Margin Debt Definition How It Works and the Pros and Cons of Using It

Margin Debt: Definition, How It Works, and the Pros and Cons

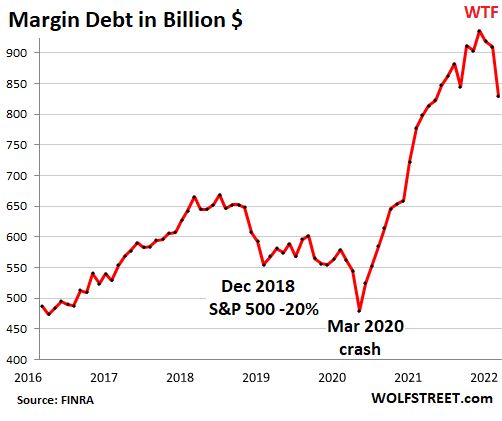

Margin debt is the debt a brokerage customer takes on by trading on margin.

When purchasing securities through a broker, investors have the option of using a cash account and covering the entire cost of the investment themselves, or using a margin account. In a margin account, investors borrow part of the initial capital from their broker. The portion that investors borrow is known as margin debt, while the portion they fund themselves is the margin, or equity.

Using margin debt has both risks and potential benefits.

Key Takeaways:

– Margin debt is the amount of money that an investor borrows from their broker via a margin account.

– Margin debt can be used to buy securities.

– Regulation T sets the initial margin at a minimum of 50%, allowing investors to take on margin debt of 50% of the account balance.

– The typical margin requirement at brokerages is 25%, meaning customers’ equity must remain above that ratio to prevent a margin call.

– Using margin debt as leverage can magnify gains but also exacerbate losses.

How Margin Debt Works

As an example, suppose an investor named Sheila wants to buy 1,000 shares of Johnson & Johnson (JNJ) for $100 per share. Instead of putting down the entire $100,000, she relies on her broker. However, the Federal Reserve Board’s Regulation T limits her broker to lending her 50% of the initial investment, also known as the initial margin.

Sheila deposits $50,000 in initial margin while taking on $50,000 in margin debt. The 1,000 shares of Johnson & Johnson act as collateral for this loan.

(Note: Brokerages may have stricter rules than required by regulators.)

Note:

Excessive buying on margin caused the 1929 U.S. stock market crash. Margin rules were looser back then, allowing investors to borrow 90% of the money to buy stocks with only 10% cash.

Advantages and Disadvantages of Margin Debt

Buying on margin has risks and potential benefits. It’s not recommended for beginners or those who can’t afford to lose money.

Disadvantages:

– If the stock loses value, investors may face a margin call and have to come up with cash quickly.

– Buying on margin means taking on debt that must be repaid.

Advantages:

– It allows investors to buy stock with borrowed money.

– It can magnify gains because of leverage.

A second scenario demonstrates the potential rewards of trading on margin. If the stock price rises, the profit made using margin debt can be greater than the profit made with a cash account.

How Long Do You Have to Answer a Margin Call?

Brokerage firms typically give customers two to five days to come up with cash after a margin call.

How Much Money Do You Need to Trade on Margin?

FINRA rules require investors to deposit a minimum of $2,000 or 100% of the purchase price of the margin securities, whichever is less. If designated as a pattern day trader, the minimum cash requirement rises to $25,000.

What Is a Pattern Day Trader?

A pattern day trader is any customer who executes four or more day trades within five business days, provided that the number of day trades represents more than 6% of the customer’s total trades in the margin account for that same five-business-day period.

The Bottom Line

Buying on margin can lead to greater gains if the stock value rises. However, it is risky and should only be done if sufficient cash is available and it can be afforded to lose it.