Triple Net Lease NNN Meaning Uses and Benefits for Investors

Triple Net Lease (NNN) Meaning, Uses, and Benefits for Investors

What Is a Triple Net Lease (NNN)?

A triple net lease (NNN) is a lease agreement on a property whereby the tenant or lessee pays all expenses, including real estate taxes, building insurance, and maintenance. These expenses are in addition to rent and utilities. In standard commercial leases, these payments are typically the responsibility of the landlord.

Key Takeaways

– With a triple net lease (NNN), the tenant pays property expenses like real estate taxes, building insurance, and maintenance in addition to rent and utilities.

– Triple net leases are common in commercial real estate.

– Triple net leases have lower rents because the tenant assumes ongoing expenses that would otherwise be the responsibility of the owner.

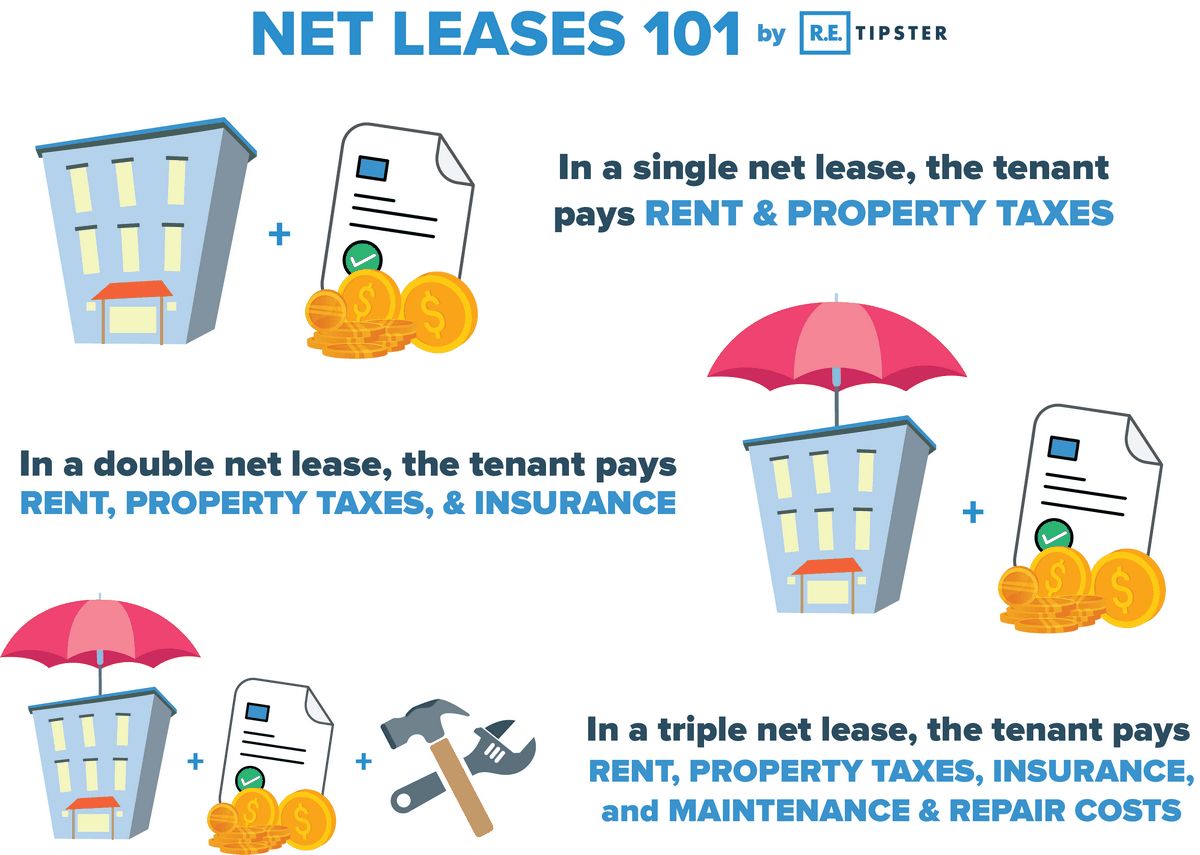

– Other net leases include single net leases (tenant pays property taxes) and double net leases (tenant pays property taxes and insurance).

– Triple net leased properties are popular investment vehicles for low-risk, steady income.

Understanding Triple Net Leases (NNN)

In commercial real estate, a net lease requires the tenant to pay taxes, fees, and maintenance costs for a property.

If a property owner leases a building using a triple net lease, the tenant is responsible for property taxes, building insurance, and maintenance. Because the tenant covers these costs, the rent in a triple net lease is generally lower than in a standard lease. The lease amount is often determined by the tenant’s creditworthiness.

Advantages and Disadvantages of Triple Net Leases

The main advantage of triple net leases is their simplicity. Tenants have control over maintenance and costs, while landlords enjoy steady income without the hassle of managing the property.

However, triple net leases present some disadvantages. Tenants assume the risk of property taxes and insurance price increases. Landlords may overestimate costs, resulting in tenants overpaying. Tenants also invest time and effort in property management, and unexpected costs may arise during occupancy.

Triple Net Leases vs. Single Net Leases and Double Net Leases

Triple net leases are one type of commercial net lease. Single net leases require only property tax payment, while double net leases include property taxes and insurance premiums. In triple net leases, tenants pay all property expenses.

Investing in Triple Net Leases

Triple net leased properties offer investors steady income with relatively low risk. Investors can participate in high-quality real estate without management concerns through triple net lease investment offerings. They may also invest in real estate investment trusts (REITs) focused on such properties.

Triple Net Lease Example

Annual Amount:

– Base rent: $1,500,000

– Recoverable expenses from tenant: $175,000

– Operating expenses: $415,000

– Property taxes: $55,000

– Insurance: $23,000

– Total annual rent: $2,168,000

– Monthly payment: $180,666

Is a Triple Net Lease a Good Idea?

Triple net leases offer freedom for tenants to customize their spaces without a purchase investment. They also provide a reliable source of income for landlords with few overhead costs.

Can You Negotiate a Triple Net Lease?

In a triple net lease, tenants are responsible for all expenses. Negotiation possibilities include the base rental amount and repair cost responsibilities.

Do I Have to Worry About Paying Net Lease Obligations on the Apartment I Rent?

Net leases are primarily used in commercial real estate. Residential tenants typically pay some utilities but not property and liability insurance or real estate taxes.

How Do You Calculate a Triple Net Lease?

Triple net lease amounts can be calculated by adding property taxes, insurance, maintenance, and common area expenses and dividing by 12. Monthly base rental amounts are often calculated based on the rate per square footage.

What Is the Landlord Responsible for in a Triple Net Lease?

In a triple net lease, tenants are responsible for most expenses, but landlords may be accountable for the roof, structure, and sometimes the parking lot.

The Bottom Line

Triple net leases offer advantages for both landlords and tenants. Landlords benefit from steady income and reduced management responsibilities, while tenants benefit from lower monthly rent. Exploring other lease options, such as single net leases and double net leases, is also recommended.