Two-Sided Market Definition and Examples

Contents

Two-Sided Market: Definition and Examples

What Is a Two-Sided Market?

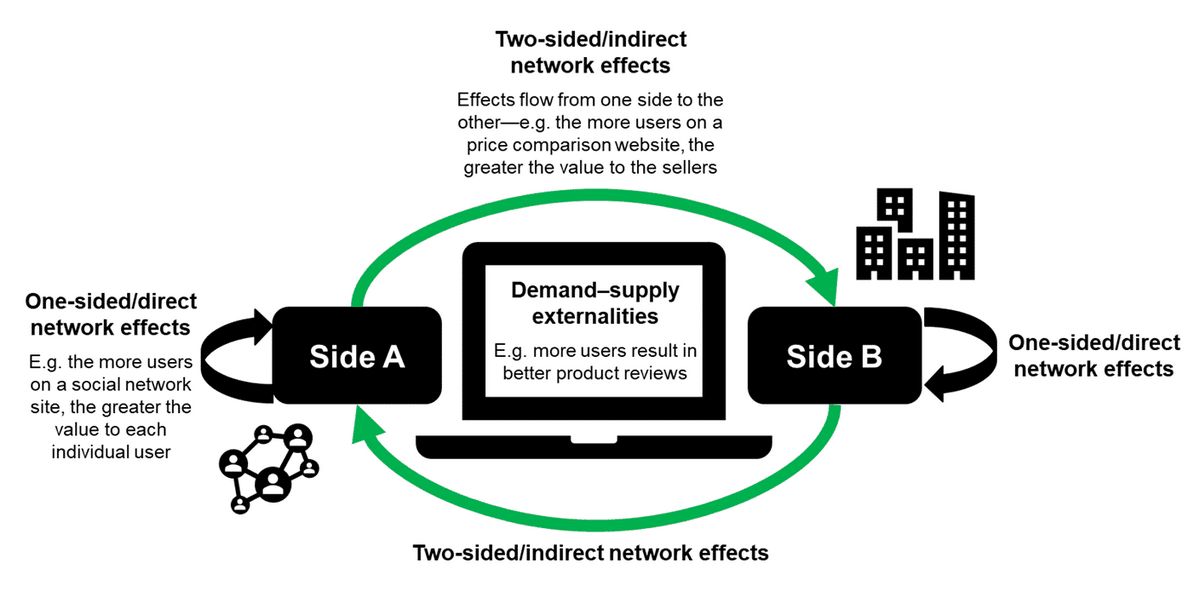

A two-sided market exists when both buyers and sellers meet to exchange a product or service, creating bids to buy and offers to sell. This can occur when user groups or agents interact through a platform to the benefit of both parties. Examples of two-sided markets are seen in various industries. One example is the relationship between market-makers (specialists), who give both a firm bid and firm ask for each security, and buyers and sellers of securities.

This can be contrasted with a one-sided market, where there exist only bids or only offers.

Key Takeaways

- A two-sided market has both sellers and buyers available for transacting in an asset, good, or service.

- Most securities exchanges are examples of two-sided markets where participants can buy and sell freely.

- Sometimes, market-makers will simultaneously provide both bids to buy and offers to sell to create liquidity.

Understanding Two-Sided Markets

A two-sided market has both buyers and sellers, meaning that market participants can transact with each other. Sometimes, market-makers provide prices on both sides of the market.

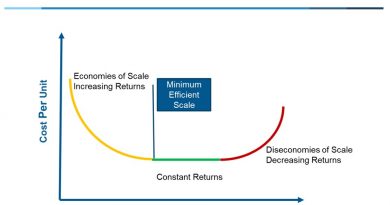

Two-sided markets simplify and accelerate transactions, as well as lower costs for the parties involved. As a two-sided network grows, successful platforms can scale. Users, seeing a larger potential marketplace, may pay a higher price to access the platform. Two-sided marketplaces have an advantage over traditional one-sided markets, as they experience diminishing returns on customer acquisition.

A two-sided market’s definition is often based on the intermediary’s relationship with external groups or agents on its platform. This relationship is seen in pricing. Platform overseers must maintain equilibrium between both sides of the network, sometimes subsidizing the more price-sensitive side and charging higher prices to the side that benefits the most from the platform’s success. It should be noted that any change to one side of the market will affect pricing on the other side, known as the "waterbed effect."

Two-Sided Market Examples

Two-sided markets exist in various industries, serving the interests of manufacturers, retailers, service providers, and consumers. A classic example is the yellow pages telephone directory, which serves consumers and advertisers. Credit card companies act as intermediaries between card-holding consumers and merchants, while video-game platforms like Microsoft’s Xbox or Sony’s PlayStation benefit video-game developers and gamers. Some modern companies that illustrate this relationship include Match.com, Facebook, LinkedIn, and eBay. Some, like Amazon.com, employ both two-sided and one-sided markets.

Two-Sided Markets and Securities Trading

In the financial world, a "two-sided market" mainly refers to the requirement that market makers give both a firm bid and firm ask for each security in which they make a market. This term can also apply in the bond market. For example, some broker-dealers make two-sided markets on larger, actively traded bonds and rarely do so in inactively traded bonds. The theory is that this helps enhance liquidity and market efficiency.