Translation Risk What it is How it Works

Translation Risk: What it is, How it Works

What Is Translation Risk?

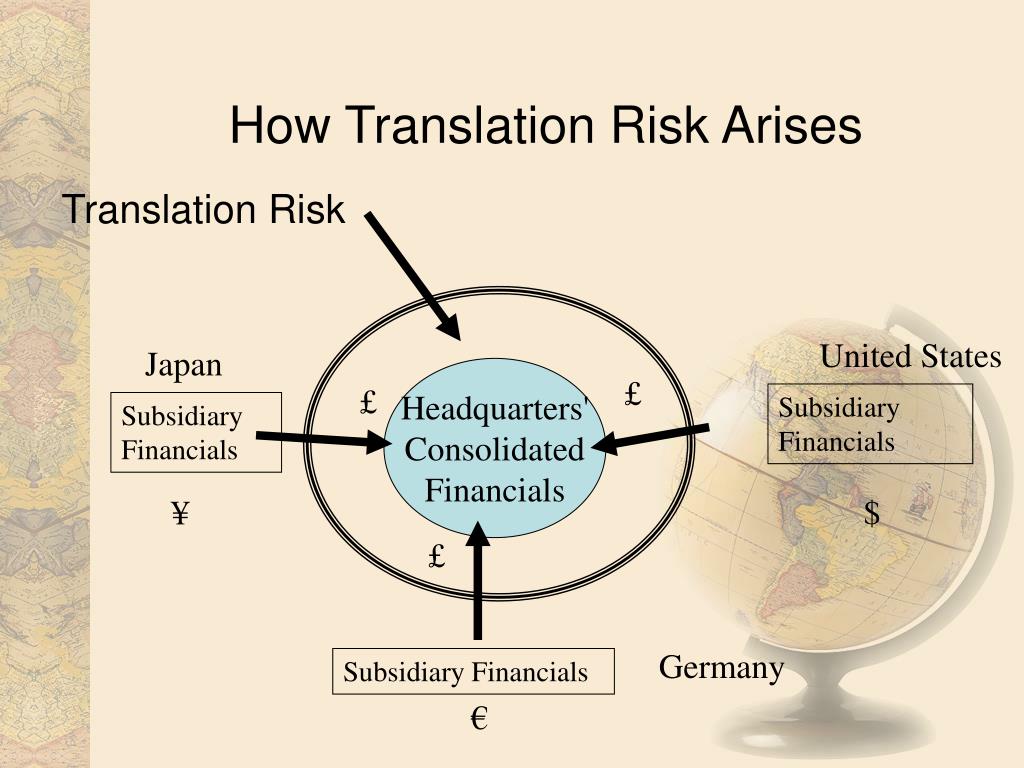

Translation risk is the exchange rate risk associated with companies that deal in foreign currencies and list foreign assets on their balance sheets. Companies that own assets in foreign countries must convert their value to the home country’s currency for accounting purposes.

In the U.S., this accounting translation is typically done on a quarterly and annual basis. Translation risk results from how much the assets’ value fluctuates based on exchange rate fluctuations between the two countries.

Key Takeaways

– Translation risk is the exchange rate risk associated with companies that deal in foreign currencies and list foreign assets.

– Companies with assets in foreign countries must convert their value to the home country’s currency.

– A financial gain or loss is reported, depending on the extent of the exchange rate movements during the quarter.

– The risk that exchange rates could depreciate the value of a company’s foreign assets is called translation risk.

Understanding Translation Risk

Companies must report their financial performance on a quarterly basis, which involves formulating their financial statements for that quarter. The balance sheet and income statement are two of the financial statements that need to be filed. If a company has assets or revenue in a foreign country, it would likely mean that those assets and revenue would be denominated in the foreign country’s local currency.

The company must translate the value of those assets and revenue into the company’s home currency when filing its quarterly financial report. When the exchange rate between the two countries fluctuates, the translation value of those assets and revenue will fluctuate as well.

A financial gain or loss is reported, depending on the extent of the exchange rate movements during the quarter. Any gain or loss would reflect the change in the value of the company’s foreign assets based on the move in the exchange rate.

In actuality, the value of the assets hasn’t really changed, but by translating the value of those assets, it provides a clearer picture of what the company owns and its financial performance for that quarter. The risk that the exchange rate could depreciate the value of those foreign assets or revenue is called translation risk.

Companies with Translation Risk

Multinational corporations that have international offices have the greatest exposure to translation risk. However, even companies that don’t have offices overseas but sell products internationally are exposed to translation risk. If a company earns revenue in a foreign country, it must convert that revenue into the company’s home or local currency when it reports its financials at the end of the quarter.

If exchange rates have fluctuated significantly, this could lead to significant changes in the value of the foreign asset or income stream. This exchange rate volatility creates risk for the company because it can be challenging to forecast how much exchange rates are going to move relative to each other.

The greater the proportion of a company’s assets, liabilities, or equities denominated in a foreign currency, the greater the company’s translation risk. Translation risk is also sometimes referred to as translation exposure.

Impact of Translation Risk

Exchange rates can change significantly between the reporting of quarterly financial statements, causing variances between the reported figures from quarter to quarter. This can sometimes cause volatility in the company’s stock price.

For example, let’s say a U.S. company has assets in Europe valued at 1 million euros, and the euro versus the U.S. dollar exchange rate has depreciated by 10% on a quarter-to-quarter basis. The value of the assets, when converted from euros into dollar terms, would also decline by 10%. However, it’s not just the assets on the balance sheet that would decline, but revenue and net income earned in euros would depreciate as well.

As a result, a company’s reported earnings can be lower due to exchange rate fluctuations leading to a poor quarterly performance and a declining stock price.

Translation risk tends to be higher in developing countries and emerging market economies. Oftentimes, these economies are politically unstable, which exacerbates the exchange rate volatility of the local currency.

Managing Translation Risk

There are various financial products that companies can use to mitigate or reduce translation risk. One popular product is a forward contract, which locks in an exchange rate for a period of time. The rate lock allows companies to fix the value of their foreign assets based on the forward contract’s exchange rate.

Companies that sell products overseas and earn foreign revenue can request that their foreign clients pay for goods and services in the company’s home currency. As a result, the risk associated with local currency fluctuations would not be borne by the company but instead by the client who is responsible for making the currency exchange prior to conducting business with the company. However, the policy of shifting the exchange rate risk onto a foreign customer can backfire if the customer doesn’t want to take on the exchange rate risk and finds a local company to do business with instead.

Real World Example of Translation Risk

McDonald’s Corporation (MCD) is the largest restaurant chain in the world and generates a significant portion of its earnings from international business. McDonald’s reported $4.7 billion in revenue for the first quarter of 2020, of which 60% was generated internationally.

As a result, the restaurant chain must contend with translation risk on a quarterly basis considering the size and scope of the restaurants, assets, and revenue generated overseas. Below is a portion of the quarterly report, which shows the impact of currency translation exposure on the company’s financial performance.

– Revenue declined by 6% for the first quarter of 2020, but with currency translation factored in, the decline was only 5%.

– Net income or profit was $1.1 billion for Q1 2020—a 17% decline from one year earlier, but after factoring in currency translation, it declined by 16%.

Although a 1% impact on net income from currency translation doesn’t appear to be material, it boosted net income by approximately $11 million for the quarter. McDonald’s has various types of hedges in place to help mitigate the risk of exchange rate losses and translation risk.