Loan-to-Cost Ratio Definition What It Tells You Calculation

Contents

Loan-to-Cost Ratio: Definition, What It Tells You, Calculation

What Is the Loan-To-Cost Ratio (LTC)?

The loan-to-cost (LTC) ratio is used in commercial real estate construction to compare project financing (offered by a loan) with building costs. It helps lenders assess the risk of a construction loan and allows developers to understand their equity share during the project. The loan-to-value (LTV) ratio is similar to the LTC ratio, but it compares the construction loan amount to the fair-market value of the project after completion.

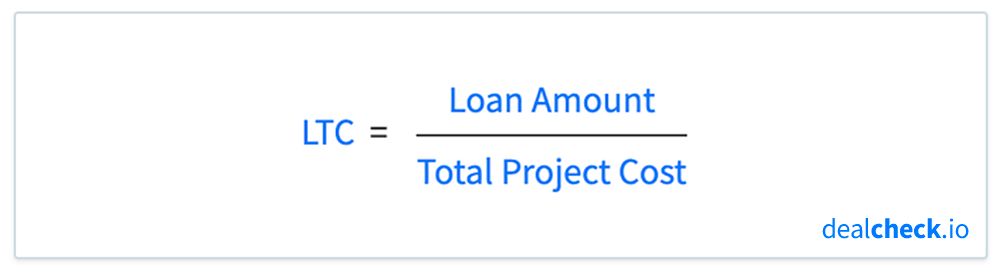

The Formula for LTC Is

Loan to Cost = Loan Amount / Construction Cost

Key Takeaways

- LTC compares the financing amount of a commercial real estate project to its cost.

- LTC is calculated as the loan amount divided by the construction cost.

- LTV compares the loan amount to the expected market value of the completed project.

- A higher LTC indicates higher risk for lenders, who typically finance projects with an LTC of up to 80%.

What Does the Loan-To-Cost Ratio Tell You?

The LTC ratio calculates the percentage or amount a lender is willing to provide based on the construction budget. After completion, the project’s value changes. Therefore, the LTC ratio and LTV ratios are used together in commercial real estate construction.

The LTC ratio delineates the risk level of financing a construction project. A higher LTC ratio indicates higher risk for lenders. Most lenders finance up to 80% of a project, while some offer a greater percentage at a higher interest rate.

In addition to the LTC ratio, lenders consider the project’s location, property value, builder credibility and experience, as well as the borrower’s credit and loan history.

Example of How to Use LTC

For example, assume the hard construction costs of a commercial real estate project are $200,000. The lender provides a $160,000 loan to ensure borrower equity and project completion. The LTC ratio for this project is $160,000 / $200,000 = 80%.

The Difference Between Loan-to-Cost and Loan-to-Value Ratio

The loan-to-value (LTV) ratio is closely related to LTC, but it compares the total loan given for a project to the project’s value after completion. In the example above, if the future project value after completion is $400,000 and the total loan given is $320,000, then the LTV ratio is also 80% or $320,000 / $400,000.