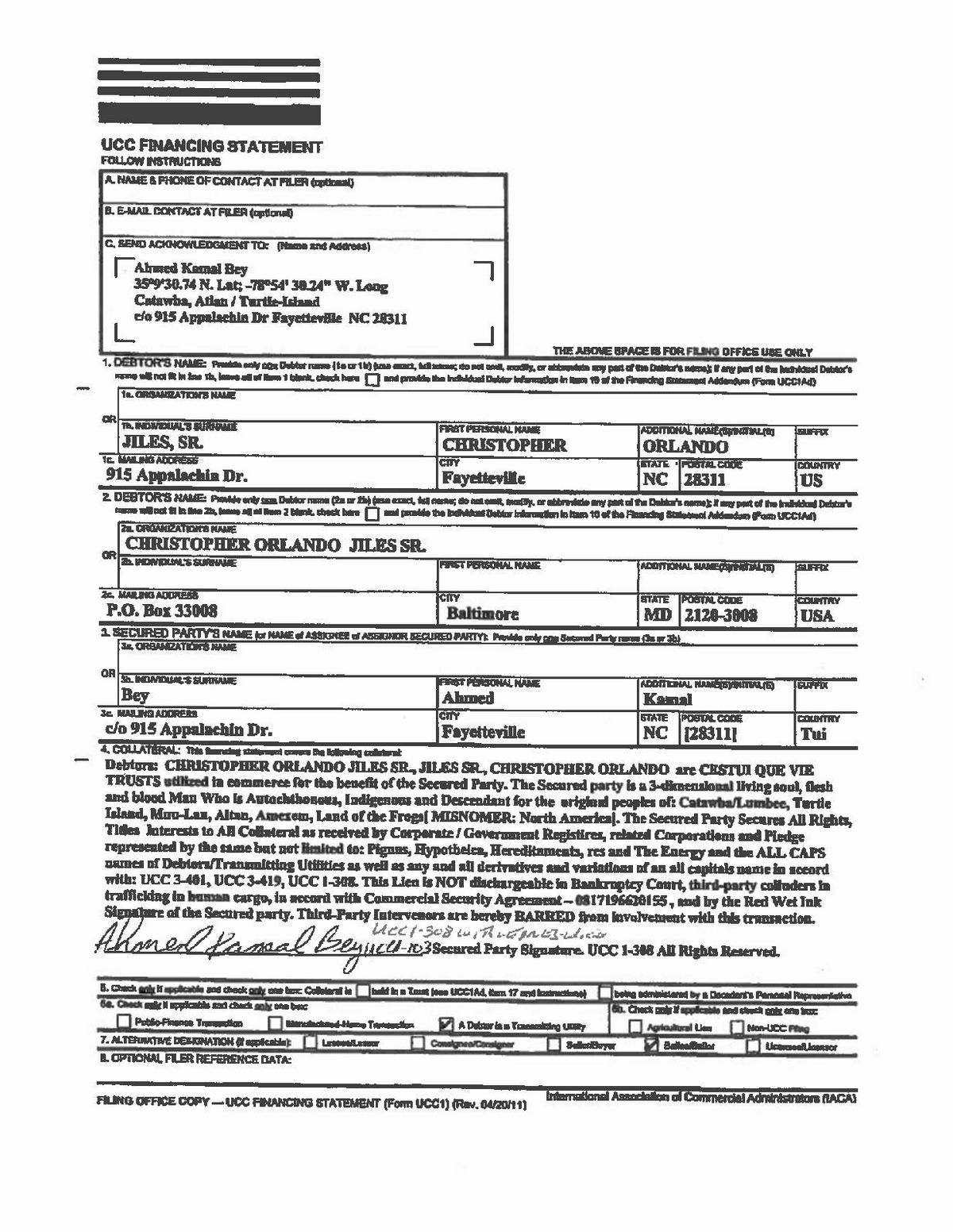

UCC-1 Statement: Definition, Types, and Example

Andrew Bloomenthal has over 20 years of editorial experience as a financial journalist and services marketing writer.

What Is a UCC-1 Statement?

A UCC-1 statement is a legal notice filed by creditors to publicly declare their rights to obtain the personal properties of debtors who default on business loans. These notices, often abbreviated as UCC-1, are printed in local newspapers to alert the masses of the creditors’ intentions.

UCC-1s are required for all business loans under the Uniform Commercial Code (UCC) and establish the priority of specific assets that may be seized in cases where there are multiple lenders to the same debtor.

Key Takeaways

- A UCC-1 statement is a legal notice filed by creditors to seize assets of debtors who default on loans.

- UCC-1 notices are typically printed in local newspapers to express a lender’s intent to seize collateralized assets.

- These forms smooth out collection processes, helping lenders secure court orders authorizing them to seize assets.

- These forms must be filed with state agencies where the borrower’s business is incorporated.

- There are two types of UCC-1 statements: blanket liens and liens attached to specific collateral.

Understanding UCC-1 Statements

A UCC-1 statement is a lien on secured collateral, similar to liens in residential mortgage loan contracts. It is governed by the Uniform Commercial Code (UCC) in the United States. According to the UCC’s ninth article titled "Secured Transactions," a lender must include completed UCC-1 statements in a business loan contract for them to be effective. The statements must provide detailed information about the borrower and itemize the descriptions of all assets named as the secured collateral. Common collateral includes real estate properties, motor vehicles, manufacturing equipment, inventory, and investment securities like stocks and bonds.

Like any ordinary lien, lenders must perfect the UCC-1 statement by filing it with the appropriate agency in the debtor company’s state of incorporation. In most cases, UCC-1 statements are filed with the secretary of state’s office, which time-stamps the document and assigns a file number.

In industry jargon, issuing UCC-1 notices is referred to as "perfecting the security interest."

Types of UCC-1 Statements

Lenders can file two types of UCC-1 statements:

- Specific collateral UCC-1 statements are commonly used in real estate or equipment transactions. They give lenders first-order secured rights to properties or specific collateral.

- A blanket lien grants the lender secured rights to a range of assets, provided the terms are detailed in the collateral section of the UCC-1 statement. Lenders often prefer blanket or "all-asset" liens.

How a UCC Filing Affects Credit Scores

While a UCC lien will appear on a business’ credit report, it won’t necessarily have an immediate negative impact on the credit score unless the business defaults on the underlying loan. The loan attached to the UCC filing will increase the business’ credit utilization ratio, which can negatively impact the score if it becomes too high. Additionally, a business cannot use the same property as collateral for another loan if there is a lien attached to it.

Example of a UCC-1 Statement

Suppose a construction company named Alex’s Excavation applies for a business loan to purchase two hydraulic excavators. When Bank XYZ offers the loan, it files a UCC-1 as part of the contract. If Alex’s Excavation later declares bankruptcy, Bank XYZ would receive the property/cash mentioned in the UCC-1 statement due to the specific collateral lien on the two excavators.

Benefits of Filing a UCC-1 Statement

Filing a UCC-1 statement allows creditors to secure their loans by utilizing their customers’ personal property assets. In the event of a customer defaulting on their loan or filing for bankruptcy, a UCC-1 elevates the lender’s status to a secured creditor, ensuring payment.

How to Remove a UCC Filing

To remove a UCC lien, you can:

- Ask the lender to remove the lien upon full loan payment by filing a UCC-3 statement.

- Visit the local secretary of state’s office if the lender fails to file a UCC-3 after you’ve paid off the loan. Swear under oath that you fulfilled the debt in full and request removal of the UCC-1.

Duration of a UCC Filing

A UCC-1 statement remains effective for five years. After this period, the lien becomes null and void.

Continuation Statements

A continuation statement extends the lender’s lien on the borrower’s collateral beyond the original financing statement’s expiration date. When a lender files a continuation statement, it extends the UCC-1 financing statement by five years from the filing date.

The Bottom Line

UCC filings allow creditors to notify others about a debtor’s assets used as collateral for a secured transaction. UCC liens serve as public notice of the creditor’s interest in the assets and can be checked on the secretary of state’s website.